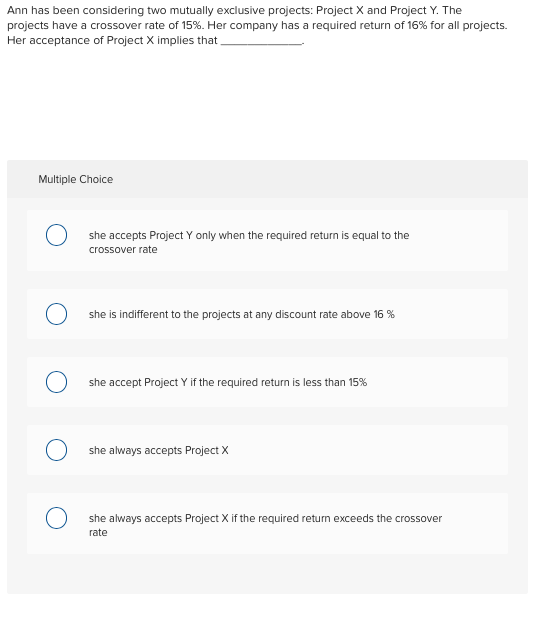

Question: Ann has been considering two mutually exclusive projects: Project X and Project Y. The projects have a crossover rate of 15%. Her company has a

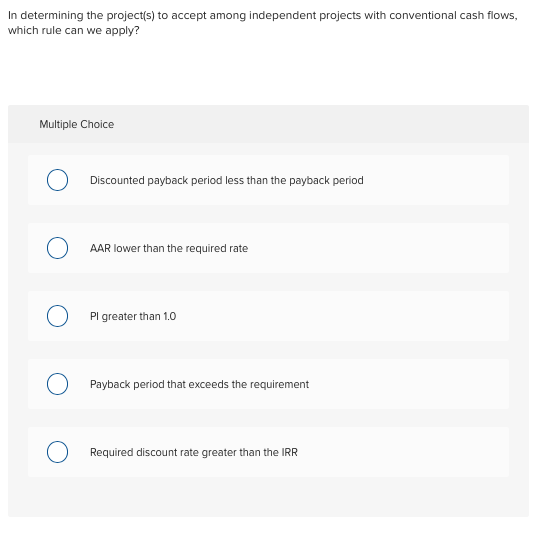

Ann has been considering two mutually exclusive projects: Project X and Project Y. The projects have a crossover rate of 15%. Her company has a required return of 16% for all projects. Her acceptance of Project X implies that Multiple Choice she accepts Project Y only when the required return is equal to the crossover rate she is indifferent to the projects at any discount rate above 16 % she accept Project Y if the required return is less than 15% O she always accepts Project X she always accepts Project X if the required return exceeds the crossover rate In determining the project(s) to accept among independent projects with conventional cash flows, which rule can we apply? Multiple Choice Discounted payback period less than the payback period AAR lower than the required rate Pl greater than 1.0 Payback period that exceeds the requirement Required discount rate greater than the IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts