Question: answer a b c plss QUESTION 3 Multi Corporation's dividend are expected to growth at a rate of 6.5 percent in the next four years.

answer a b c plss

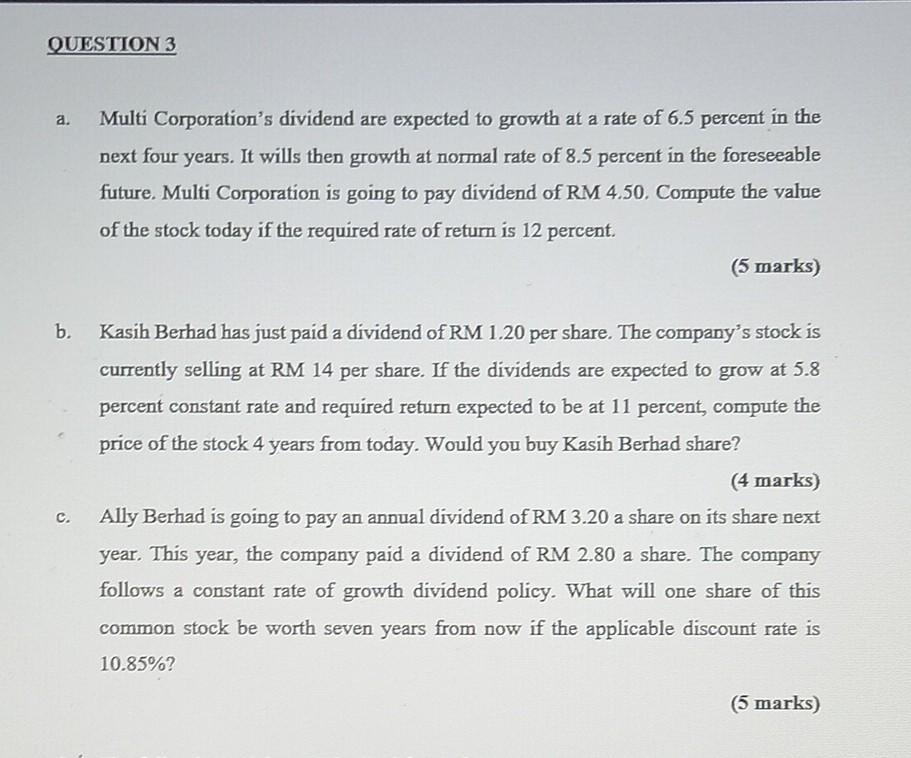

QUESTION 3 Multi Corporation's dividend are expected to growth at a rate of 6.5 percent in the next four years. It wills then growth at normal rate of 8.5 percent in the foreseeable future. Multi Corporation is going to pay dividend of RM 4.50. Compute the value of the stock today if the required rate of return is 12 percent. (5 marks) Kasih Berhad has just paid a dividend of RM 1.20 per share. The company's stock is currently selling at RM 14 per share. If the dividends are expected to grow at 5.8 percent constant rate and required return expected to be at 11 percent, compute the price of the stock 4 years from today. Would you buy Kasih Berhad share? (4 marks) c. Ally Berhad is going to pay an annual dividend of RM 3.20 a share on its share next year. This year, the company paid a dividend of RM 2.80 a share. The company follows a constant rate of growth dividend policy. What will one share of this common stock be worth seven years from now if the applicable discount rate is 10.85%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts