Question: Answer: A the answer is A but can someone explain to me why? show yor work and thanks in advance! The following data apply to

Answer: A

the answer is A but can someone explain to me why? show yor work and thanks in advance!

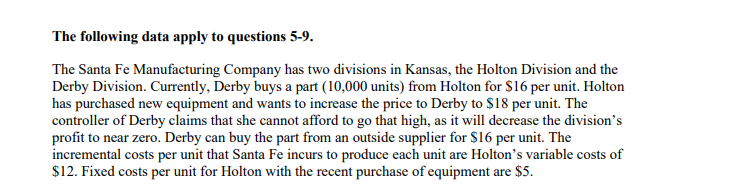

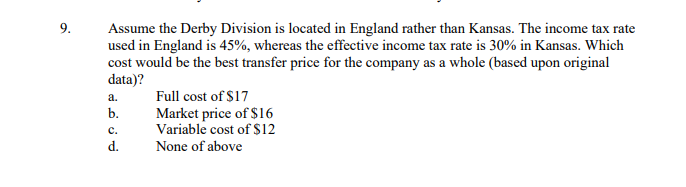

The following data apply to questions 5-9 The Santa Fe Manufacturing Company has two divisions in Kansas, the Holton Division and the Derby Division. Currently, Derby buys a part (10,000 units) from Holton for $16 per unit. Holton has purchased new equipment and wants to increase the price to Derby to $18 per unit. The controller of Derby claims that she cannot afford to go that high, as it will decrease the division's profit to near zero. Derby can buy the part from an outside supplier for $16 per unit. The incremental costs per unit that Santa Fe incurs to produce each unit are Holton's variable costs of $12. Fixed costs per unit for Holton with the recent purchase of equipment are $5. Assume the Derby Division is located in England rather than Kansas. The income tax rate used in England is 45%, whereas the effective income tax rate is 30% in Kansas. Which cost would be the best transfer price for the company as a whole (based upon original data)? Full cost of $17 Market price of $16 Variable cost of S12 . b. . None of above d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts