Question: Answer all 4 mcqs correct pls with logical answer. If try to solve only one then dont attempt. Chegg allows upto 4 parts. Which of

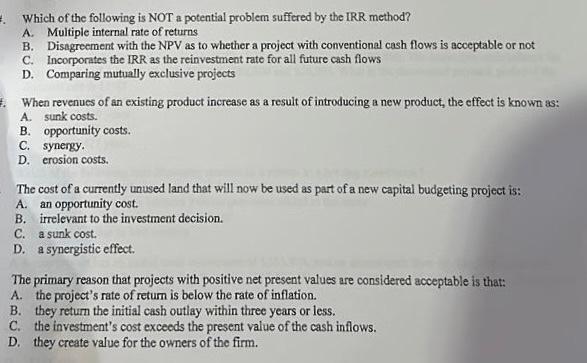

Which of the following is NOT a potential problem suffered by the IRR method? A. Multiple internal rate of returns B. Disigreement with the NPV as to whether a project with conventional cash flows is acceptable or not C. Incorponates the IRR as the reinvestment rate for all future cash flows D. Comparing mutually exclusive projects When revenues of an existing product increase as a result of introducing a new product, the effect is known as: A. sunk costs. B. opportunity costs. C. synengy. D. erosion costs. The cost of a currently unused land that will now be used as part of a new capital budgeting project is: A. an opportunity cost. B. irrelevant to the investment decision. C. a sunk cost. D. a synergistic effect. The primary reason that projects with positive net present values are considered acceptable is that: A. the project's rate of return is below the rate of inflation. B. they return the initial cash outlay within three years or less. C. the investment's cost exceeds the present value of the cash inflows. D. they create value for the owners of the firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts