Question: Analyze the structure ( Porter ' s 5 Forces ) of the soft drink industry. Why are Coke and Pepsi so profitable? What prevents other

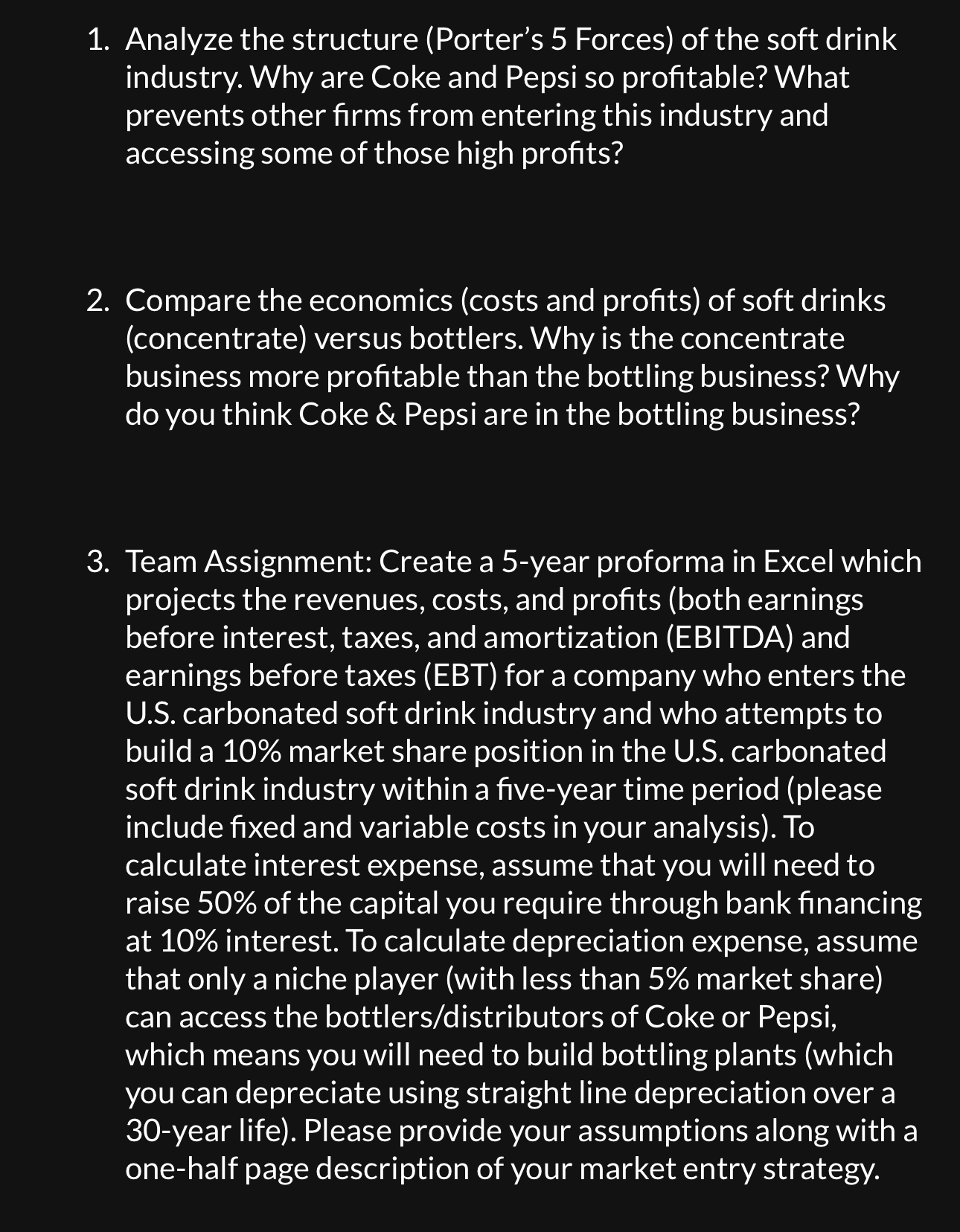

Analyze the structure Porters Forces of the soft drink industry. Why are Coke and Pepsi so profitable? What prevents other firms from entering this industry and accessing some of those high profits?

Compare the economics costs and profits of soft drinks concentrate versus bottlers. Why is the concentrate business more profitable than the bottling business? Why do you think Coke & Pepsi are in the bottling business?

Team Assignment: Create a year proforma in Excel which projects the revenues, costs, and profits both earnings before interest, taxes, and amortization EBITDA and earnings before taxes EBT for a company who enters the US carbonated soft drink industry and who attempts to build a market share position in the US carbonated soft drink industry within a fiveyear time period please include fixed and variable costs in your analysis To calculate interest expense, assume that you will need to raise of the capital you require through bank financing at interest. To calculate depreciation expense, assume that only a niche player with less than market share can access the bottlersdistributors of Coke or Pepsi, which means you will need to build bottling plants which you can depreciate using straight line depreciation over a year life Please provide your assumptions along with a onehalf page description of your market entry strategy.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock