Question: Analyzing common-size financial statements) Use the common-size financial statements found here to respond to your boss' request that you write up your assessment of the

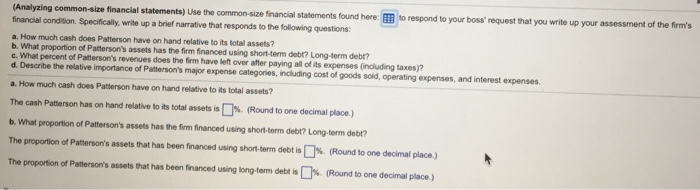

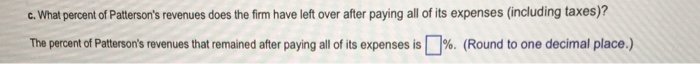

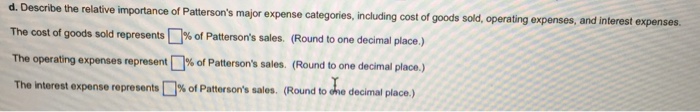

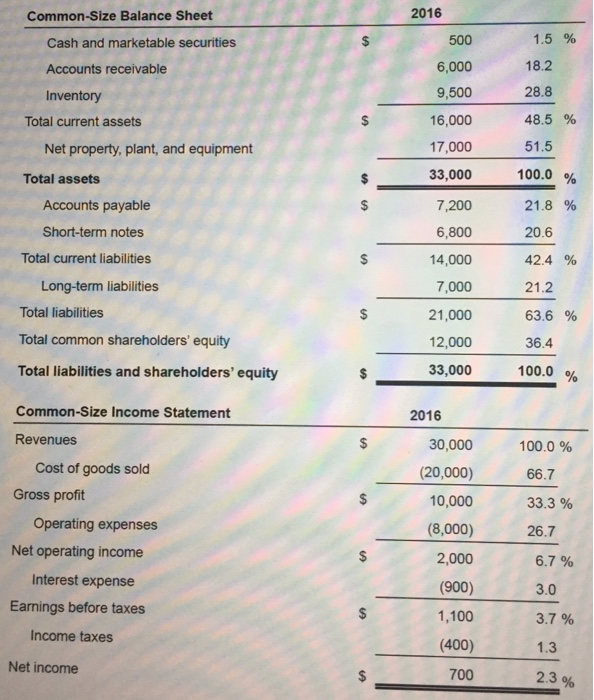

Analyzing common-size financial statements) Use the common-size financial statements found here to respond to your boss' request that you write up your assessment of the firm's financial condision. Specifically, write up a brief narrative that responds to the following questions: a. How much cash does Patterson have on hand relative to its total assets? proportion of Paterson's assets has the firm financed using short-term debt? Long-torm debl? c. What percent of Patterson's revenues does the firm have left over after paying all of its expenses (including taxes)? d. Describe the relative importance of Patterson's major expense categories, including cost of goods sold, operating expenses, and interest expenses a. How much cash does Patterson have on hand relative to its total assets? The cash Patterson has on hand relative to its total assets is % (Round to one decimal place ) b. What proportion of Patterson's assets has the firm financed using shorl-term debt? Long-term debt? The proportion of Paterson's assets that has been financed using short-le m debt is %, Round to one decimal place.) The proportion of Patterson's assets that has been financed using long-term debt is (Round to one decimal place)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts