Question: ANSWER 3&4 3 Long Question (40 points) 1. (5 points) You have a one year zero coupon bond that pays $100. The price today is

ANSWER 3&4

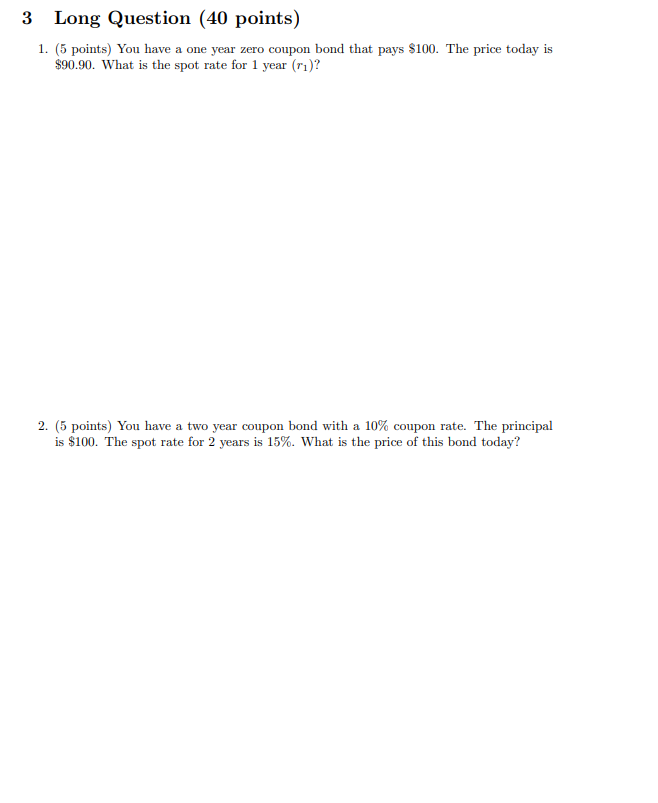

3 Long Question (40 points) 1. (5 points) You have a one year zero coupon bond that pays $100. The price today is $90.90. What is the spot rate for 1 year (ru)? 2. (5 points) You have a two year coupon bond with a 10% coupon rate. The principal is $100. The spot rate for 2 years is 15%. What is the price of this bond today? 3. (10 points) Compute the duration for the coupon bond and set the equation that would solve for the Yield to Maturity. 4. (10 points) Compute the modified duration for the two bonds and answer what would be the price of the two bonds if the YTM increases in every case by 1%. The Yield to maturity for the coupon bond is 14.74%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts