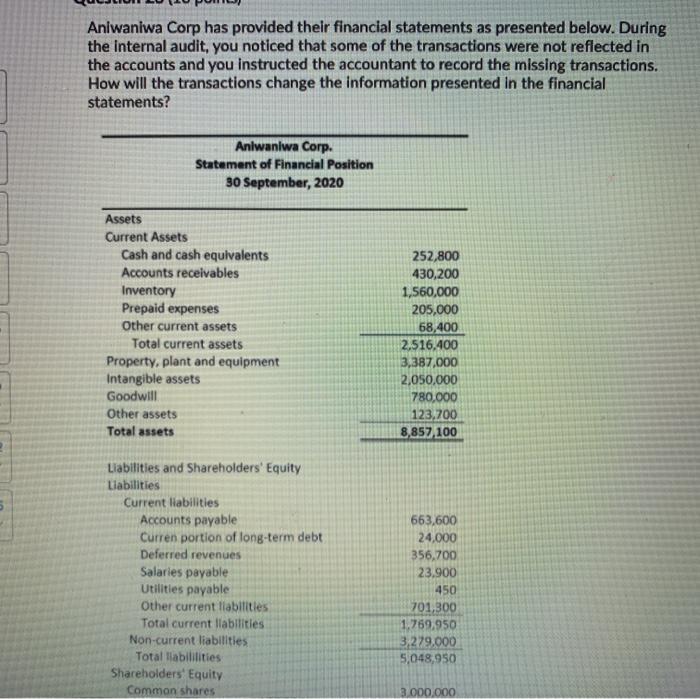

Question: Aniwaniwa Corp has provided their financial statements as presented below. During the internal audit, you noticed that some of the transactions were not reflected in

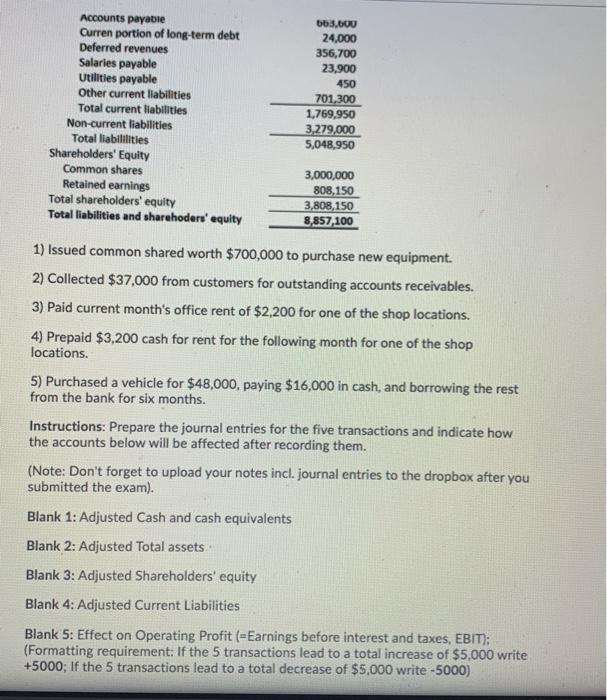

Aniwaniwa Corp has provided their financial statements as presented below. During the internal audit, you noticed that some of the transactions were not reflected in the accounts and you instructed the accountant to record the missing transactions. How will the transactions change the information presented in the financial statements? Anlwaniwa Corp. Statement of Financial Position 30 September, 2020 Assets Current Assets Cash and cash equivalents Accounts receivables Inventory Prepaid expenses Other current assets Total current assets Property, plant and equipment Intangible assets Goodwill Other assets Total assets 252,800 430,200 1,560,000 205,000 68,400 2,516,400 3,387,000 2,050,000 780,000 123,700 8,857 100 Liabilities and Shareholders' Equity Liabilities Current liabilities Accounts payable Curren portion of long-term debt Deferred revenues Salaries payable Utilities payable Other current liabilities Total current liabilities Non-current liabilities Total liabililities Shareholders' Equity Common shares 663,600 24,000 356,700 23.900 450 701,300 1,769.950 3,279.000 5,048,950 3.000.000 Accounts payable Curren portion of long-term debt Deferred revenues Salaries payable Utilities payable Other current liabilities Total current liabilities Non-current liabilities Total liabililities Shareholders' Equity Common shares Retained earnings Total shareholders' equity Total liabilities and sharehoders' equity 663,000 24,000 356,700 23,900 450 701,300 1,769,950 3,279.000 5,048,950 3,000,000 808,150 3,808,150 8,857, 100 1) Issued common shared worth $700,000 to purchase new equipment. 2) Collected $37,000 from customers for outstanding accounts receivables. 3) Paid current month's office rent of $2,200 for one of the shop locations. 4) Prepaid $3,200 cash for rent for the following month for one of the shop locations 5) Purchased a vehicle for $48,000, paying $16,000 in cash, and borrowing the rest from the bank for six months. Instructions: Prepare the journal entries for the five transactions and indicate how the accounts below will be affected after recording them. (Note: Don't forget to upload your notes incl. journal entries to the dropbox after you submitted the exam). Blank 1: Adjusted Cash and cash equivalents Blank 2: Adjusted Total assets Blank 3: Adjusted Shareholders' equity Blank 4: Adjusted Current Liabilities Blank 5: Effect on Operating Profit (=Earnings before interest and taxes, EBIT): (Formatting requirement: If the 5 transactions lead to a total increase of $5,000 write +5000; If the 5 transactions lead to a total decrease of $5,000 write -5000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts