Question: Answer all parts please. A1, A2, B, C, and D During Year 1 and Year 2, Agatha Corporation completed the following transactions relating to its

Answer all parts please. A1, A2, B, C, and D

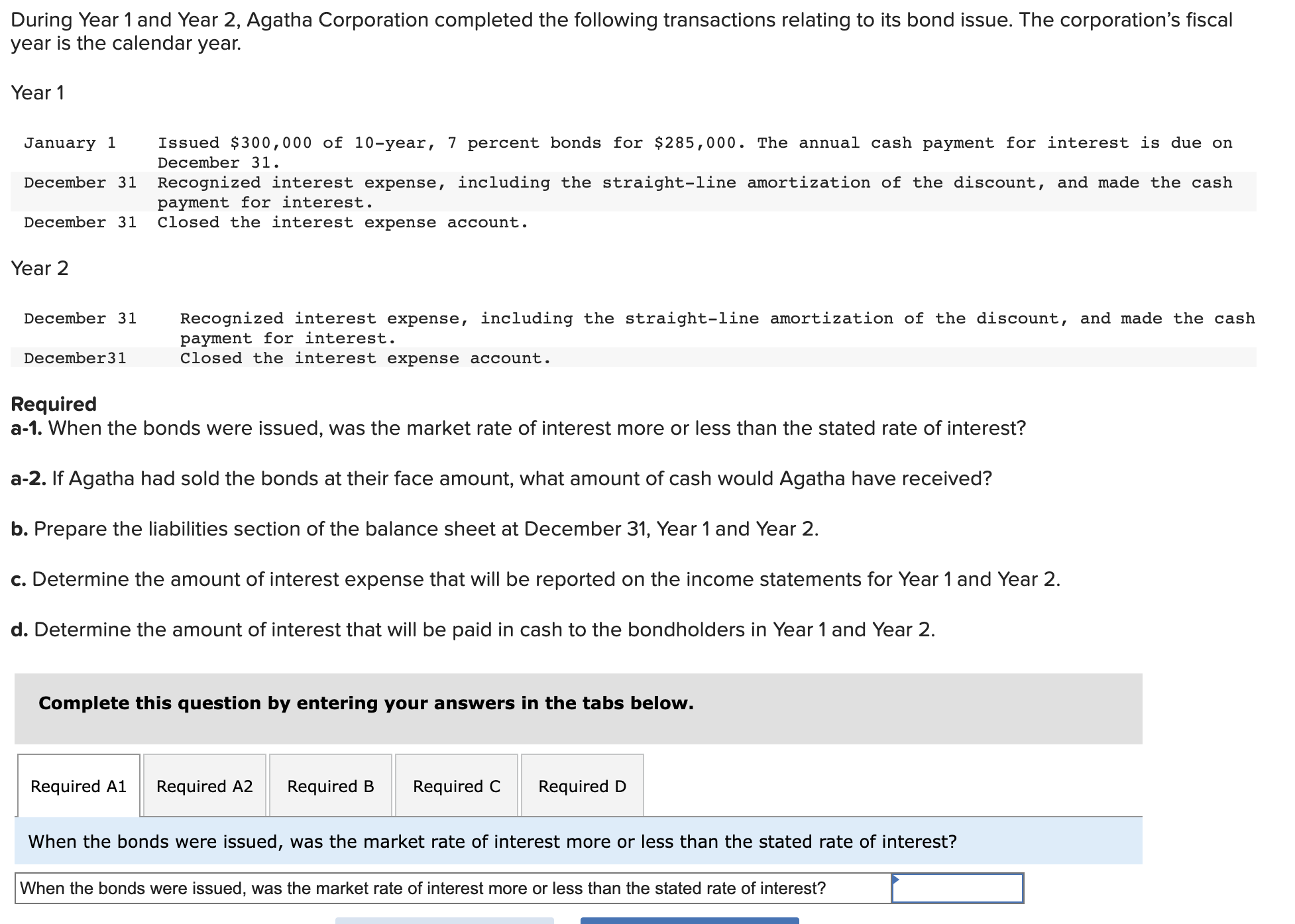

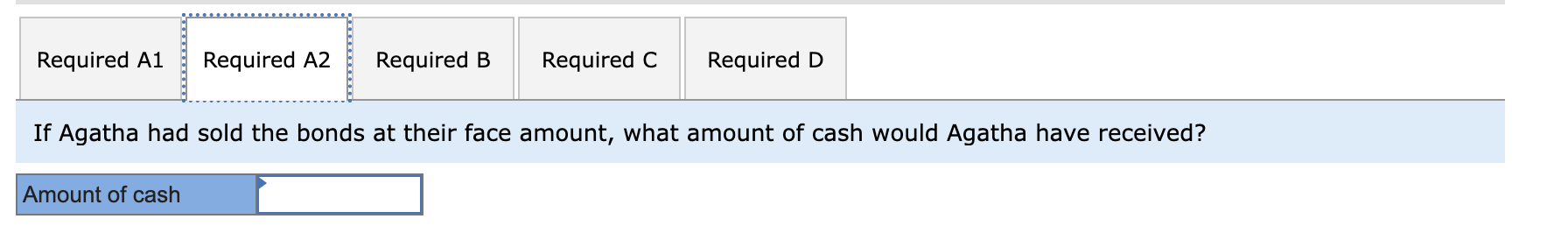

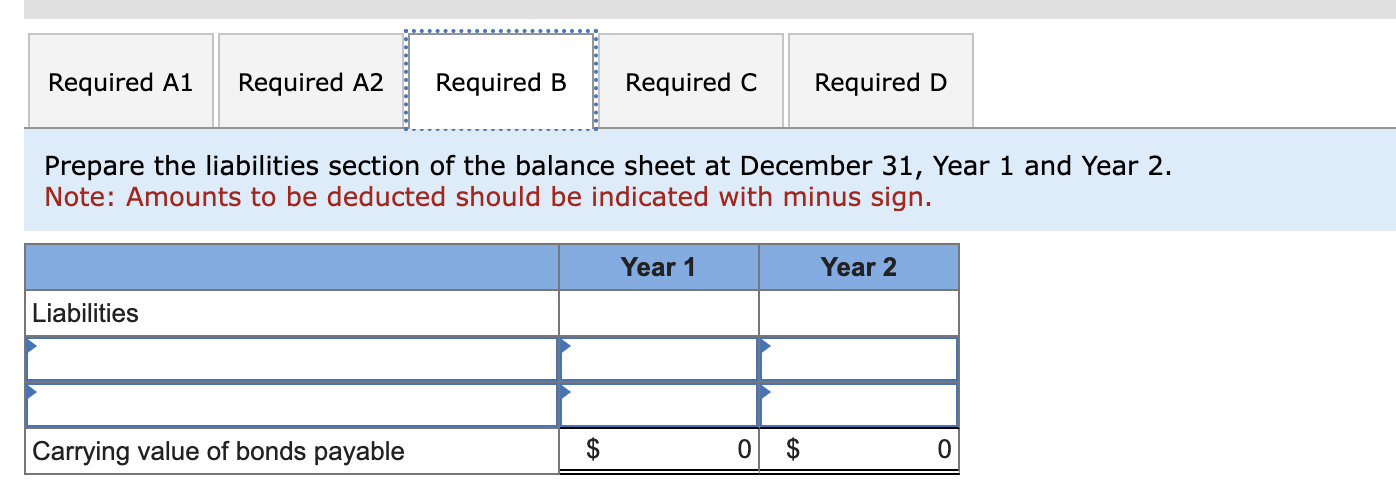

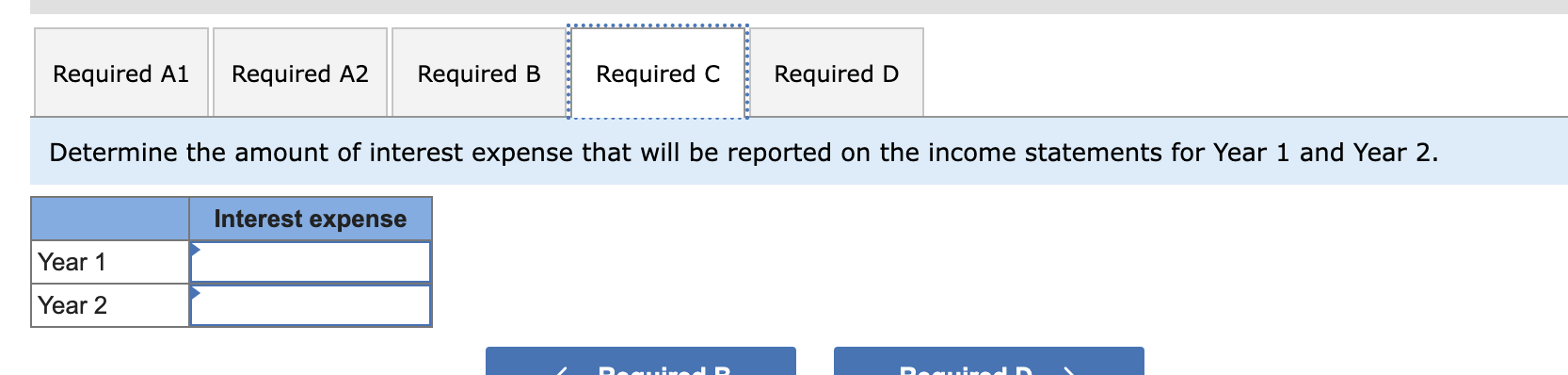

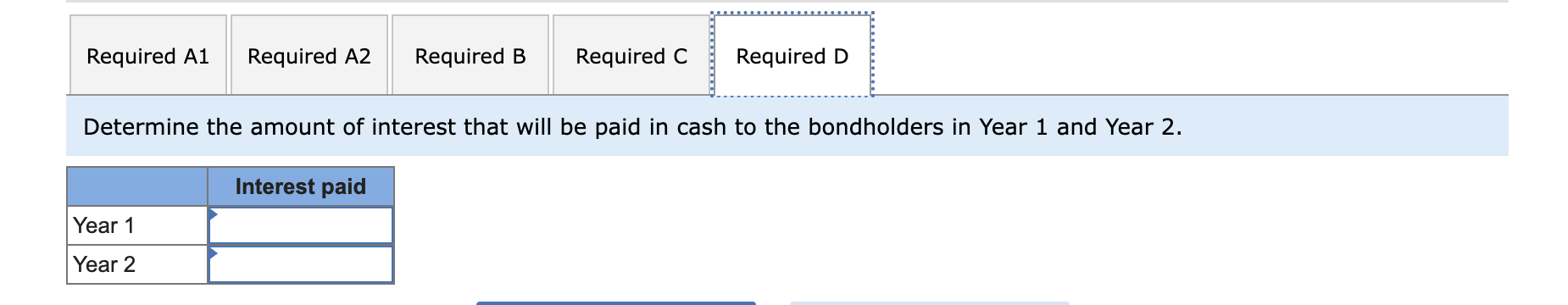

During Year 1 and Year 2, Agatha Corporation completed the following transactions relating to its bond issue. The corporation's fiscal year is the calendar year. Year 1 January 1 Issued $300,000 of 10 -year, 7 percent bonds for $285,000. The annual cash payment for interest is due on December 31 . December 31 Recognized interest expense, including the straight-line amortization of the discount, and made the cash payment for interest. December 31 Closed the interest expense account. Year 2 December 31 Recognized interest expense, including the straight-line amortization of the discount, and made the cash December31 plosed the interest expense account. Required a-1. When the bonds were issued, was the market rate of interest more or less than the stated rate of interest? a-2. If Agatha had sold the bonds at their face amount, what amount of cash would Agatha have received? b. Prepare the liabilities section of the balance sheet at December 31, Year 1 and Year 2. c. Determine the amount of interest expense that will be reported on the income statements for Year 1 and Year 2. d. Determine the amount of interest that will be paid in cash to the bondholders in Year 1 and Year 2. Complete this question by entering your answers in the tabs below. When the bonds were issued, was the market rate of interest more or less than the stated rate of interest? When the bonds were issued, was the market rate of interest more or less than the stated rate of interest? Agatha had sold the bonds at their face amount, what amount of cash would Agatha have received? Prepare the liabilities section of the balance sheet at December 31 , Year 1 and Year 2. Note: Amounts to be deducted should be indicated with minus sign. Determine the amount of interest expense that will be reported on the income statements for Year 1 and Year 2. Determine the amount of interest that will be paid in cash to the bondholders in Year 1 and Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts