Question: Another method of measuring interest-rate risk is the duration gap analysis, examines the sensitivity of the market value of the financial institutions net worth to

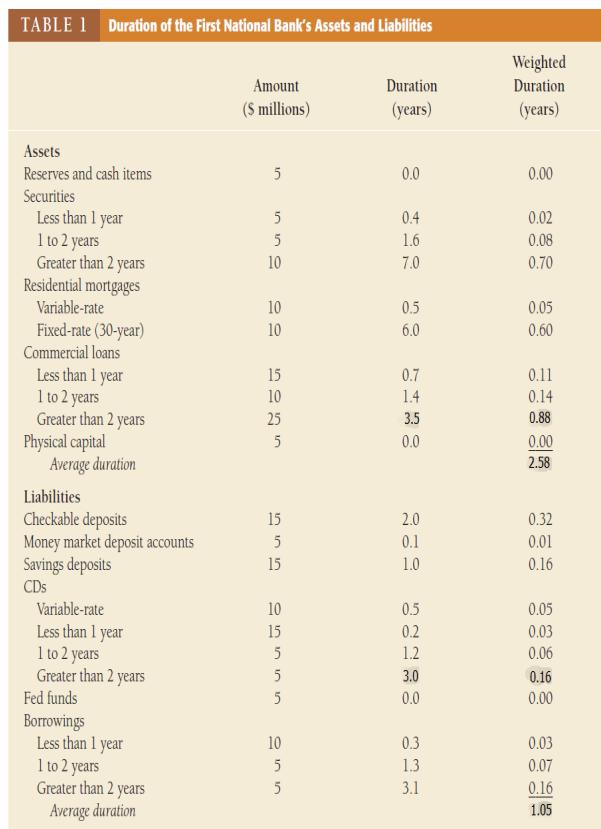

Another method of measuring interest-rate risk is the duration gap analysis, examines the sensitivity of the market value of the financial institution’s net worth to changes in interest rates. Duration analysis is based on Macaulay’s concept of duration, which measures the average lifetime of a security’s stream of payments. Duration is a useful concept, because it provides a good approximation, particularly when interest-rate changes are small, of the sensitivity of a security’s market value to a change in its interest rate. Bank managers can figure out the effect of interest-rate changes on the market value of net worth by calculating the average duration for assets and for liabilities. These durations are then used to estimate the effects of interest-rate changes. Table 1 shows the balance sheet of the First National Bank. The bank manager has already calculated the duration of each assets and liabilities, as listed in the last column of the table.

Q1 The bank manager wants to know what happens when the interest rate rises from 10% to 11%. The total asset value is $100 million, and the total liability value is $95 million. Calculate the change in the market value of the assets and liabilities.

Q2 Based on the Q1, calculate the duration gap for the First National Bank.

Q3 What is the change in the market value of net worth as a percentage of assets if interest rates rise from 10% to 11%?

TABLE 1 Duration of the First National Bank's Assets and Liabilities Assets Reserves and cash items Securities Less than 1 year 1 to 2 years Greater than 2 years Residential mortgages Variable-rate Fixed-rate (30-year) Commercial loans Less than 1 year 1 to 2 years Greater than 2 years Physical capital Average duration Liabilities Checkable deposits Money market deposit accounts Savings deposits CDs Variable-rate Less than 1 year 1 to 2 years Greater than 2 years Fed funds Borrowings Less than 1 year 1 to 2 years Greater than 2 years Average duration Amount (S millions) 5 5 5 10 10 10 15 5055 10 25 15 555 15 10 e in in 15 5 5 5 10 055 Duration (years) 0.0 0.4 1.6 7.0 0.5 6.0 0.7 1.4 3.5 0.0 2.0 0.1 1.0 0.5 522 0.2 3.0 0.0 0.3 1.3 3.1 Weighted Duration (years) 0.00 0.02 0.08 0.70 0.05 0.60 0.11 0.14 0.88 0.00 2.58 0.32 0.01 0.16 0.05 0.03 0.06 0.16 0.00 0.03 0.07 0.16 1.05

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

To calculate the changes in market values of assets and liabilities and the duration gap we will use the concept of duration and the formula for estim... View full answer

Get step-by-step solutions from verified subject matter experts