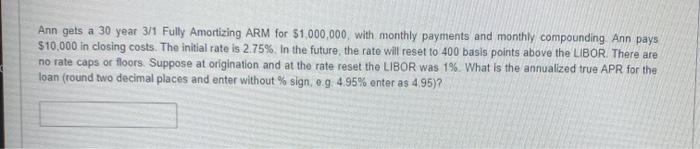

Question: Ann gets a 30 year 3/1 Fully Amortizing ARM for $1,000,000, with monthly payments and monthly compounding Ann pays $10,000 in closing costs. The initial

Ann gets a 30 year 3/1 Fully Amortizing ARM for $1,000,000, with monthly payments and monthly compounding Ann pays $10,000 in closing costs. The initial rate is 2.75%. In the future, the rate will reset to 400 basis points above the LIBOR. There are no rate caps or floors. Suppose at origination and at the rate reset the LIBOR was 1%. What is the annualized true APR for the loan (round two decimal places and enter without % sign, og 4.95% enter as 4.95)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts