Question: And show the solution AutoSeve CF 11hdtoe Chapter 16 Eacal Mater thdent el Hokit Lau File Home Insert Page Layouts Formulas Data Seview View Developer

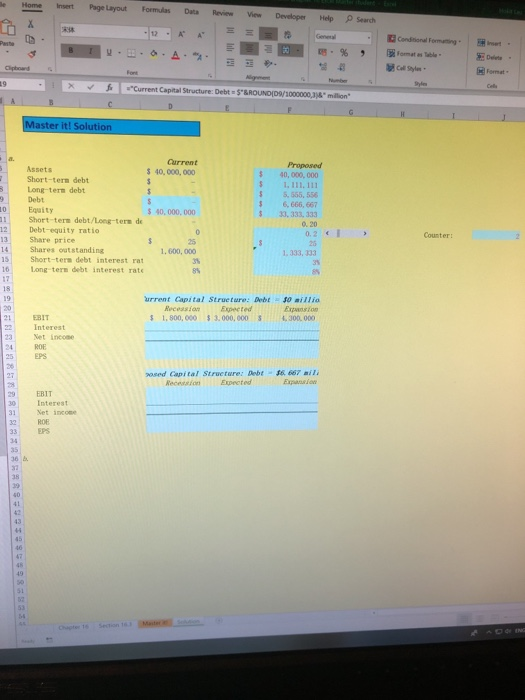

AutoSeve CF 11hdtoe Chapter 16 Eacal Mater thdent el Hokit Lau File Home Insert Page Layouts Formulas Data Seview View Developer P Searchs Help Condiionlomang 12 A General A" Fomat a Tbe Paste 9% B I Cll Sty- E Fomet Clgboad Aligmene Nunbe Edtes To illustrate the new capital structure, you would lke to create a pie chart. Another pie chart that is available is the pie of pie chart, Using the pis 12 Chapter 16 Master it! The TL. Corporation currently has no debt outstanding. Josh Culberson, the CFO, is considering restructuring the coepany by issuing debt and using the proceeds to repurehase outstanding equity. The company's assets are worth $40 nillion, the stock price is $25 per share, and there are 1,600, 000 shares outstanding. In the expected state of the econony, EBIT is espeeted to be $3 illion If there is a recession, EBIT would fall to $1.8 aillion and in an expansion EBIT vould increase te 4.3 illion If the company isses debt, it will issue a combination of short-ters debt and long ters debt. The ratio of short-tern debt to long-tern debt will be 0.20. The short ters debt will have an interest rate of 3 percent1 and the long term debt will have an interest rate of 8 percent On the next worksheet, fill in the valses in each table. For the debt equity ratio, create a spinner thet changes the debt equity ratio, The resulting debt equity ratio should range froe 0 to 10 at incresents of 0.1. Graph the EBIT and EPS for the TL Corporation on the sane graph using a scatter plot. b Shat is the breakeven EBIT betwees the current capital structure and the new capi tal structure? c. To illustrate the new capital structure. you would like to create a pie chart. Another pie chart that is available is the pie of pie chart, Using the pie of pie chart, graph the equity and total debt in the sain pie chart and the short-ters debt and long-tern debt in the secondary pie chart, Note, if you right-elick on a data series in the chart and select Format Data Series, Series Options, then Split Series By will permit you to display the series by a custonized choice. In the customization, you can select which data series you want displayed in the prinary pie chart and the secondary pie chart. le Home E Insert Page Layout Formulas Data Review View Developer Help Search R 12 A A Geneal Conditional Fomating inet Paste R9% U A-"a - omat es Teble Delete Call Style Clipboand Format- Allignment mber Syle Cello "Current Capital Structure: Debt $&ROUND(D9/1000000,3&" million" E G Master it! Solution a. Current Proposed Assets S 40, 000, 000 40, 000, 000 Short-tern debt Long term debt Debt 1, 111. 111 5, 655, 556 6, 666, 667 33, 333, 333 10 Equity Short-ters debt/Long-ters de Debt-equity ratio Share price $ 40, 000, 000 11 0,20 12 0.2 25 Counter 13 25 S Shares outstanding Short-term debt interest rat Long tern debt interest rate 14 1, 600, 000 1,333, 333 15 3% 16 17 18 19 urrent Capital Strueture: Debt s0 millio Expansion 4,300, 000 20 Receasion $ 1,800, 000 Expected $ 3,000, 000 21 EBIT Interest 27 23 Net income 24 ROE EPS 20 26 667 ail. 20sed Capital Structure: Debt 27 Receseion Expected Expansion EBIT Interest Net incose 30 3. ROE 32 gPs 33 34 35 36 b 37 38 39 40 41 42 43 44 45 46 47 4h 49 51 53 Master Section 16 Chapter 16 e aganaatanaana 12 A" General Conditional Paste U -9% Fomat as Ta . . Call Styles Cipboard Font Alignment Number #"Current Capital Structure: Debt $"&ROUND(D9/1000000,3)&" million" D19 Styles A B C D 31 Net income G 32 ROE 33 EPS 34 35 36 b. 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 Breakeven EBIT 62 c 63 64 d 65 66 67 68 65 70 71 72 73 74 75 76 77 78 75 80 82 Itl rl Styles ding URE Rew capital structure, you would like to create a pie chart. Another pie chart that is available is the pie of pie chart, Using the pie A Chapter 16- Master it! The TL Corporation currently has no debt outstanding. Josh Culberson, the CFO, is considering restructuring the company by issuing debt and using the proceeds to repurchase out standing equity. The company's assets are worth $40 million, the stock price is $25 per share, and there are 1, 600, 000 shares outstanding. In the expected state of the economy, EBIT is expected to be $3 million. If there is a recession, EBIT would fall to $1.8 million and in an expansion EBIT would increase to $4. 3 million. If the company issues debt, it will issue a combination of short-tern debt and long-term debt. The ratio of short-tern debt to long term debt will be 0. 20. The short-term debt will have an interest rate of 3 percent and the long-term debt will have an interest rate of 8 percent. On the next worksheet, fill in the values in each table. For the debt-equity ratio, create a spinner that changes the debt-equity ratio. The resulting debt-equity ratio should range from 0 to 10 at increments of 0.1. a. Graph the EBIT and EPS for the TL Corporation on the same graph using a scatter plot. b. What is the breakeven EBIT between the current capital structure and the new capital structure? c. chart, Using the pie of pie chart, graph the equity and total debt in the main pie chart and the short-tern debt and long tern debt in d. the secondary pie chart. Note, if you right-click on a data series in the chart and select Format Data Series, Series Options, then To illustrate the new capital structure, you would like to create a pie chart. Another pie chart that is available is the pie of pie Split Series By wil1 permit you to display the series by a customized choice. In the custonization, you can select which data series you want displayed in the primary pie chart and the secondary pie chart. AutoSeve CF 11hdtoe Chapter 16 Eacal Mater thdent el Hokit Lau File Home Insert Page Layouts Formulas Data Seview View Developer P Searchs Help Condiionlomang 12 A General A" Fomat a Tbe Paste 9% B I Cll Sty- E Fomet Clgboad Aligmene Nunbe Edtes To illustrate the new capital structure, you would lke to create a pie chart. Another pie chart that is available is the pie of pie chart, Using the pis 12 Chapter 16 Master it! The TL. Corporation currently has no debt outstanding. Josh Culberson, the CFO, is considering restructuring the coepany by issuing debt and using the proceeds to repurehase outstanding equity. The company's assets are worth $40 nillion, the stock price is $25 per share, and there are 1,600, 000 shares outstanding. In the expected state of the econony, EBIT is espeeted to be $3 illion If there is a recession, EBIT would fall to $1.8 aillion and in an expansion EBIT vould increase te 4.3 illion If the company isses debt, it will issue a combination of short-ters debt and long ters debt. The ratio of short-tern debt to long-tern debt will be 0.20. The short ters debt will have an interest rate of 3 percent1 and the long term debt will have an interest rate of 8 percent On the next worksheet, fill in the valses in each table. For the debt equity ratio, create a spinner thet changes the debt equity ratio, The resulting debt equity ratio should range froe 0 to 10 at incresents of 0.1. Graph the EBIT and EPS for the TL Corporation on the sane graph using a scatter plot. b Shat is the breakeven EBIT betwees the current capital structure and the new capi tal structure? c. To illustrate the new capital structure. you would like to create a pie chart. Another pie chart that is available is the pie of pie chart, Using the pie of pie chart, graph the equity and total debt in the sain pie chart and the short-ters debt and long-tern debt in the secondary pie chart, Note, if you right-elick on a data series in the chart and select Format Data Series, Series Options, then Split Series By will permit you to display the series by a custonized choice. In the customization, you can select which data series you want displayed in the prinary pie chart and the secondary pie chart. le Home E Insert Page Layout Formulas Data Review View Developer Help Search R 12 A A Geneal Conditional Fomating inet Paste R9% U A-"a - omat es Teble Delete Call Style Clipboand Format- Allignment mber Syle Cello "Current Capital Structure: Debt $&ROUND(D9/1000000,3&" million" E G Master it! Solution a. Current Proposed Assets S 40, 000, 000 40, 000, 000 Short-tern debt Long term debt Debt 1, 111. 111 5, 655, 556 6, 666, 667 33, 333, 333 10 Equity Short-ters debt/Long-ters de Debt-equity ratio Share price $ 40, 000, 000 11 0,20 12 0.2 25 Counter 13 25 S Shares outstanding Short-term debt interest rat Long tern debt interest rate 14 1, 600, 000 1,333, 333 15 3% 16 17 18 19 urrent Capital Strueture: Debt s0 millio Expansion 4,300, 000 20 Receasion $ 1,800, 000 Expected $ 3,000, 000 21 EBIT Interest 27 23 Net income 24 ROE EPS 20 26 667 ail. 20sed Capital Structure: Debt 27 Receseion Expected Expansion EBIT Interest Net incose 30 3. ROE 32 gPs 33 34 35 36 b 37 38 39 40 41 42 43 44 45 46 47 4h 49 51 53 Master Section 16 Chapter 16 e aganaatanaana 12 A" General Conditional Paste U -9% Fomat as Ta . . Call Styles Cipboard Font Alignment Number #"Current Capital Structure: Debt $"&ROUND(D9/1000000,3)&" million" D19 Styles A B C D 31 Net income G 32 ROE 33 EPS 34 35 36 b. 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 Breakeven EBIT 62 c 63 64 d 65 66 67 68 65 70 71 72 73 74 75 76 77 78 75 80 82 Itl rl Styles ding URE Rew capital structure, you would like to create a pie chart. Another pie chart that is available is the pie of pie chart, Using the pie A Chapter 16- Master it! The TL Corporation currently has no debt outstanding. Josh Culberson, the CFO, is considering restructuring the company by issuing debt and using the proceeds to repurchase out standing equity. The company's assets are worth $40 million, the stock price is $25 per share, and there are 1, 600, 000 shares outstanding. In the expected state of the economy, EBIT is expected to be $3 million. If there is a recession, EBIT would fall to $1.8 million and in an expansion EBIT would increase to $4. 3 million. If the company issues debt, it will issue a combination of short-tern debt and long-term debt. The ratio of short-tern debt to long term debt will be 0. 20. The short-term debt will have an interest rate of 3 percent and the long-term debt will have an interest rate of 8 percent. On the next worksheet, fill in the values in each table. For the debt-equity ratio, create a spinner that changes the debt-equity ratio. The resulting debt-equity ratio should range from 0 to 10 at increments of 0.1. a. Graph the EBIT and EPS for the TL Corporation on the same graph using a scatter plot. b. What is the breakeven EBIT between the current capital structure and the new capital structure? c. chart, Using the pie of pie chart, graph the equity and total debt in the main pie chart and the short-tern debt and long tern debt in d. the secondary pie chart. Note, if you right-click on a data series in the chart and select Format Data Series, Series Options, then To illustrate the new capital structure, you would like to create a pie chart. Another pie chart that is available is the pie of pie Split Series By wil1 permit you to display the series by a customized choice. In the custonization, you can select which data series you want displayed in the primary pie chart and the secondary pie chart

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts