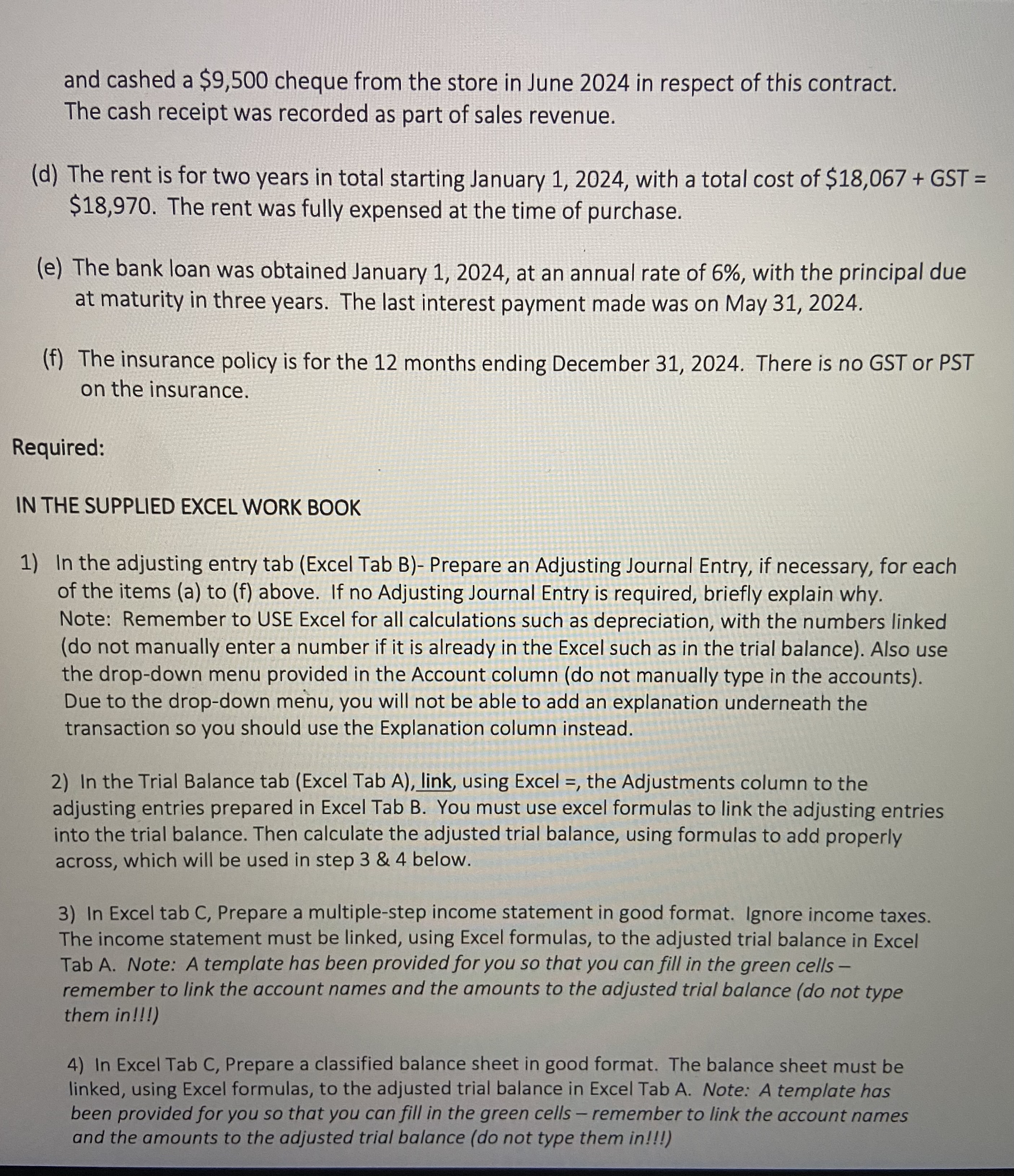

Question: and cashed a $ 9 , 5 0 0 cheque from the store in June 2 0 2 4 in respect of this contract. The

and cashed a $ cheque from the store in June in respect of this contract.

The cash receipt was recorded as part of sales revenue.

d The rent is for two years in total starting January with a total cost of $ GST

$ The rent was fully expensed at the time of purchase.

e The bank loan was obtained January at an annual rate of with the principal due

at maturity in three years. The last interest payment made was on May

f The insurance policy is for the months ending December There is no GST or PST

on the insurance.

Required:

IN THE SUPPLIED EXCEL WORK BOOK

In the adjusting entry tab Excel Tab BPrepare an Adjusting Journal Entry, if necessary, for each

of the items a to f above. If no Adjusting Journal Entry is required, briefly explain why.

Note: Remember to USE Excel for all calculations such as depreciation, with the numbers linked

do not manually enter a number if it is already in the Excel such as in the trial balance Also use

the dropdown menu provided in the Account column do not manually type in the accounts

Due to the dropdown menu, you will not be able to add an explanation underneath the

transaction so you should use the Explanation column instead.

In the Trial Balance tab Excel Tab A link, using Excel the Adjustments column to the

adjusting entries prepared in Excel Tab B You must use excel formulas to link the adjusting entries

into the trial balance. Then calculate the adjusted trial balance, using formulas to add properly

across, which will be used in step & below.

In Excel tab C Prepare a multiplestep income statement in good format. Ignore income taxes.

The income statement must be linked, using Excel formulas, to the adjusted trial balance in Excel

Tab A Note: A template has been provided for you so that you can fill in the green cells

remember to link the account names and the amounts to the adjusted trial balance do not type

them in

In Excel Tab C Prepare a classified balance sheet in good format. The balance sheet must be

linked, using Excel formulas, to the adjusted trial balance in Excel Tab A Note: A template has

been provided for you so that you can fill in the green cells remember to link the account names

and the amounts to the adjusted trial balance do not type them in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock