Question: Answer all questions. 1. Describe how the direct step-down and reciprocal cost allocation methods differ in the way they recognise reciprocal services among support departments

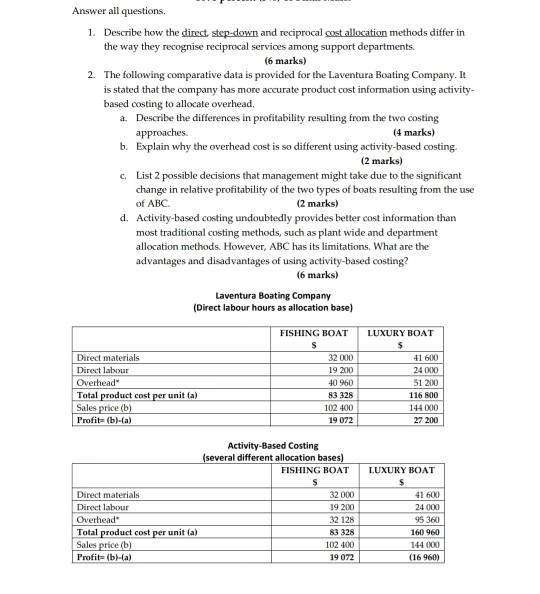

Answer all questions. 1. Describe how the direct step-down and reciprocal cost allocation methods differ in the way they recognise reciprocal services among support departments (6 marks) 2. The following comparative data is provided for the Laventura Boating Company. It is stated that the company has more accurate product cost information using activity based costing to allocate overhead. a. Describe the differences in profitability resulting from the two costing approaches. (4 marks) b. Explain why the overhead cost is so different using activity-based costing (2 marks) c. List 2 possible decisions that management might take due to the significant change in relative profitability of the two types of boats resulting from the use of ABC (2 marks) d. Activity-based costing undoubtedly provides better cost information than most traditional costing methods, such as plant wide and department allocation methods. However, ABC has its limitations. What are the advantages and disadvantages of using activity-based costing? (6 marks) Laventura Boating Company (Direct labour hours as allocation base) FISHING BOAT LUXURY BOAT 32 000 19 200 40 960 Direct materials Direct labour Overhead Total product cost per unit (a) Sales price (b) Profit (b)-la) 41 600 24000 51 200 116 00 144 000 27 200 53 328 102 400 19072 Activity-Based Costing (several different allocation bases) FISHING BOAT LUXURY BOAT Direct materials Direct Labour Overhead Total product cost per unit a) Sales price (b) Profit (ba) 32 000 19 200 32 128 3328 102 400 19 072 41 00 24 000 95 360 60 960 144 000 (16 960) 1 Answer all questions. 1. Describe how the direct step-down and reciprocal cost allocation methods differ in the way they recognise reciprocal services among support departments (6 marks) 2. The following comparative data is provided for the Laventura Boating Company. It is stated that the company has more accurate product cost information using activity based costing to allocate overhead. a. Describe the differences in profitability resulting from the two costing approaches. (4 marks) b. Explain why the overhead cost is so different using activity-based costing (2 marks) c. List 2 possible decisions that management might take due to the significant change in relative profitability of the two types of boats resulting from the use of ABC (2 marks) d. Activity-based costing undoubtedly provides better cost information than most traditional costing methods, such as plant wide and department allocation methods. However, ABC has its limitations. What are the advantages and disadvantages of using activity-based costing? (6 marks) Laventura Boating Company (Direct labour hours as allocation base) FISHING BOAT LUXURY BOAT 32 000 19 200 40 960 Direct materials Direct labour Overhead Total product cost per unit (a) Sales price (b) Profit (b)-la) 41 600 24000 51 200 116 00 144 000 27 200 53 328 102 400 19072 Activity-Based Costing (several different allocation bases) FISHING BOAT LUXURY BOAT Direct materials Direct Labour Overhead Total product cost per unit a) Sales price (b) Profit (ba) 32 000 19 200 32 128 3328 102 400 19 072 41 00 24 000 95 360 60 960 144 000 (16 960) 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts