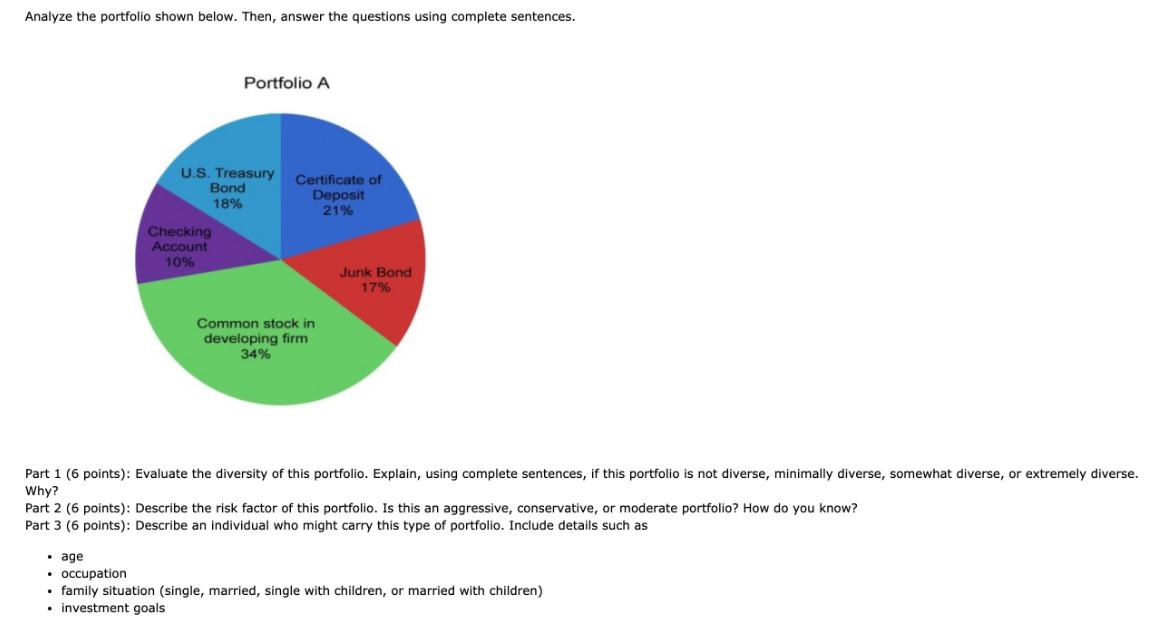

Question: Analyze the portfolio shown below. Then, answer the questions using complete sentences. Portfolio A U.S. Treasury Certificate of Deposit 21% Bond 18% Checking Account

Analyze the portfolio shown below. Then, answer the questions using complete sentences. Portfolio A U.S. Treasury Certificate of Deposit 21% Bond 18% Checking Account 10% Common stock in developing firm 34% Junk Bond 17% Part 1 (6 points): Evaluate the diversity of this portfolio. Explain, using complete sentences, if this portfolio is not diverse, minimally diverse, somewhat diverse, or extremely diverse. Why? Part 2 (6 points): Describe the risk factor of this portfolio. Is this an aggressive, conservative, or moderate portfolio? How do you know? Part 3 (6 points): Describe an individual who might carry this type of portfolio. Include details such as age occupation family situation (single, married, single with children, or married with children) investment goals Portfolio 1 pPortfolio 2 Portfolio 3 $4,000 $1,000 $13,500 $1,050 $1,000 $2,250 5.7% $700 $15,000 $850 4.2% $2,700 $1,700 $3,250 Calculate the weighted mean of the RORS for each portfolio. I 12, ROR 11.3% $900 -35.5% $1,000 32.4% $5,400

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Part 1 The diversity of this portfolio is somewhat diverse While it includes various asset classes such as US Treasury Bonds Certificate of Deposit Ch... View full answer

Get step-by-step solutions from verified subject matter experts