Question: Answer all 3 questions please This is the question Intro Wish Inc. sells low-cost items online. Its most recent income statement and balance sheet are

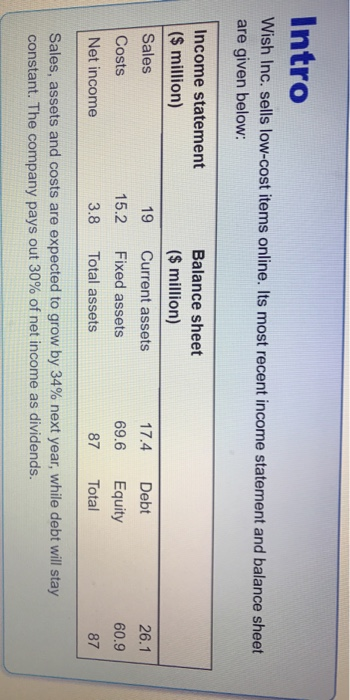

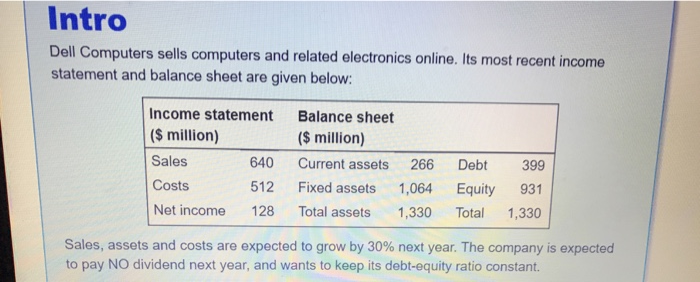

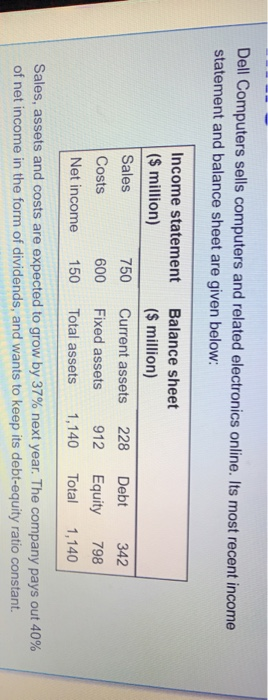

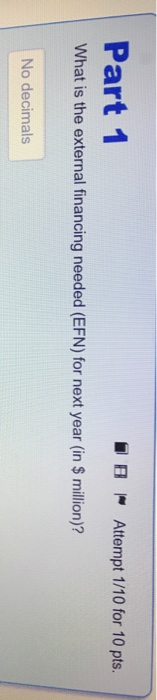

Intro Wish Inc. sells low-cost items online. Its most recent income statement and balance sheet are given below: Income statement ($ million) Sales Costs Net income 19 15.2 3.8 Balance sheet ($ million) Current assets Fixed assets Total assets 17.4 69.6 87 Debt Equity Total 26.1 60.9 87 Sales, assets and costs are expected to grow by 34% next year, while debt will stay constant. The company pays out 30% of net income as dividends. What is the external financing needed (EFN) for next year (in $ million)? 1 + decimals Intro Dell Computers sells computers and related electronics online. Its most recent income statement and balance sheet are given below: Income statement ($ million) Sales 640 Costs 512 Net income 128 Balance sheet ($ million) Current assets 266 Fixed assets 1,064 Total assets 1,330 Debt Equity Total 399 931 1,330 Sales, assets and costs are expected to grow by 30% next year. The company is expected to pay NO dividend next year, and wants to keep its debt-equity ratio constant. Part 1 To Attempt 1/10 for 10 pts. What is the external financing needed (EFN) for next year (in $ million)? No decimals Dell Computers sells computers and related electronics online. Its most recent income statement and balance sheet are given below: Income statement ($ million) Sales 750 Costs 600 Net income 150 Balance sheet ($ million) Current assets 228 Fixed assets 912 Total assets 1,140 Debt Equity Total 342 798 1,140 Sales, assets and costs are expected to grow by 37% next year. The company pays out 40% of net income in the form of dividends, and wants to keep its debt-equity ratio constant. Part 1 To Attempt 1/10 for 10 pts. What is the external financing needed (EFN) for next year (in $ million)? No decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts