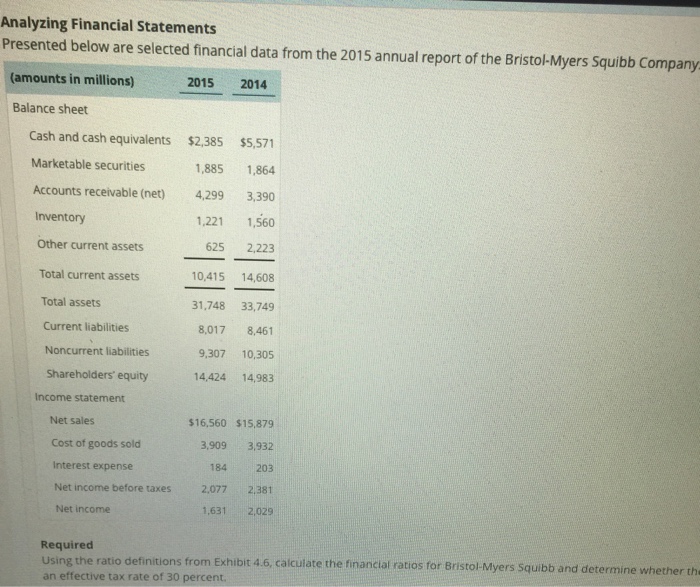

Question: Analyzing Financial Statements Presented below are selected financial data from the 2015 annual report of the Bristol-Myers Squibb Company (amounts in millions) 2015 2014 Balance

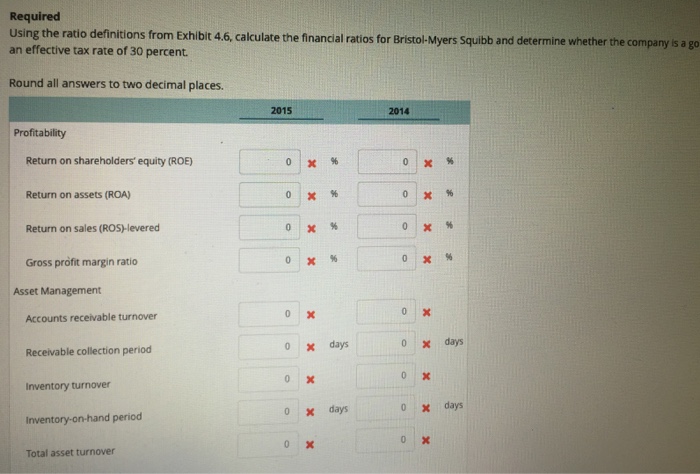

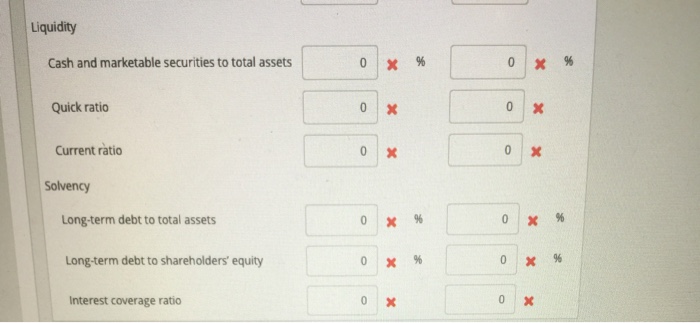

Analyzing Financial Statements Presented below are selected financial data from the 2015 annual report of the Bristol-Myers Squibb Company (amounts in millions) 2015 2014 Balance sheet Cash and cash equivalents $2,385 $5,571 1,885 1,864 Accounts receivable (net) 4,299 3,390 1,221 1,560 625 2,223 10,415 14,608 31,748 33,749 8,017 8,461 Marketable securities Inventory Other current assets Total current assets Total assets Current liabilities Noncurrent liabilities 9.307 10,305 Shareholders' equity 14,424 14,983 Income statement Net sales Cost of goods sold Interest expense $16,560 $15,879 3,909 3,932 184 203 Net income before taxes 2.077 2.381 1,631 2,029 Net income Required ing the ratio definitions from Exhibit 4.6, calculate the financial ratios for Bristol-Myers Squibb and determine whether the an effective tax rate of 30 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts