Question: ANSWER A- ANSWER b- Answer C- Question 2 (12 marks) Jason, a foreign exchange trader at JPMorgan Chase, can invest $5 million, or the foreign

ANSWER A-

ANSWER b-

Answer C-

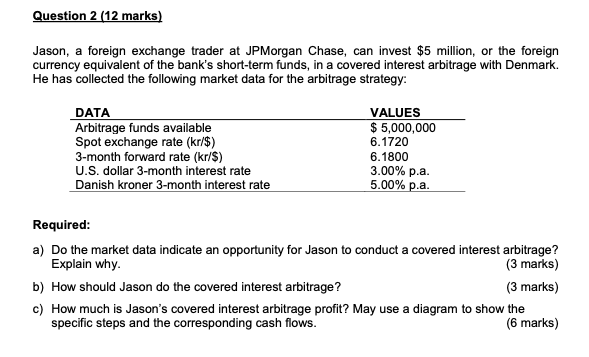

Question 2 (12 marks) Jason, a foreign exchange trader at JPMorgan Chase, can invest $5 million, or the foreign currency equivalent of the bank's short-term funds, in a covered interest arbitrage with Denmark. He has collected the following market data for the arbitrage strategy: DATA Arbitrage funds available Spot exchange rate (kr/$) 3-month forward rate (kr/$) U.S. dollar 3-month interest rate Danish kroner 3-month interest rate VALUES $5,000,000 6.1720 6.1800 3.00% p.a. 5.00% p.a. Required: a) Do the market data indicate an opportunity for Jason to conduct a covered interest arbitrage? Explain why. (3 marks) b) How should Jason do the covered interest arbitrage? (3 marks) c) How much is Jason's covered interest arbitrage profit? May use a diagram to show the specific steps and the corresponding cash flows. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts