Question: answer all 4 for a thumbs up please Rusty Co. sells two products: X and Y. Last year, Rusty sold 5,000 units of X and

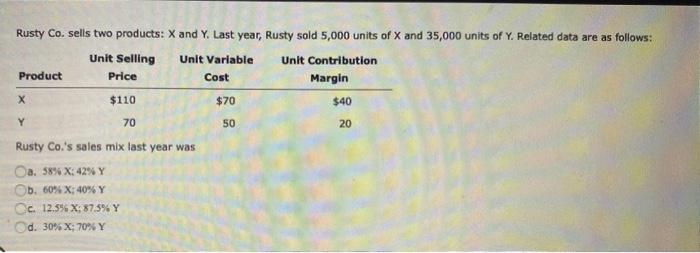

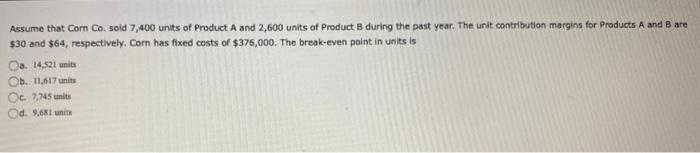

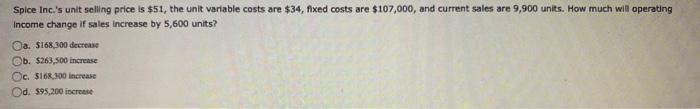

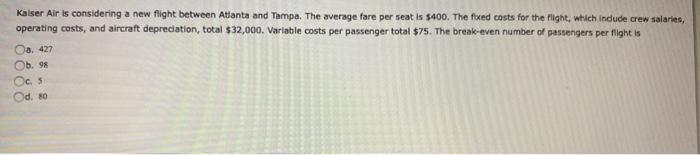

Rusty Co. sells two products: X and Y. Last year, Rusty sold 5,000 units of X and 35,000 units of Y. Related data are as follows: Rusty Co.'s sales mix last year was a. 58%X;42%Y b. 60%X;40%Y c. 12.5%X;87.5%Y d. 30%X;70%Y Assume that Com Co. sold 7,400 units of Product A and 2,600 units of Product B during the past year. The unit contribution margins for Products A and B are $30 and $64, respectively. Com has fixed costs of $376,000. The break-even point in units is 8. 14,521 mits b. 11,617 units c. 7,745 units d. 9,681 unita Spice Inc.'s unit selling price is $51, the unit variable costs are $34, fixed costs are $107,000, and current sales are 9,900 units. How much will operating income change if sales increase by 5,600 units? a. 5168,300 decttas b. 5263,500 incrense c. $168,300 increase d. $95,200 iscreste Kalser Air is considering a new flight between Adianta and Tampa. The average fare per seat is s400. The foxed costs for the flight, which indude crew salaries, operating costs, and aireraft depreciation, total $32,000. Variable costs per passenger total $75. The break-even number of passengers per fight is 3. 427 b. 98 C. 5 d. 80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts