Question: Question # 1 In order to properly understand the intermediate accounting concepts covered in Acct 2 1 1 , you need to have a strong

Question #

In order to properly understand the intermediate accounting concepts covered in Acct

you

need to have a strong ability to visualize and complete the accounting cycle. This first question

challenges you in this regard. You may need to review your Introductory

Intermediate Accounting

textbook

notes

The process, logic and terminology associated with the accounting cycle will be used regularly

throughout this course, so it is important to not only complete this question but also to understand

what is happening.

You are the accountant with Bake by the Numbers Inc.

BNI

which is a new company that sells

accounting

themed baked goods. The business is owned and operated by Shirley Debit. Debit has

been so busy that she hasn't had any time to complete her Financial Statements as of and for the

months ended June

Debits bank manager has threatened to cancel BNI's bank loan

due approximately two years from now

if he does not receive an Income Statement showing the

company's gross profit and net income by next week.

Debit started to make adjustments and corrections but simply ran out of time. She assembled the

attached worksheet and handed you the following information she thought you might need.

a

No depreciation has been recorded on the equipment. The equipment has a useful life of

years at which time it is estimated to have a resale value of $

BNI will record an entire

year of depreciation in the first year.

b

BNI became a GST registrant during the year. As the type of food products that BNI sells are

PST and GST exempt, neither tax is charged to their customers. After registering, BNI

purchased equipment for $

PST $

GST $

for a total of $

Equipment

was debited for $

Udder wants you to confirm that the accounting was correct and if

not, correct it

c

BNI recently signed an agreement with "Addition Coffee" to supply BNI goods to its stores.

The contract is worth $

and deliveries will commence in October

BNI received and cashed a $ cheque from the store in June in respect of this contract.

The cash receipt was recorded as part of sales revenue.

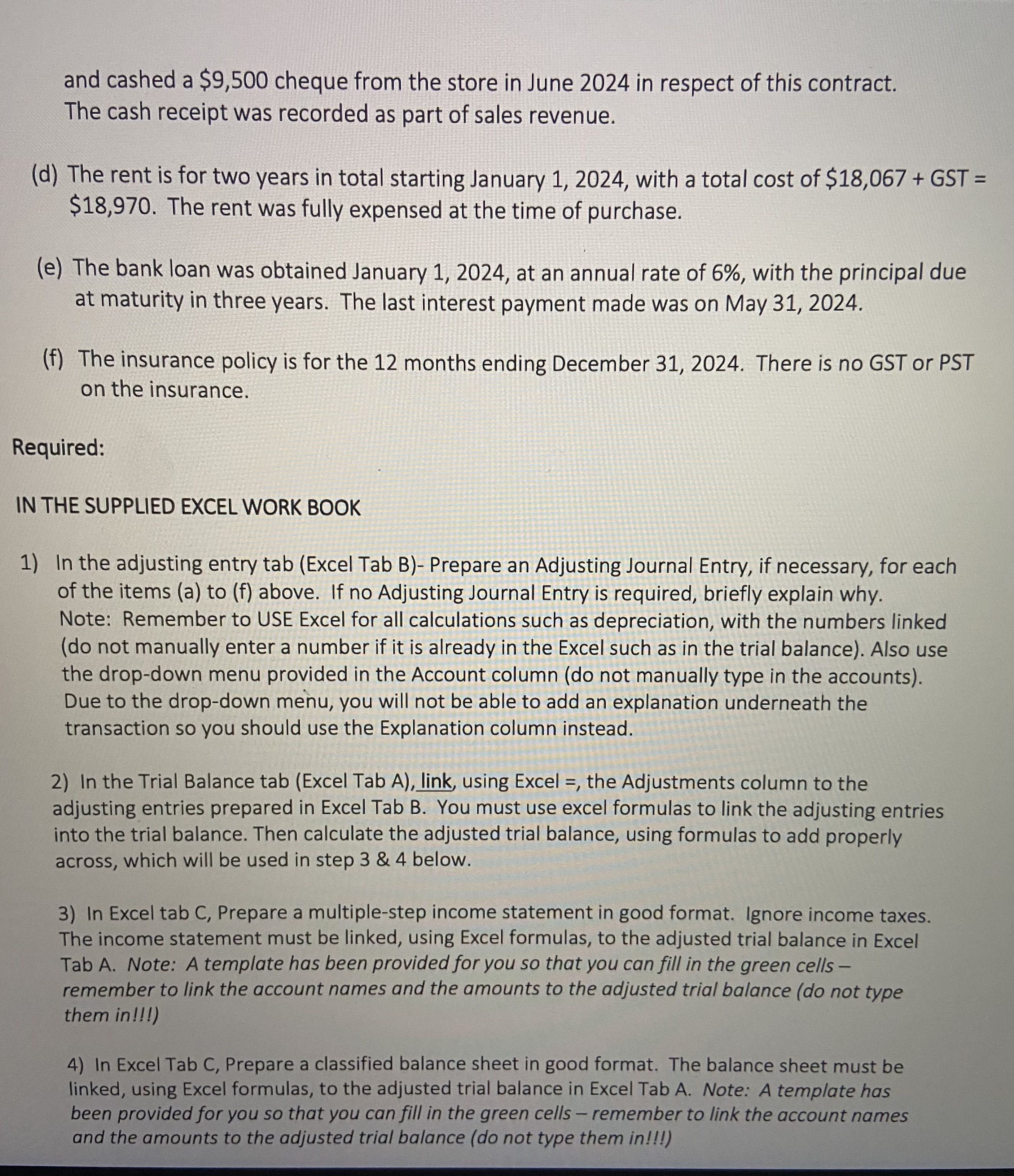

d The rent is for two years in total starting January with a total cost of $ GST

$ The rent was fully expensed at the time of purchase.

e The bank loan was obtained January at an annual rate of with the principal due

at maturity in three years. The last interest payment made was on May

f The insurance policy is for the months ending December There is no GST or PST

on the insurance.

Required:

IN THE SUPPLIED EXCEL WORK BOOK

In the adjusting entry tab Excel Tab BPrepare an Adjusting Journal Entry, if necessary, for each

of the items a to f above. If no Adjusting Journal Entry is required, briefly explain why.

Note: Remember to USE Excel for all calculations such as depreciation, with the numbers linked

do not manually enter a number if it is already in the Excel such as in the trial balance Also use

the dropdown menu provided in the Account column do not manually type in the accounts

Due to the dropdown menu, you will not be able to add an explanation underneath the

transaction so you should use the Explanation column instead.

In the Trial Balance tab Excel Tab A link, using Excel the Adjustments column to the

adjusting entries prepared in Excel Tab B You must use excel formulas to link the adjusting entries

into the trial balance. Then calculate the adjusted trial balance, using formulas to add properly

across, which will be used in step & below.

In Excel tab C Prepare a multiplestep income statement in good format. Ignore income taxes.

The income statement must be linked, using Excel formulas, to the adjusted trial balance in Excel

Tab A Note: A template has been provided for you so that you can fill in the green cells

remember to link the account names and the amounts to the adjusted trial balance do not type

them in

In Excel Tab C Prepare a classified balance sheet in good format. The balance sheet must be

linked, using Excel formulas, to the adjusted trial balance in Excel Tab A Note: A template has

been provided for you so that you can fill in the green cells remember to link the account names

and the amounts to the adjusted trial balance do not type them in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock