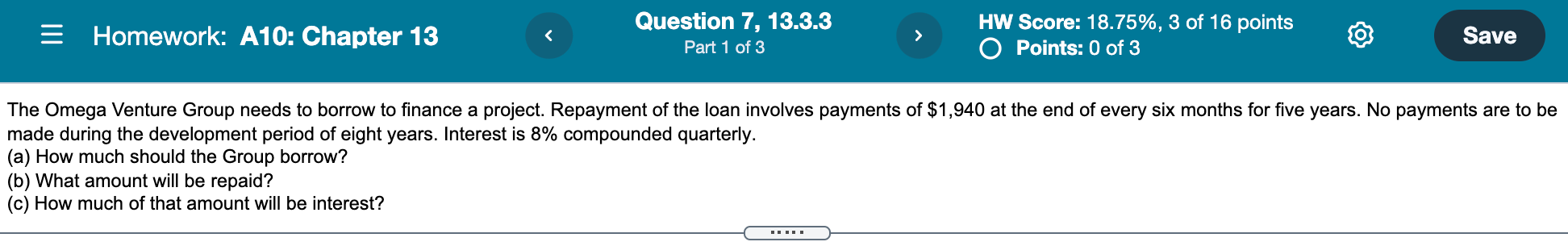

Question: ANNUITY Homework: A10: Chapter 13 Question 7, 13.3.3 HW Score: 18.75%, 3 of 16 points O Part 1 of 3 O Points: 0 of 3

ANNUITY

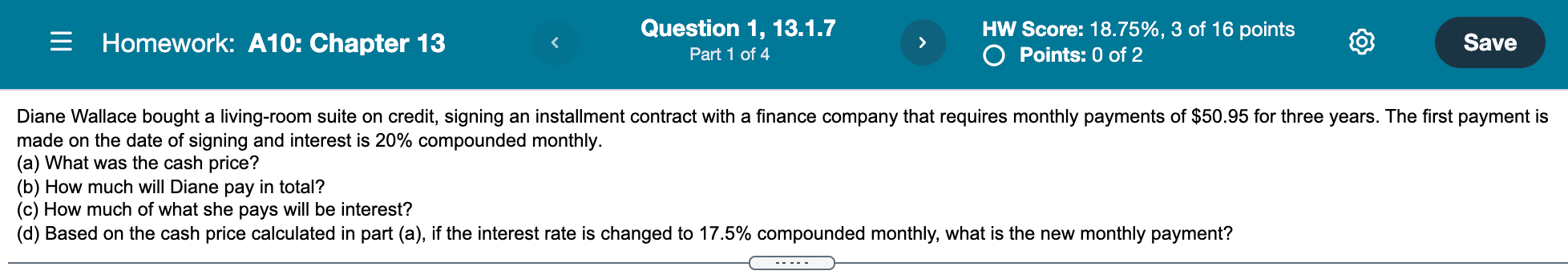

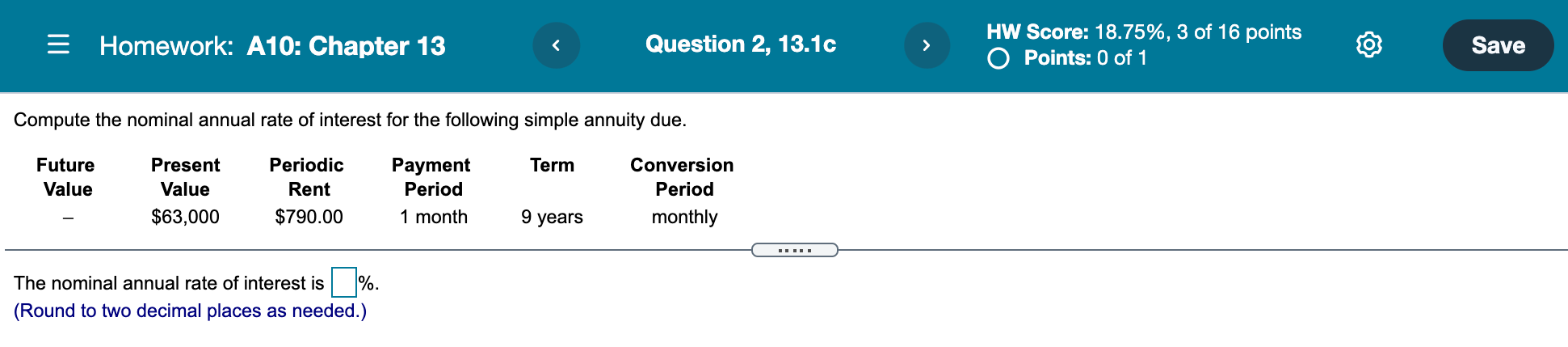

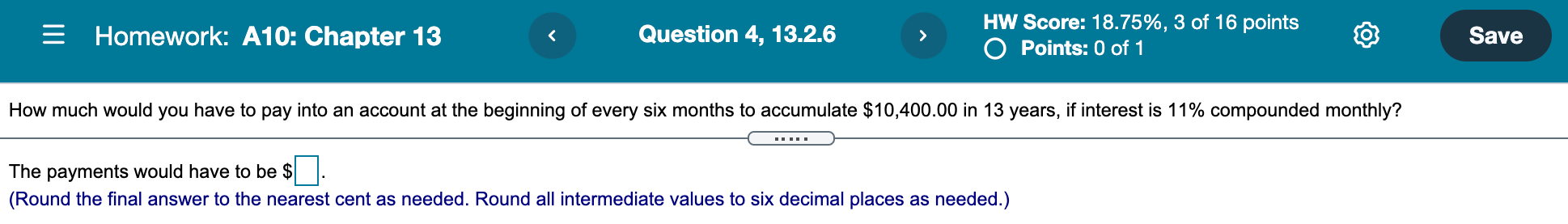

Homework: A10: Chapter 13 Question 7, 13.3.3 HW Score: 18.75%, 3 of 16 points O Part 1 of 3 O Points: 0 of 3 Save The Omega Venture Group needs to borrow to finance a project. Repayment of the loan involves payments of $1,940 at the end of every six months for five years. No payments are to be made during the development period of eight years. Interest is 8% compounded quarterly. (a) How much should the Group borrow? (b) What amount will be repaid? (c) How much of that amount will be interest?E Homework: A10: Chapter 13 Question 1, 13.1.7 HW Score: 18.75%, 3 of 16 points Part 1 of 4 O Points: 0 of 2 Save Diane Wallace bought a living-room suite on credit, signing an installment contract with a finance company that requires monthly payments of $50.95 for three years. The first payment is made on the date of signing and interest is 20% compounded monthly. (a) What was the cash price? (b) How much will Diane pay in total? (c) How much of what she pays will be interest? (d) Based on the cash price calculated in part (a), if the interest rate is changed to 17.5% compounded monthly, what is the new monthly payment?HW Score: 18.75%, 3 of 16 points @ 0 Points: 0 of 1 Homework: A1 0: Chapter 1 3 Question 2, 13.1 c Compute the nominal annual rate of interest for the following simple annuity due. Future Present Periodic Payment Term Conversion Value Value Rent Period Period $63,000 $790.00 1 month 9 years monthly The nominal annual rate of interest is l]%. (Round to two decimal places as needed.) HW Score: 18.75%, 3 of 16 points 0 Points: 0 of 1 Homework: A10: Chapter 13 Question 4, 13.2.6 How much would you have to pay into an account at the beginning of every six months to accumulate $10,400.00 in 13 years, if interest is 11% compounded monthly? The payments would have to be $|:. (Round the nal answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts