Anita Kaur runs a courier service in downtown Seattle. She charges clients $0.62 per mile driven....

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

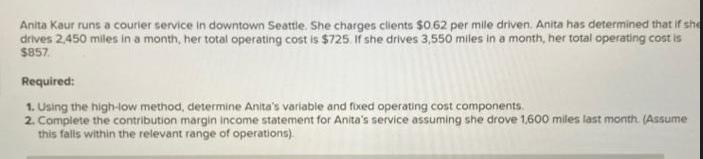

Anita Kaur runs a courier service in downtown Seattle. She charges clients $0.62 per mile driven. Anita has determined that if she drives 2,450 miles in a month, her total operating cost is $725. If she drives 3,550 miles in a month, her total operating cost is $857. Required: 1. Using the high-low method, determine Anita's variable and fixed operating cost components. 2. Complete the contribution margin income statement for Anita's service assuming she drove 1,600 miles last month. (Assume this falls within the relevant range of operations). Anita Kaur runs a courier service in downtown Seattle. She charges clients $0.62 per mile driven. Anita has determined that if she drives 2,450 miles in a month, her total operating cost is $725. If she drives 3,550 miles in a month, her total operating cost is $857. Required: 1. Using the high-low method, determine Anita's variable and fixed operating cost components. 2. Complete the contribution margin income statement for Anita's service assuming she drove 1,600 miles last month. (Assume this falls within the relevant range of operations).

Expert Answer:

Answer rating: 100% (QA)

To determine Anitas variable and fixed operating cost components using the highlow method we need to ... View the full answer

Related Book For

Managerial Accounting

ISBN: 978-0078025518

2nd edition

Authors: Stacey Whitecotton, Robert Libby, Fred Phillips

Posted Date:

Students also viewed these accounting questions

-

Joyce Murphy runs a courier service in downtown Seattle. She charges clients $0.50 per mile driven. Joyce has determined that if she drives 3,300 miles in a month, her total operating cost is $875....

-

es Joyce Murphy runs a courier service in downtown Seattle. She charges clients $0.42 per mile driven. Joyce has determined that if she drives 3,300 miles in a month, her total operating cost is...

-

Joyce Murphy runs a courier service in downtown Seattle. She charges clients $0.50 per mile driven. Joyce has determined that if she drives 3,300 miles in a month, her total operating cost is $875....

-

The object is used to execute a static Oracle query, but the object is used to execute a dynamic Oracle query with IN and OUT parameters. a. PreparedStatement, Statement b. Statement,...

-

Is that what happened with Despatch?

-

The following sales and cost data (in thousands) are for two companies in the transportation industry: Required 1. Calculate the degree of operating leverage (DOL) for each company. If sales increase...

-

Using one beam element and one spring element, find the natural frequencies of the uniform, spring-supported cantilever beam shown in Fig. 12.22. Figure 12.22:- p. A,I,E X X+ 7777 b Section X-X h...

-

The Berndt Corporation expects to have sales of $12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be $1.5 million. All sales revenues will be...

-

Evaluate the following definite integral. 1 x (4x 1)4 dz 0 1/3 X

-

WW Development Inc. (WW), a real estate developer, was incorporated in Canada in 1975 by two brothers, Peter and David Wang. In the 1980s and 1990s, WW was quite successful. In early 2002, Peter and...

-

In our quest to understand and bridge the old and new technology or the emerging technology in this modern world, there are techniques to follow to achieve this. Expand your knowledge on the 6 above...

-

How can managers mitigate political risk?

-

What is global competition and what does it mean to the global manager?

-

Why have companies experienced an increasing importance in supporting spouses? What initiatives should they take in offering support?

-

Which countries are currently considered politically too risky to conduct business, and why?

-

What are some of the barriers managers face in creating a global e-business?

-

A conflict of interest exists if the representation of a client by an attorney adversely affects another client or if the representation of a client may be limited materially with the...

-

What is the expected payoff of an investment that yields $5,000 with a probability of 0.15 and $500 with a probability of 0.85? Select one: O a. $325 O b. $5,500 O c. $2,750 O d. $1,175

-

Refer to PB12-4. Additional Data: a. Prepaid Expenses relate to rent paid in advance. b. Other Operating Expenses were paid in cash. c. An owner contributed capital by paying $200 cash in exchange...

-

What are the typical cash inflows from investing activities? What are the typical cash outflows from investing activities? Discuss.

-

Quail Company produces outdoor gear. Salter is a division of Quail that manufactures unbreakable zippers used in Quails gear and sold to other manufacturers. Cost information per zipper follows:...

-

What does it mean to say that the demand for resources is a derived demand? Is the demand for all goods and services a derived demand?

-

Using the data in exercise 2, determine how many units of resources the firm will want to acquire. Data from in exercise 2 Using the information in the following table, calculate the marginal revenue...

-

Using the information in the following table, calculate the marginal revenue product (MRP = MPP MR). Unit of Resources Total Resource Output Price Price 1 10 $5 $10 2 25 $5 $10 345 35 $5 $10 40 $5...

Study smarter with the SolutionInn App