Question: answer 13 14 15 ty will rate up for you!! answer 16 17 18 ty present value of an annuity column and row should be

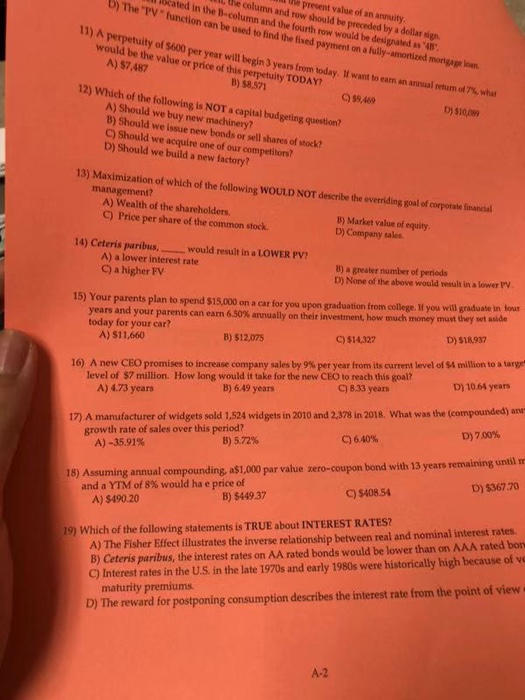

present value of an annuity column and row should be preceded by a dollar sign in the B-column and the fourth row would be designated as "48 D) The PV function can be used to find the fixed payment on a fully-amortized morlgage loan 11) A perpetuity of $600 per year will begin 3 years from today. If want to earm an anal retum of 7% what would be the value or price of this perpetulty TODAY? A) $7,487 B) $8,571 959,469 12) Which of the following is NOT a capital budgeting question? A) Should we buy new machinery? B) Should we issue new bonds or sell shares of stock? C) Should we acquire one of our competitors? D) Should we build a new factory? D) $10,09 13) Maximization of which of the following WOULD NOT describe the overriding goal of corporate financial management? A) Wealth of the shareholders. C) Price per share of the common stock B) Market value of equity. D) Company sales. 14) Ceteris paribus, A) a lower interest rate C) a higher FV would result in a LOWER PV? B) a greater number of periods D) None of the above would result in a lower PV 15) Your parents plan to spend $15,000 on a car for you upon graduation from college. If you will graduate in four years and your parents can earn 6.50 % annually on their investment, how much money must they set aside today for your car? A) $11,660 D) $18,937 )514,327 B) $12,075 A new CEO promises to increase company sales by 9 % per year from its current level of $4 million to a targe" 16) level of $7 million. How long would it take for the new CEO to reach this goal? A) 4.73 years D) 10.64 years C)8.33 years B) 6.49 years 17) A manufacturer of widgets sold 1,524 widgets in 2010 and 2,378 in 2018. What was the (compounded) an- growth rate of sales over this period? A)-35.91% D)7.00 % C)640 % B) 5.72 % 18) Assuming annual compounding, a$1,000 par value zero-coupon bond with 13 years remaining until mr and a YTM of 8 % would ha e price of A) $490.20 D) $367.70 9 $408.54 B) $449.37 19) Which of the following statements is TRUE about INTEREST RATES? A) The Fisher Effect illustrates the inverse relationship between real and nominal interest rates. B) Ceteris paribus, the interest rates on AA rated bonds would be lower than on AAA rated bon C) Interest rates in the U.S. in the late 1970s and early 1980s were historically high because of ve maturity premiums. D) The reward for postponing consumption describes the interest rate from the point of view A-2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts