Question: Ang Electronics, Incorporated, has developed a new mesh network. If successful, the present value of the payoff (when the product is brought to market)

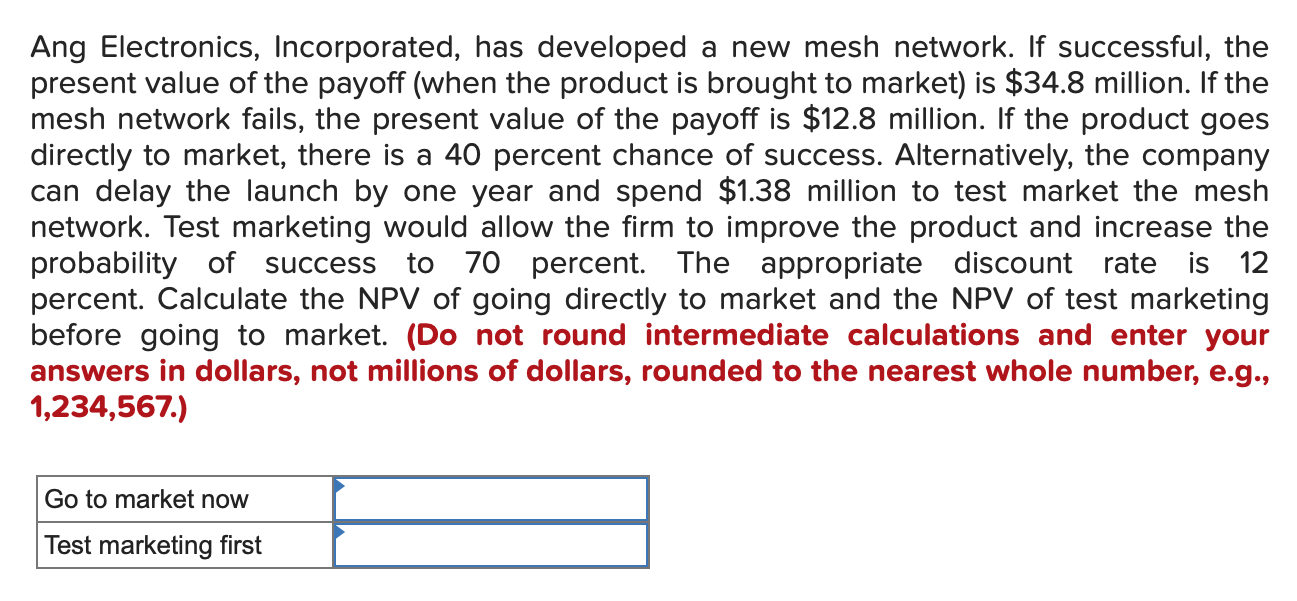

Ang Electronics, Incorporated, has developed a new mesh network. If successful, the present value of the payoff (when the product is brought to market) is $34.8 million. If the mesh network fails, the present value of the payoff is $12.8 million. If the product goes directly to market, there is a 40 percent chance of success. Alternatively, the company can delay the launch by one year and spend $1.38 million to test market the mesh network. Test marketing would allow the firm to improve the product and increase the probability of success to 70 percent. The appropriate discount rate is 12 percent. Calculate the NPV of going directly to market and the NPV of test marketing before going to market. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) Go to market now Test marketing first

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

To calculate the Net Present Value NPV of going directly to market and the NPV of test marketing bef... View full answer

Get step-by-step solutions from verified subject matter experts