Question: Analyzing the Impact on Ratios from Changing Inventory Prices Consider two companies that are identical except for the way they value inventory. One company uses

Analyzing the Impact on Ratios from Changing Inventory Prices

Consider two companies that are identical except for the way they value inventory. One company uses FIFO Company F while the other uses LIFO Company L Assume prices are rising in the markets in which these companies buy materials. Indicate for each ratio below which company Company F Company L or neither will have the larger ratio value. Determining Merchandise to Be Included or Excluded from Ending Inventory

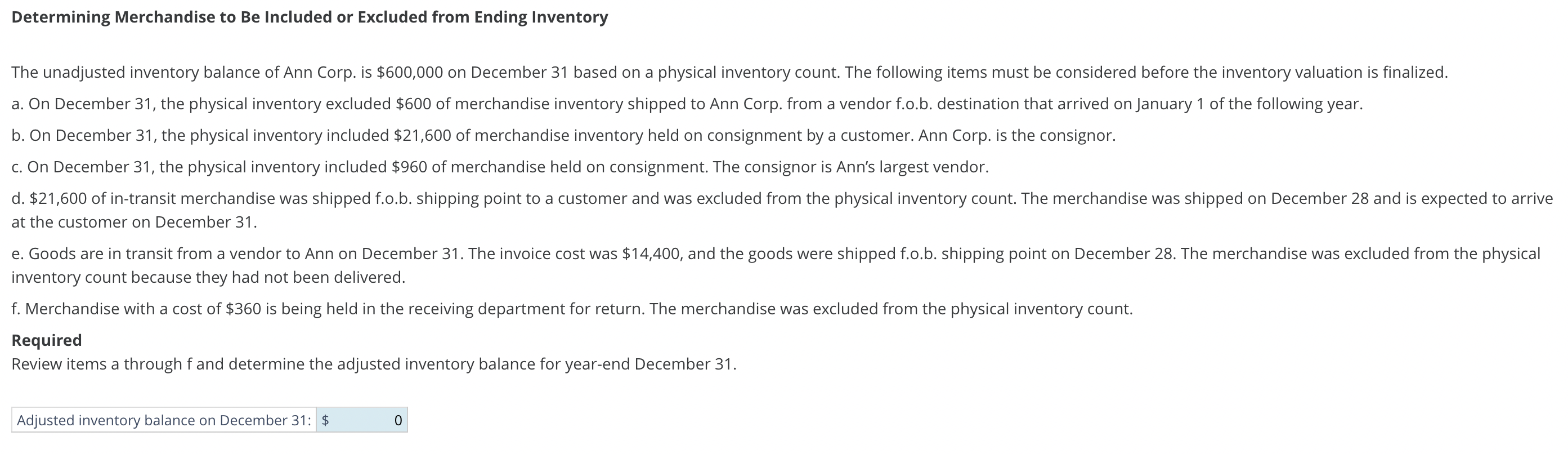

The unadjusted inventory balance of Ann Corp. is $ on December based on a physical inventory count. The following items must be considered before the inventory valuation is finalized.

a On December the physical inventory excluded $ of merchandise inventory shipped to Ann Corp. from a vendor fob destination that arrived on January of the following year.

b On December the physical inventory included $ of merchandise inventory held on consignment by a customer. Ann Corp. is the consignor.

c On December the physical inventory included $ of merchandise held on consignment. The consignor is Ann's largest vendor.

d$ of intransit merchandise was shipped fob shipping point to a customer and was excluded from the physical inventory count. The merchandise was shipped on December and is expected to arrive at the customer on December

e Goods are in transit from a vendor to Ann on December The invoice cost was $ and the goods were shipped fob shipping point on December The merchandise was excluded from the physical inventory count because they had not been delivered.

f Merchandise with a cost of $ is being held in the receiving department for return. The merchandise was excluded from the physical inventory count.

Required

Review items a through f and determine the adjusted inventory balance for yearend December

Adjusted inventory balance on December : $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock