Question: Answer all 4 mcqs correct pls with logical answer. If try to solve only one then dont attempt. Chegg allows upto 4 parts. Which of

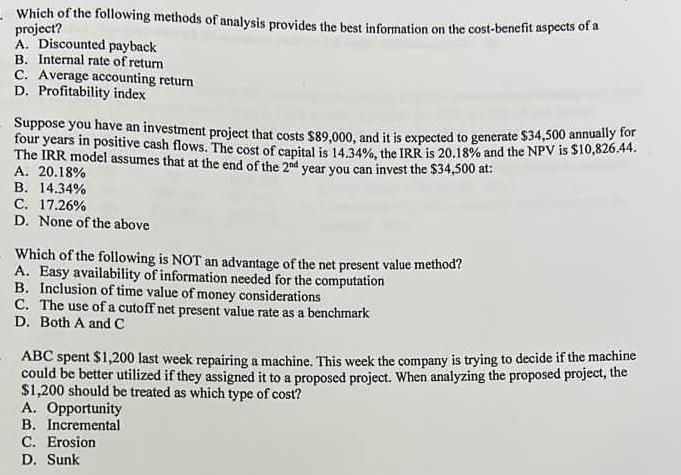

Which of the following methods of analysis provides the best information on the cost-benefit aspects of a project? A. Discounted payback B. Internal rate of return C. Average accounting return D. Profitability index Suppose you have an investment project that costs $89,000, and it is expected to generate $34,500 annually for four years in positive cash flows. The cost of capital is 14.34%, the IRR is 20.18% and the NPV is $10,826.44. The IRR model assumes that at the end of the 2nd year you can invest the $34,500 at: A. 20.18% B. 14.34% C. 17.26% D. None of the above Which of the following is NOT an advantage of the net present value method? A. Easy availability of information needed for the computation B. Inclusion of time value of money considerations C. The use of a cutoff net present value rate as a benchmark D. Both A and C ABC spent $1,200 last week repairing a machine. This week the company is trying to decide if the machine could be better utilized if they assigned it to a proposed project. When analyzing the proposed project, the $1,200 should be treated as which type of cost? A. Opportunity B. Incremental C. Erosion D. Sunk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts