Question: ANSWER 21 AND 22 PLEASE! A local bookstore is considering adding a coffee shop to their store. Building the coffee shop will cost $231,497.00 today.

ANSWER 21 AND 22 PLEASE!

ANSWER 21 AND 22 PLEASE!

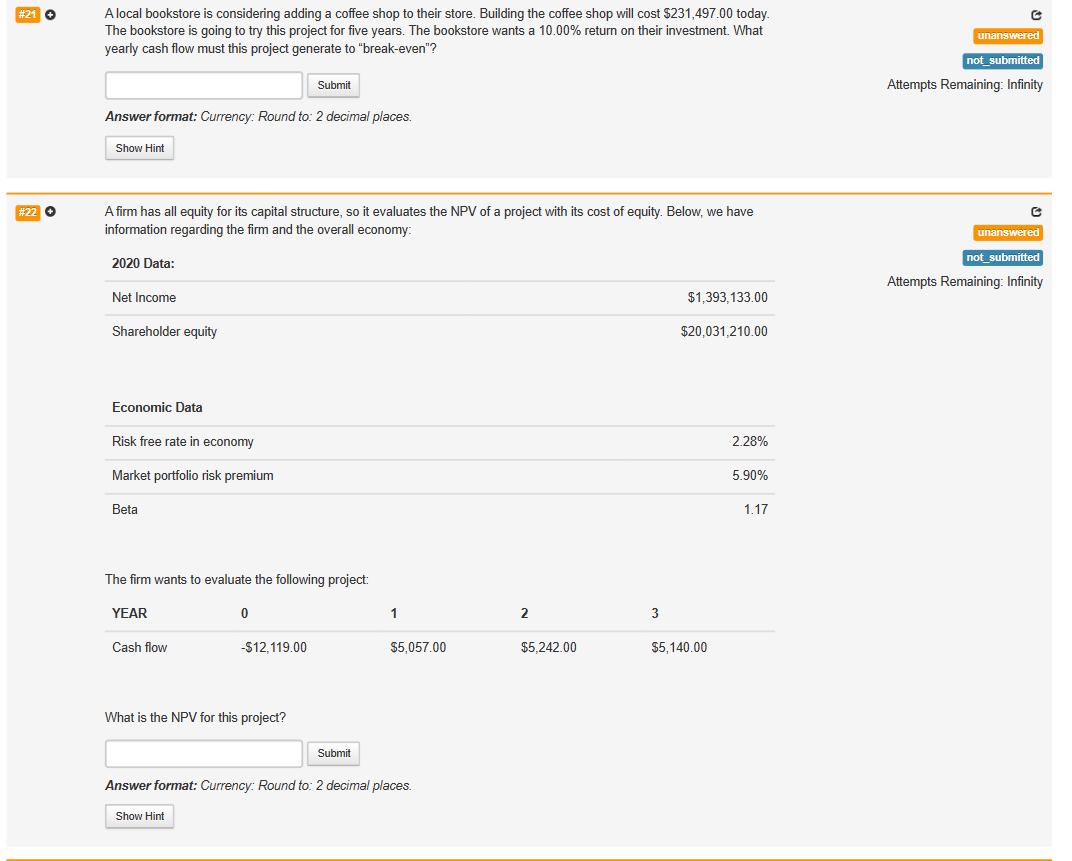

A local bookstore is considering adding a coffee shop to their store. Building the coffee shop will cost $231,497.00 today. The bookstore is going to try this project for five years. The bookstore wants a 10.00% return on their investment. What yearly cash flow must this project generate to "break-even"? Attempts Remaining: Infinity Answer format: Currency: Round to: 2 decimal places. A firm has all equity for its capital structure, so it evaluates the NPV of a project with its cost of equity. Below, we have information regarding the firm and the overall economy: 2020 Data: Attempts Remaining: Infinity Net Income Shareholder equity $20,031,210.00 The firm wants to evaluate the following project: What is the NPV for this project? Answer format: Currency: Round to: 2 decimal places. A local bookstore is considering adding a coffee shop to their store. Building the coffee shop will cost $231,497.00 today. The bookstore is going to try this project for five years. The bookstore wants a 10.00% return on their investment. What yearly cash flow must this project generate to "break-even"? Attempts Remaining: Infinity Answer format: Currency: Round to: 2 decimal places. A firm has all equity for its capital structure, so it evaluates the NPV of a project with its cost of equity. Below, we have information regarding the firm and the overall economy: 2020 Data: Attempts Remaining: Infinity Net Income Shareholder equity $20,031,210.00 The firm wants to evaluate the following project: What is the NPV for this project? Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts