Question: Answer 25-28 please show work The next five problems refer to Acme Enterprises Acme Enterprises is considering a new four- requires an initial fixed asset

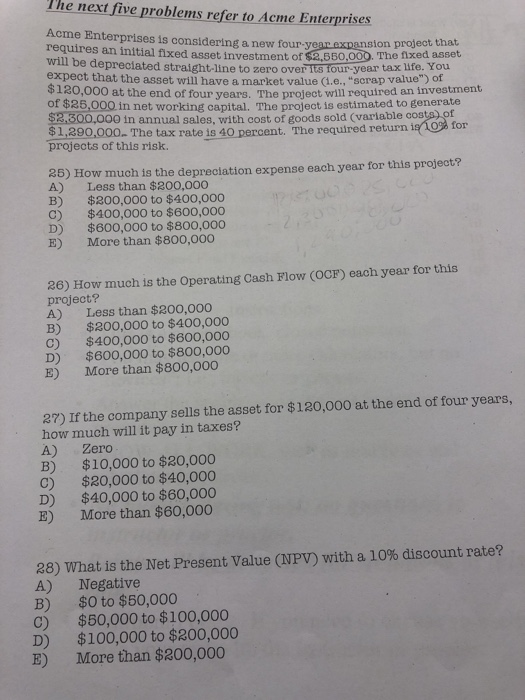

The next five problems refer to Acme Enterprises Acme Enterprises is considering a new four- requires an initial fixed asset investment of $2.550,000. The fixed asset will be depreciated straight-line to zero over on project that its four-year tax life. You expect that the asset will have a market-value (i.e., scrap value") of $120,000 at the end of four vears. The project will required an investment of $25,000 in net working capital. The project is estimated to generate 53,500,000 in annual sales, with cost of goods sold (variable costs) o $1,390,000. The tax rate is 40 percent. The required ret projects of this risk. urn ia. for 25) How much is the depreciation expense each year for this project? A) Less than $200,000 B) $200,000 to $400,000 C) D) E) $400,000 to $600,000 $600,000 to $800,000 More than $800,000 26) How much is the Operating Cash Flow (OCF) each year for this project? Less than $200,000 $300,000 to $400,000 $400,000 to $600,000 $600,000 to $800,000 More than $800,000 A) B) C) D) E) 27) If the company sells the asset for $120,000 at the end of four years, how much will it pay in taxes? A) Zero B) $10,000 to $20,000 C) $20,000 to $40,000 D) $40,000 to $60,000 E) More than $60,000 28) What is the Net Present Value (NPV) with a 10% discount rate? A) Negative B) $0 to $50,000 C) D) E) $50,000 to $100,000 $100,000 to $300,000 More than $200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts