Question: Answer all questions all information needed is provided in the attached file there are 3 questions. Brief anwer 1. Cipriano's operates luxury restaurants around the

Answer all questions all information needed is provided in the attached file there are 3 questions. Brief anwer

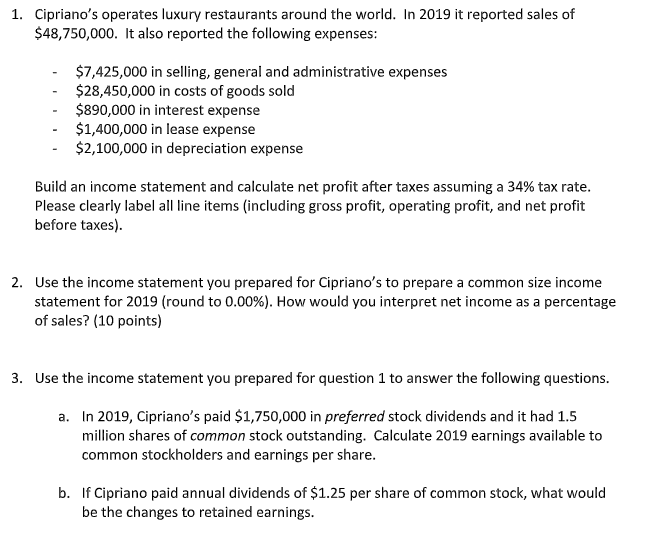

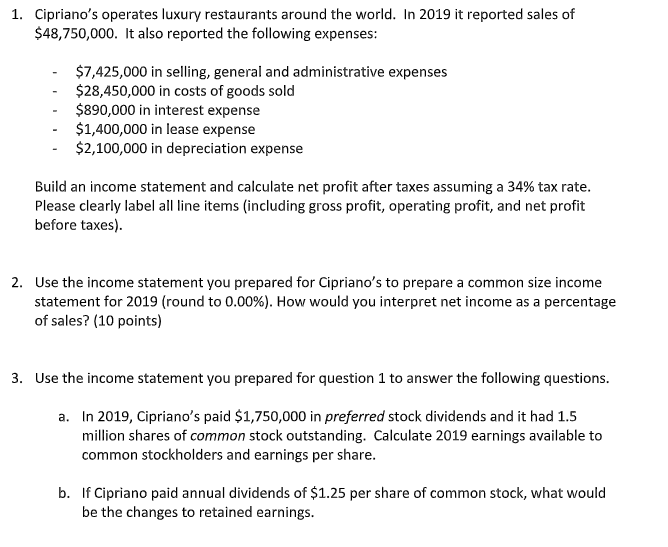

1. Cipriano's operates luxury restaurants around the world. In 2019 it reported sales of $48,750,000. It also reported the following expenses: $7,425,000 in selling, general and administrative expenses $28,450,000 in costs of goods sold $890,000 in interest expense $1,400,000 in lease expense $2,100,000 in depreciation expense Build an income statement and calculate net profit after taxes assuming a 34% tax rate. Please clearly label all line items (including gross profit, operating profit, and net profit before taxes). 2. Use the income statement you prepared for Cipriano's to prepare a common size income statement for 2019 (round to 0.00%). How would you interpret net income as a percentage of sales? (10 points) 3. Use the income statement you prepared for question 1 to answer the following questions. a. In 2019, Cipriano's paid $1,750,000 in preferred stock dividends and it had 1.5 million shares of common stock outstanding. Calculate 2019 earnings available to common stockholders and earnings per share. b. If Cipriano paid annual dividends of $1.25 per share of common stock, what would be the changes to retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts