Question: Answer all questions and highlight final answer. DO NOT answer if you cannot answer all the questions. 8. You are considering two mutually exclusive projects

Answer all questions and highlight final answer. DO NOT answer if you cannot answer all the questions.

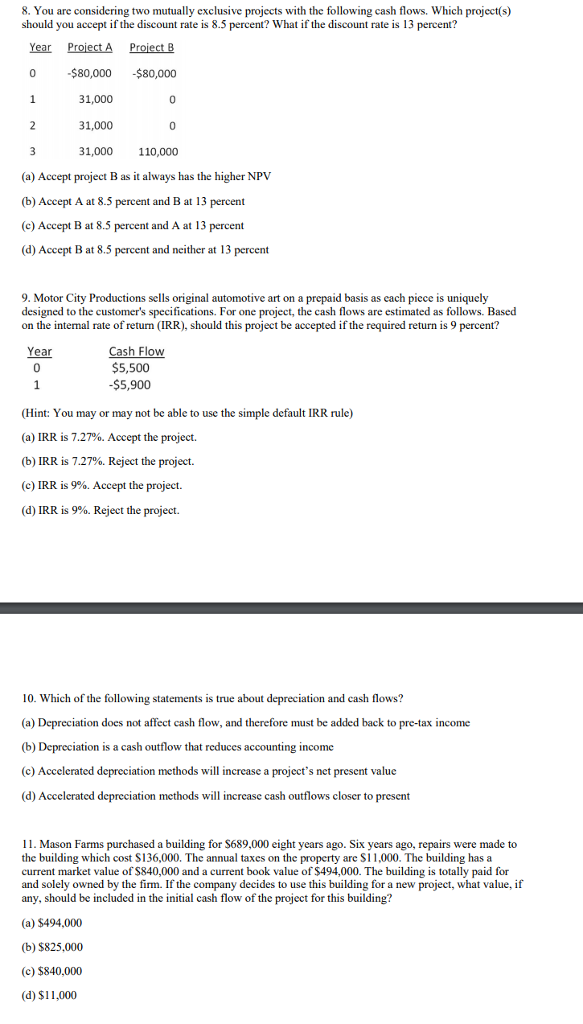

8. You are considering two mutually exclusive projects with the following cash flows. Which project(s) should you accept if the discount rate is 8.5 percent? What if the discount rate is 13 percent? Year Proiect A Proiect B $80,000 $80,000 0 0 31,000 110,000 0 31,000 31,000 (a) Accept project B as it always has the higher NPV (b) Accept A at 8.5 percent and B at 13 percent (c) Accept B at 8.5 percent and A at 13 percent (d) Accept B at 8.5 percent and neither at 13 percent 9. Motor City Productions sells original automotive art on a prepaid basis as cach piece is uniqucly designed to the customer's specifications. For one project, the cash flows are estimated as follows. Based on the intemal rate of return (IRR), should this project be accepted if the required return is 9 percent? Year Cash Flow $5,500 $5,900 (Hint: You may or may not be able to use the simple default IRR rule) (a) IRR is 7.27%. Accept the project. (b) IRR is 7.27%. Reject the project. (c) IRR is 9%. Accept the project. (d) IRR is 9%, Reject the project. 10. Which of the following statements is true about depreciation and cash flows? (a) Depreciation does not affect cash flow, and therefore must be added back to pre-tax income (b) Depreciation is a cash outflow that reduces accounting income (c) Accelerated depreciation methods will increase a project's net present value (d) Accelerated depreciation methods will increase cash outflows closer to present 11. Mason Farms purchased a building for S689,000 eight years ago. Six years ago, repairs were made to the building which cost $136,000. The annual taxes on the property are S11,000. The building has a current market value of $840,000 and a current book value of $494,000. The building is totally paid for and solely owned by the firm. If the company decides to use this building for a new project, what value, if any, should be included in the initial cash flow of the project for this building? (a) $494.000 (b) $825,000 (c) $840,000 (d) $11,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts