Question: Andy purchases a 2 5 - year bond with coupons of 1 0 % payable half - yearly at a price of $ 1 ,

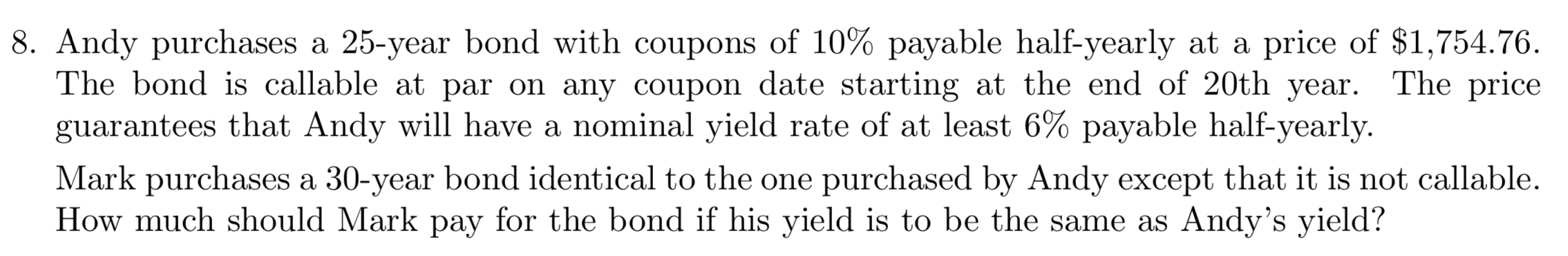

Andy purchases a year bond with coupons of payable halfyearly at a price of $ The bond is callable at par on any coupon date starting at the end of th year. The price guarantees that Andy will have a nominal yield rate of at least payable halfyearly.

Mark purchases a year bond identical to the one purchased by Andy except that it is not callable. How much should Mark pay for the bond if his yield is to be the same as Andy's yield?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock