Question: Answer All or none Asap E8-16 (Algo) Recording the Disposal of an Asset at Three Different Sale Prices LO8-5 Delta Air Lines owns hundreds of

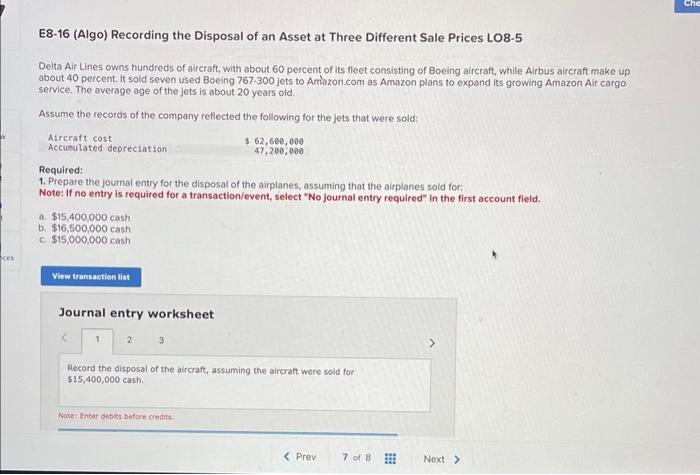

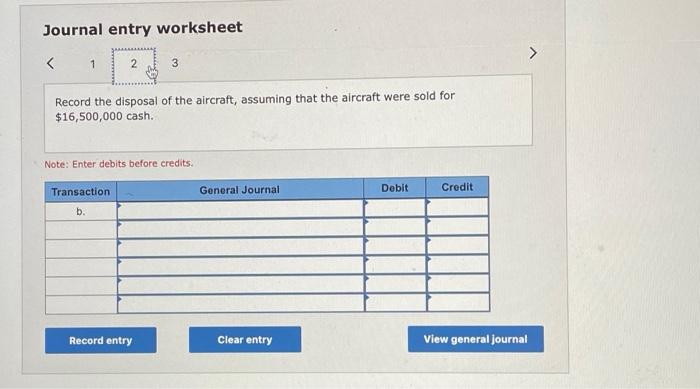

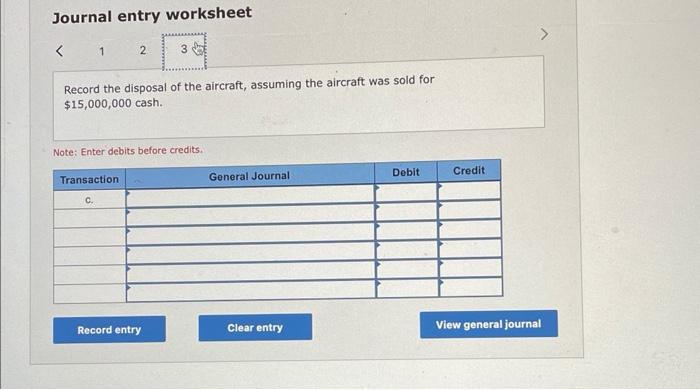

E8-16 (Algo) Recording the Disposal of an Asset at Three Different Sale Prices LO8-5 Delta Air Lines owns hundreds of alrcraft, with about 60 percent of its fleet consisting of Boeing alrcraft, while Alrbus alrcraft make up about 40 percent. It sold seven used Boeing 767-300 jets to Ammazon.com as Amazon plans to expand its growing Amazon Air cargo. service. The averoge age of the jets is about 20 years old. Assume the records of the company reflected the following for the jets that were sold: Required: 1. Prepare the journal entry for the disposal of the airplanes, assuming that the airplanes sold for: Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account fleld. a. $15,400,000cosh b. $16,500,000 cash c. $15,000.000 cash Journal entry worksheet Record the disposal of the aircratt, assuming the aircraft were sold for $15,400,000 cash. Note Enter debits before oredits. Journal entry worksheet Record the disposal of the aircraft, assuming that the aircraft were sold for $16,500,000 cash. Note: Enter debits before credits. Journal entry worksheet Record the disposal of the aircraft, assuming the aircraft was sold for $15,000,000cash. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts