Question: Anderson's current assets are $3,000, current liabilities are $7,000, and long-term debt is $2,000,000. If the company adopts the new project, the current assets will

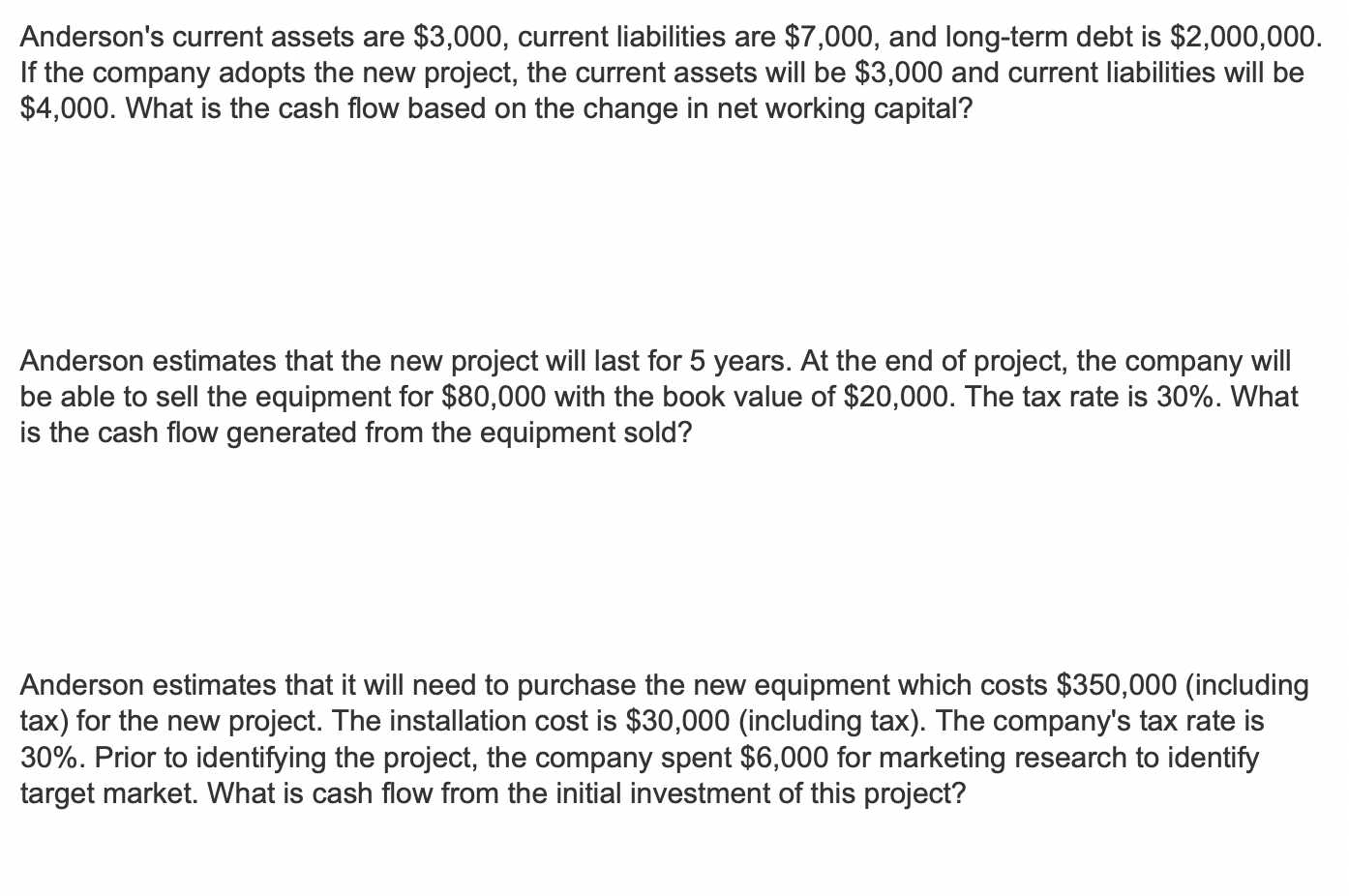

Anderson's current assets are $3,000, current liabilities are $7,000, and long-term debt is $2,000,000. If the company adopts the new project, the current assets will be $3,000 and current liabilities will be $4,000. What is the cash flow based on the change in net working capital? Anderson estimates that the new project will last for 5 years. At the end of project, the company will be able to sell the equipment for $80,000 with the book value of $20,000. The tax rate is 30%. What is the cash flow generated from the equipment sold? Anderson estimates that it will need to purchase the new equipment which costs $350,000 (including tax) for the new project. The installation cost is $30,000 (including tax). The company's tax rate is 30%. Prior to identifying the project, the company spent $6,000 for marketing research to identify target market. What is cash flow from the initial investment of this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts