Question: Answer all please Super Shop is a small local convenience store. All transactions are in cash, and collections may be up to $3, 000 per

Answer all please

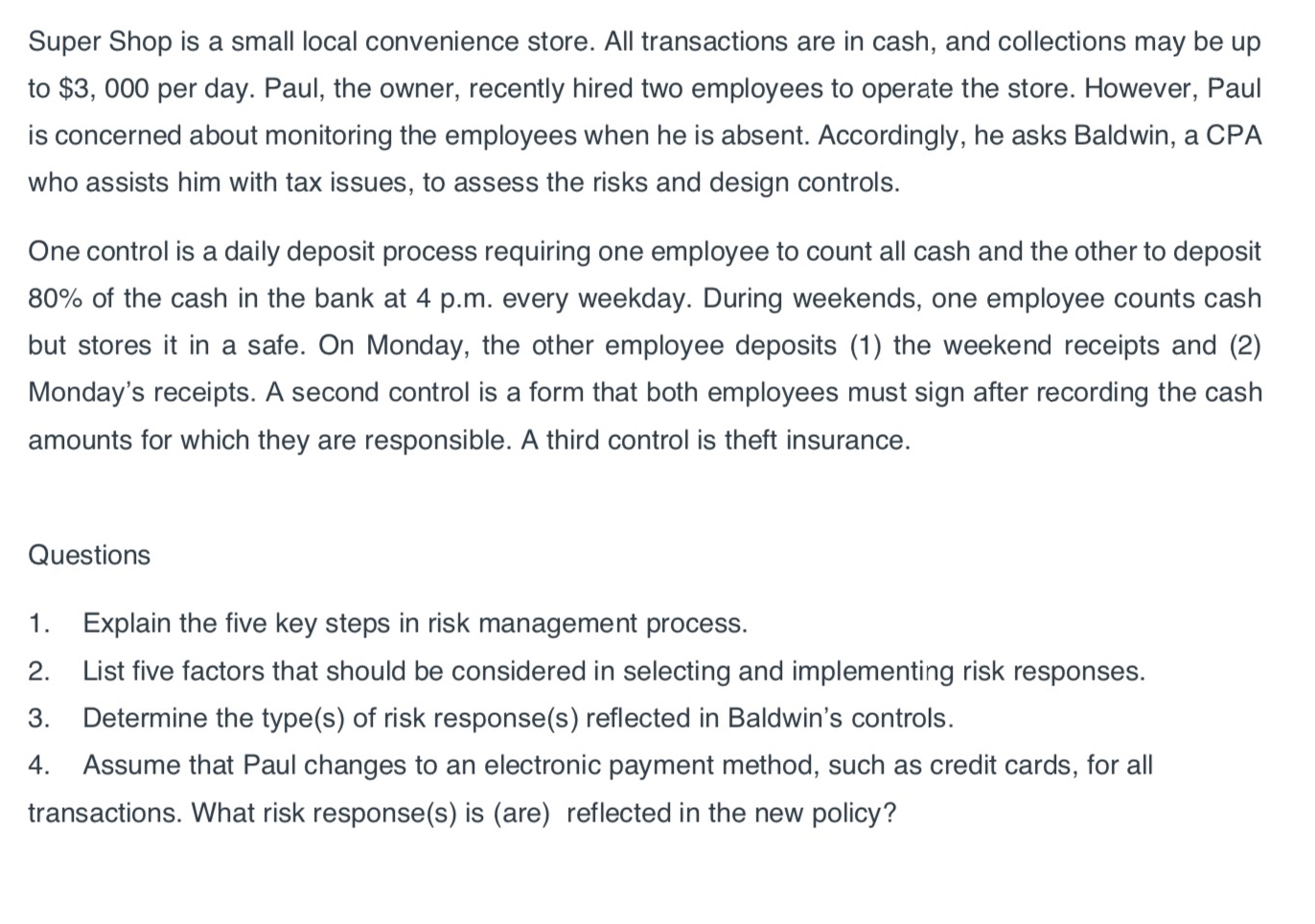

Super Shop is a small local convenience store. All transactions are in cash, and collections may be up to $3, 000 per day. Paul, the owner, recently hired two employees to operate the store. However, Paul is concerned about monitoring the employees when he is absent. Accordingly, he asks Baldwin, a CPA who assists him with tax issues, to assess the risks and design controls. One control is a daily deposit process requiring one employee to count all cash and the otherto deposit 80% of the cash in the bank at 4 pm. every weekday. During weekends, one employee counts cash but stores it in a safe. On Monday, the other employee deposits (1) the weekend receipts and (2) Monday's receipts. A second control is a form that both employees must sign after recording the cash amounts for which they are responsible. A third control is theft insurance. Questions 1. Explain the five key steps in risk management process. 2. List five factors that should be considered in selecting and implementing risk responses. 3. Determine the type(s) of risk response(s) reflected in Baldwin's controls. 4. Assume that Paul changes to an electronic payment method, such as credit cards, for all transactions. What risk response(s) is (are) reflected in the new policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts