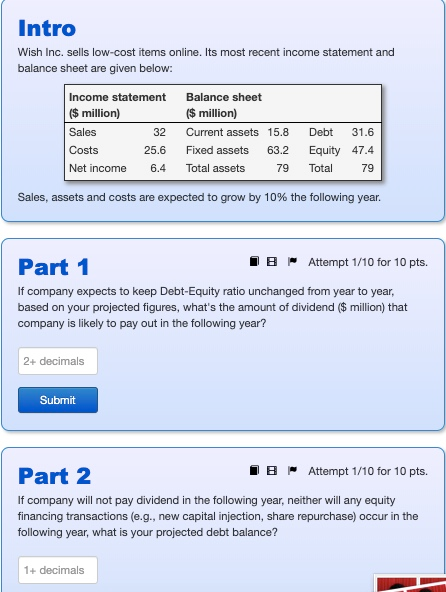

Question: Intro Wish Inc. sells low-cost items online. Its most recent income statement and balance sheet are given below: Income statement (S million) Balance sheet ($million)

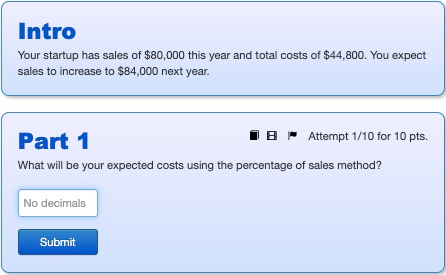

Intro Wish Inc. sells low-cost items online. Its most recent income statement and balance sheet are given below: Income statement (S million) Balance sheet ($million) Sales 32 Current assets 15.8 Debt 31.6 Equity 47.4 Total Costs 25.6 Fixed assets 63.2 Total assets Net income 6.4 79 79 Sales, assets and costs are expected to grow by 10% the following year. Attempt 1/10 for 10 pts. B Part 1 If company expects to keep Debt-Equity ratio unchanged from year to year, based on your projected figures, what's the amount of dividend ( million) that company is likely to pay out in the following year? 2+ decimals Submit Attempt 1/10 for 10 pts. B Part 2 If company will not pay dividend in the following year, neither will any equity financing transactions (e.g., new capital injection, share repurchase) occur in the following year, what is your projected debt balance? 1+ decimals Intro Your startup has sales of $80,000 this year and total costs of $44,800. You expect sales to increase to $84,000 next year. Attempt 1/10 for 10 pts. Part 1 What will be your expected costs using the percentage of sales method? No decimals Submit Intro Wish Inc. sells low-cost items online. Its most recent income statement and balance sheet are given below: Income statement (S million) Balance sheet ($million) Sales 32 Current assets 15.8 Debt 31.6 Equity 47.4 Total Costs 25.6 Fixed assets 63.2 Total assets Net income 6.4 79 79 Sales, assets and costs are expected to grow by 10% the following year. Attempt 1/10 for 10 pts. B Part 1 If company expects to keep Debt-Equity ratio unchanged from year to year, based on your projected figures, what's the amount of dividend ( million) that company is likely to pay out in the following year? 2+ decimals Submit Attempt 1/10 for 10 pts. B Part 2 If company will not pay dividend in the following year, neither will any equity financing transactions (e.g., new capital injection, share repurchase) occur in the following year, what is your projected debt balance? 1+ decimals Intro Your startup has sales of $80,000 this year and total costs of $44,800. You expect sales to increase to $84,000 next year. Attempt 1/10 for 10 pts. Part 1 What will be your expected costs using the percentage of sales method? No decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts