Question: Answer 1-4 with a complete solution. do not submit an incomplete answer. Agustin and Parana are apparel manufacturers for both men and women. They use

Answer 1-4 with a complete solution.

do not submit an incomplete answer.

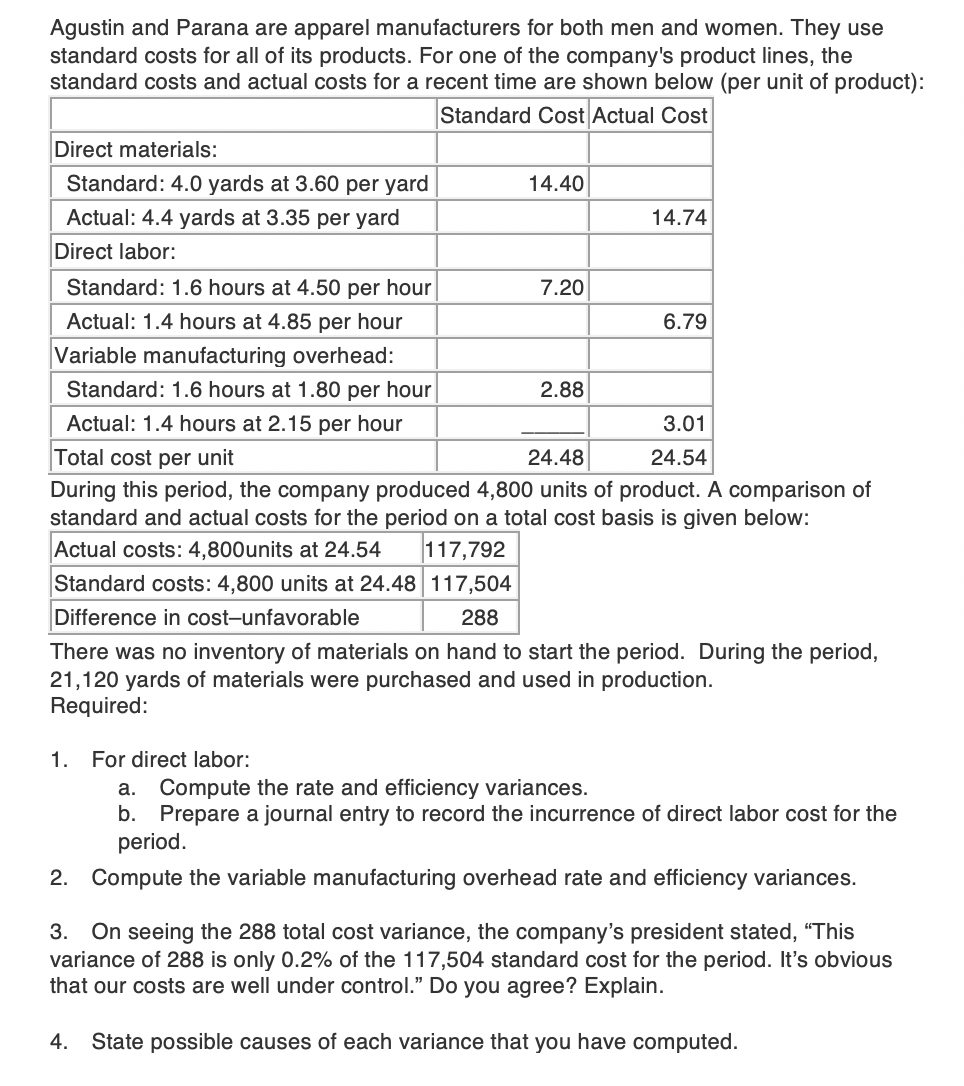

Agustin and Parana are apparel manufacturers for both men and women. They use standard costs for all of its products. For one of the company's product lines, the standard costs and actual costs for a recent time are shown below (per unit of product): Standard Cost Actual Cost Direct materials: Standard: 4.0 yards at 3.60 per yard 14.40 Actual: 4.4 yards at 3.35 per yard 14.74 Direct labor: Standard: 1.6 hours at 4.50 per hour 7.20 Actual: 1.4 hours at 4.85 per hour 6.79 Variable manufacturing overhead: Standard: 1.6 hours at 1.80 per hour 2.88 Actual: 1.4 hours at 2.15 per hour 3.01 Total cost per unit 24.48 24.54 During this period, the company produced 4,800 units of product. A comparison of standard and actual costs for the period on a total cost basis is given below: Actual costs: 4,800 units at 24.54 117,792 Standard costs: 4,800 units at 24.48 117,504 Difference in cost-unfavorable 288 There was no inventory of materials on hand to start the period. During the period, 21,120 yards of materials were purchased and used in production. Required: 1. For direct labor: a. Compute the rate and efficiency variances. b. Prepare a journal entry to record the incurrence of direct labor cost for the period. 2. Compute the variable manufacturing overhead rate and efficiency variances. 3. On seeing the 288 total cost variance, the company's president stated, This variance of 288 is only 0.2% of the 117,504 standard cost for the period. It's obvious that our costs are well under control. Do you agree? Explain. 4. State possible causes of each variance that you have computed. Agustin and Parana are apparel manufacturers for both men and women. They use standard costs for all of its products. For one of the company's product lines, the standard costs and actual costs for a recent time are shown below (per unit of product): Standard Cost Actual Cost Direct materials: Standard: 4.0 yards at 3.60 per yard 14.40 Actual: 4.4 yards at 3.35 per yard 14.74 Direct labor: Standard: 1.6 hours at 4.50 per hour 7.20 Actual: 1.4 hours at 4.85 per hour 6.79 Variable manufacturing overhead: Standard: 1.6 hours at 1.80 per hour 2.88 Actual: 1.4 hours at 2.15 per hour 3.01 Total cost per unit 24.48 24.54 During this period, the company produced 4,800 units of product. A comparison of standard and actual costs for the period on a total cost basis is given below: Actual costs: 4,800 units at 24.54 117,792 Standard costs: 4,800 units at 24.48 117,504 Difference in cost-unfavorable 288 There was no inventory of materials on hand to start the period. During the period, 21,120 yards of materials were purchased and used in production. Required: 1. For direct labor: a. Compute the rate and efficiency variances. b. Prepare a journal entry to record the incurrence of direct labor cost for the period. 2. Compute the variable manufacturing overhead rate and efficiency variances. 3. On seeing the 288 total cost variance, the company's president stated, This variance of 288 is only 0.2% of the 117,504 standard cost for the period. It's obvious that our costs are well under control. Do you agree? Explain. 4. State possible causes of each variance that you have computed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts