Question: Answer all plz Plant assets are: A) Current assets. B) Tangible assets used in the operation of a business that have a useful life of

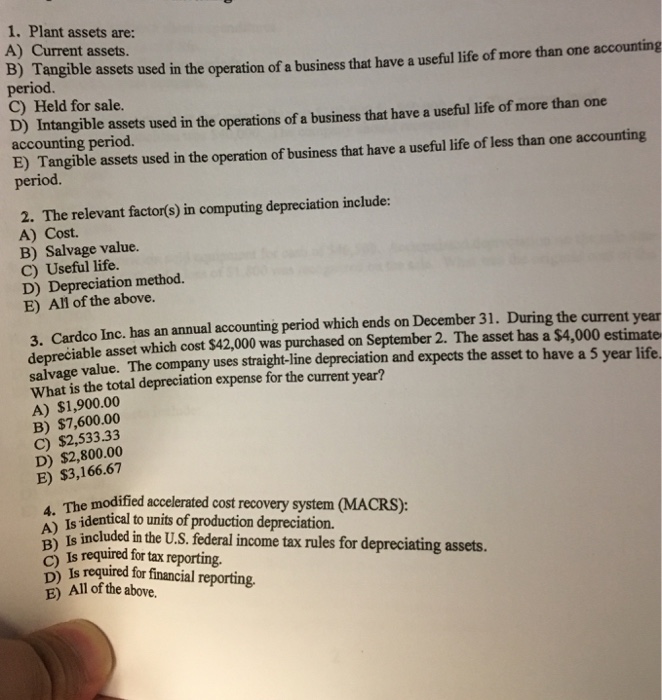

Plant assets are: A) Current assets. B) Tangible assets used in the operation of a business that have a useful life of more than one accounting period. C) Held for sale. D) Intangible assets used in the operations of a business that have a useful life of more than one accounting period. E) Tangible assets used in the operation of business that have a useful life of less than one accounting period. The relevant factor(s) in computing depreciation include: A) Cost. B) Salvage value. C) Useful life. D) Depreciation method. E) All of the above. Cardco Inc. has an annual accounting period which ends on December 31. During the current year depreciable asset which cost exist42,000 was purchased on September 2. The asset has a exist4,000 estimate salvage value. The company uses straight-line depreciation and expects the asset to have a 5 year life. What is the total depreciation expense for the current year? A) exist1, 900.00 B) exist7, 600.00 C) exist2, 533.33 D) exist2, 800.00 E) exist3, 166.67 The modified accelerated cost recovery system (MACRS): A) Is identical to units of production depreciation. B) Is included in the U.S. federal income tax rules for depreciating assets. C) Is required for tax reporting. D) Is required for financial reporting. E) All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts