Question: Answer a) 11.09 Answer b) 10.33 4 The current term structure has the following nominal annual spot rates, i(2) : 6-month spot rate is 8%;

Answer a) 11.09

Answer a) 11.09

Answer b) 10.33

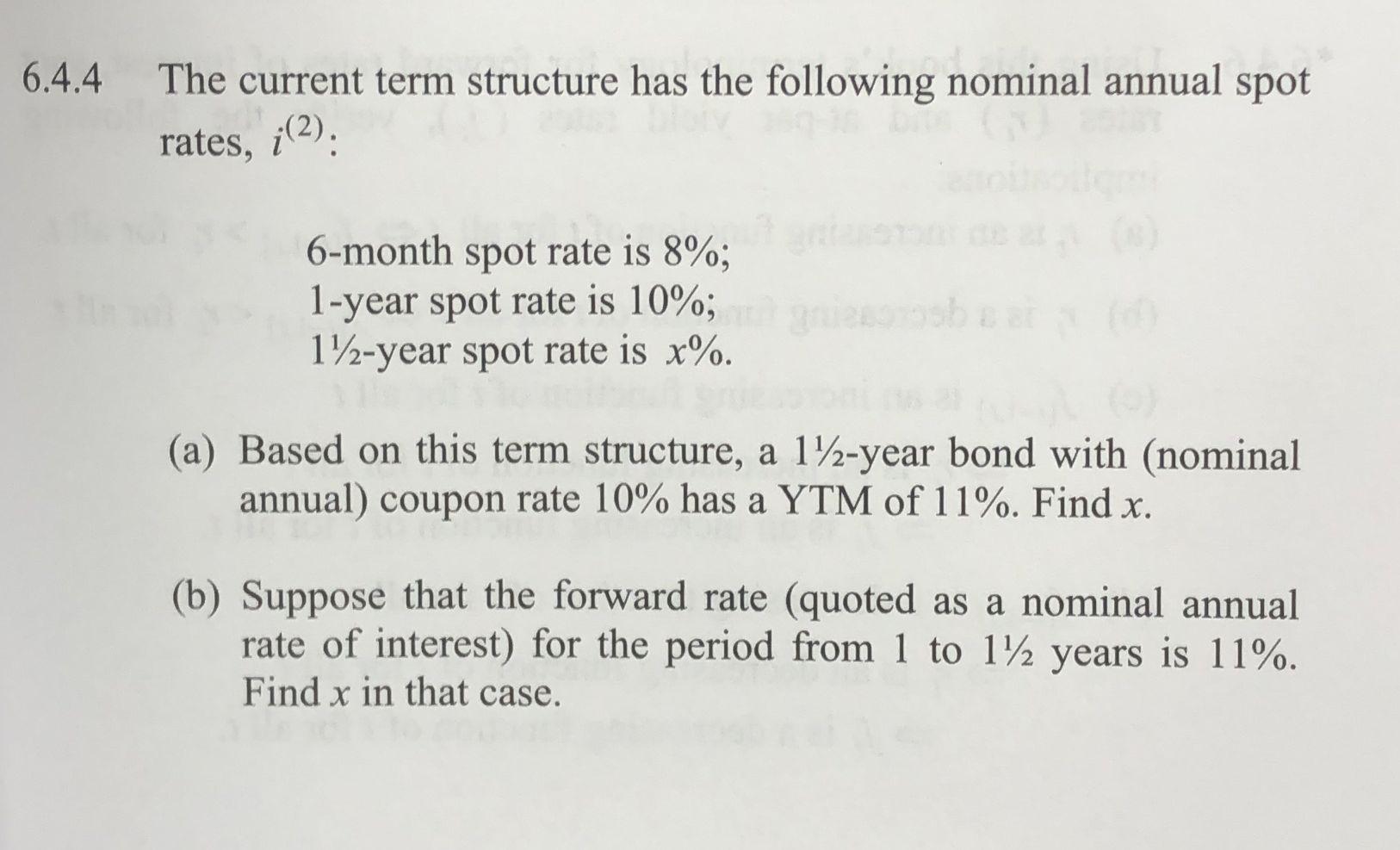

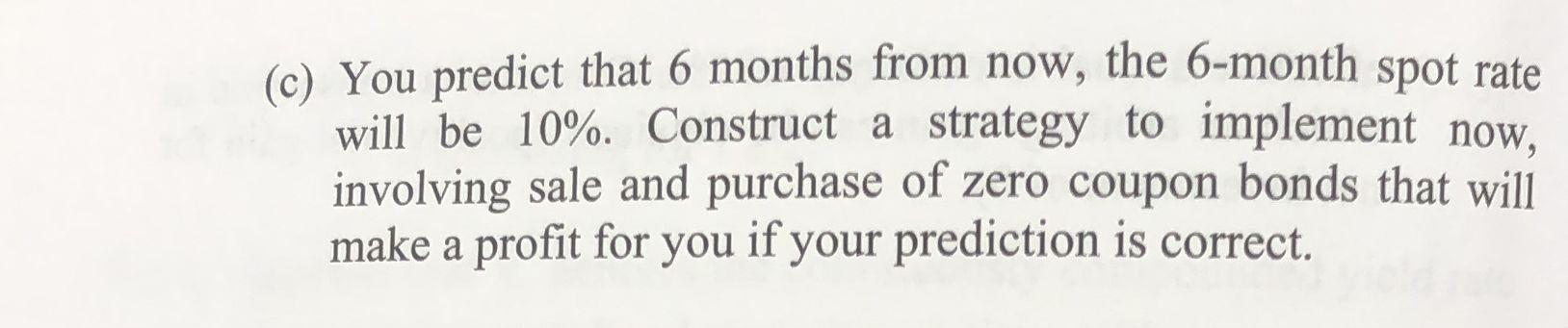

4 The current term structure has the following nominal annual spot rates, i(2) : 6-month spot rate is 8%; 1-year spot rate is 10%; 11/2-year spot rate is x%. (a) Based on this term structure, a 121-year bond with (nominal annual) coupon rate 10% has a YTM of 11%. Find x. (b) Suppose that the forward rate (quoted as a nominal annual rate of interest) for the period from 1 to 121 years is 11%. Find x in that case. (c) You predict that 6 months from now, the 6-month spot rate will be 10%. Construct a strategy to implement now, involving sale and purchase of zero coupon bonds that will make a profit for you if your prediction is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts