Question: answer all please 12-15 are based on the following problem: Sue, an FNBK 3650 student at UNO, has learned so much in this class she

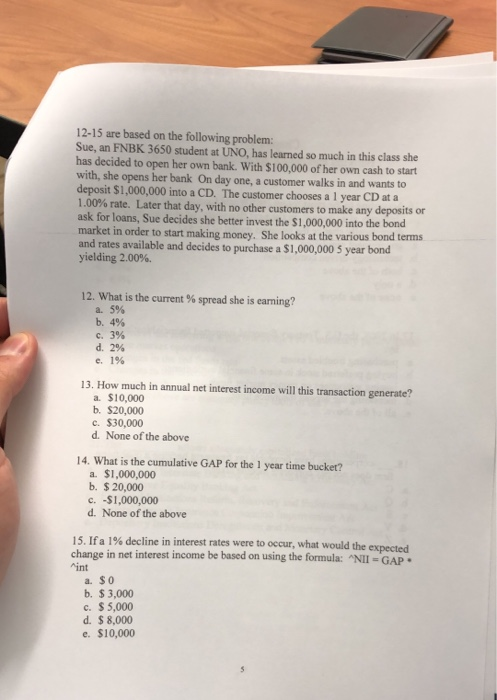

12-15 are based on the following problem: Sue, an FNBK 3650 student at UNO, has learned so much in this class she has decided to open her own bank. With $100,000 of her own cash to start with, she opens her bank On day one, a customer walks in and wants to deposit $1,000,000 into a CD. The customer chooses a 1 year CD at a 1.00% rate. Later that day, with no other customers to make any deposits or ask for loans, Sue decides she better invest the $1,000,000 into the bond market in order to start making money. She looks at the various bond terms and rates available and decides to purchase a $1,000,000 5 year bond yielding 2.00% 12. What is the current % spread she is earning? a. 5% b. 4% c. 3% d. 2% c. 1% 13. How much in annual net interest income will this transaction generate? a $10,000 b. $20,000 c. $30,000 d. None of the above 14. What is the cumulative GAP for the 1 year time bucket? a. $1,000,000 b. $ 20,000 C. -$1,000,000 d. None of the above 15. If a 1% decline in interest rates were to occur, what would the expected change in net interest income be based on using the formula: "NII GAP rint a. So b. $3,000 c. $5,000 d. $ 8,000 e. $10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts