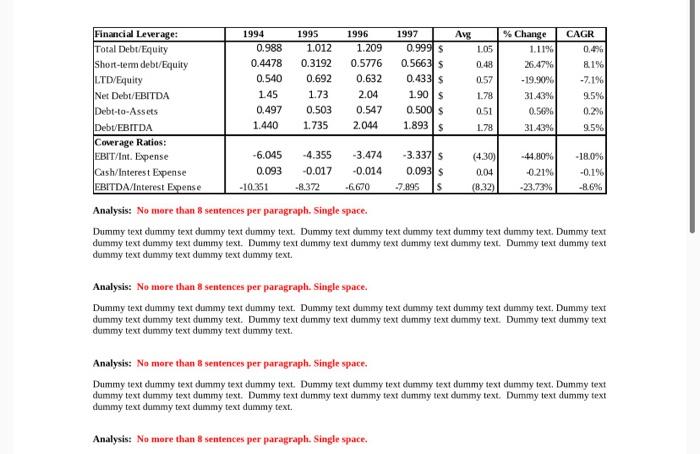

Question: analyze the financial leverage and coverage ratio from the table Be Our Guest Financial Leverage: 1994 1995 1996 1997 Avg % Change CAGR Total Debt/Equity

Financial Leverage: 1994 1995 1996 1997 Avg % Change CAGR Total Debt/Equity 0.988 1.012 1.209 0.999 $ 1.05 1.11% 0.476 Short-tem debt/Equity 0.4478 0.3192 0.5776 0.56635 0.48 26.47% 8.1% LTD/Equity 0.540 0.692 0.632 0.4335 0.57 -19.90% -7.1% Net Debt/EBITDA 1.45 1.73 2.04 1.90$ 1.78 31.43% 9.5% Debt-to-Assets 0.497 0.503 0.547 0.500 s 0.51 0.56% 0.2% Debt EBITDA 1.440 1.735 2.044 1.893 $ 1.78 31.43% 9.5% Coverage Ratios: EBIT/Int. Expense -6.045 -4.355 -3.474 -3.337 (4.30) -44.80% -18.0% Cash/Interest Expense 0.093 -0.017 -0.014 0.093 $ 0.04 -0.21% -0.1% EBITDA Interest Expense -10.351 -8.372 -6.670 -7.895 S (8.32) -23.73% -8.6% Analysis: No more than 8 sentences per paragraph. Single space. Dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text cummy text. Dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text dummy text. Analysis: No more than 8 sentences per paragraph. Single space. Dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text.Dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text dummy text. Analysis: No more than 8 sentences per paragraph. Single space. Dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text dummy text. Analysis: No more than 8 sentences per paragraph. Single space. Financial Leverage: 1994 1995 1996 1997 Avg % Change CAGR Total Debt/Equity 0.988 1.012 1.209 0.999 $ 1.05 1.11% 0.476 Short-tem debt/Equity 0.4478 0.3192 0.5776 0.56635 0.48 26.47% 8.1% LTD/Equity 0.540 0.692 0.632 0.4335 0.57 -19.90% -7.1% Net Debt/EBITDA 1.45 1.73 2.04 1.90$ 1.78 31.43% 9.5% Debt-to-Assets 0.497 0.503 0.547 0.500 s 0.51 0.56% 0.2% Debt EBITDA 1.440 1.735 2.044 1.893 $ 1.78 31.43% 9.5% Coverage Ratios: EBIT/Int. Expense -6.045 -4.355 -3.474 -3.337 (4.30) -44.80% -18.0% Cash/Interest Expense 0.093 -0.017 -0.014 0.093 $ 0.04 -0.21% -0.1% EBITDA Interest Expense -10.351 -8.372 -6.670 -7.895 S (8.32) -23.73% -8.6% Analysis: No more than 8 sentences per paragraph. Single space. Dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text cummy text. Dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text dummy text. Analysis: No more than 8 sentences per paragraph. Single space. Dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text.Dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text dummy text. Analysis: No more than 8 sentences per paragraph. Single space. Dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text. Dummy text dummy text dummy text dummy text dummy text dummy text. Analysis: No more than 8 sentences per paragraph. Single space

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts