Question: ANSWER ALL QUESTIONS AND MAKE SURE THEY ARE CORRECT PLEASE Q1. Foxglove Interiors has net fixed assets of $38,215, long-term debt of $22,400, cash of

ANSWER ALL QUESTIONS AND MAKE SURE THEY ARE CORRECT PLEASE

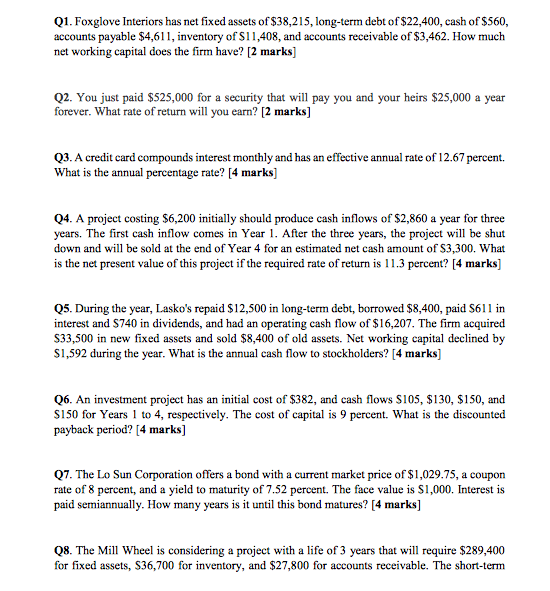

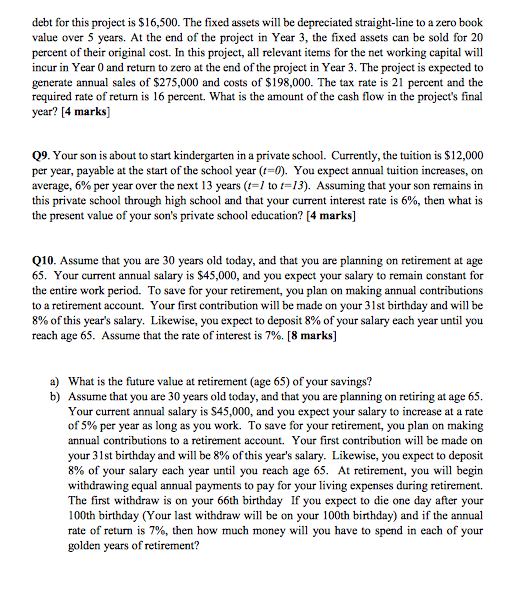

Q1. Foxglove Interiors has net fixed assets of $38,215, long-term debt of $22,400, cash of $560, accounts payable $4,611, inventory of $11,408, and accounts receivable of $3,462. How much net working capital does the firm have? [2 marks] Q2. You just paid $525,000 for a security that will pay you and your heirs $25,000 a year forever. What rate of return will you earn? [2 marks] Q3. A credit card compounds interest monthly and has an effective annual rate of 12.67 percent. What is the annual percentage rate? [4 marks] Q4. A project costing $6,200 initially should produce cash inflows of $2,860 a year for three years. The first cash inflow comes in Year 1. After the three years, the project will be shut down and will be sold at the end of Year 4 for an estimated net cash amount of $3,300. What is the net present value of this project if the required rate of return is 11.3 percent? [4 marks] Q5. During the year, Lasko's repaid $12,500 in long-term debt, borrowed $8,400, paid $611 in interest and $740 in dividends, and had an operating cash flow of $16,207. The firm acquired $33,500 in new fixed assets and sold $8,400 of old assets. Net working capital declined by $1,592 during the year. What is the annual cash flow to stockholders? [4 marks] Q6. An investment project has an initial cost of $382, and cash flows $105, $130, $150, and $150 for Years 1 to 4, respectively. The cost of capital is 9 percent. What is the discounted payback period? [4 marks] Q7. The Lo Sun Corporation offers a bond with a current market price of $1,029.75, a coupon rate of 8 percent, and a yield to maturity of 7.52 percent. The face value is $1,000. Interest is paid semiannually. How many years is it until this bond matures? [4 marks] Q8. The Mill Wheel is considering a project with a life of 3 years that will require $289,400 for fixed assets, S36,700 for inventory, and $27,800 for accounts receivable. The short-term debt for this project is $16,500. The fixed assets will be depreciated straight-line to a zero book value over 5 years. At the end of the project in Year 3, the fixed assets can be sold for 20 percent of their original cost. In this project, all relevant items for the net working capital will incur in Year and return to zero at the end of the project in Year 3. The project is expected to generate annual sales of $275,000 and costs of $198,000. The tax rate is 21 percent and the required rate of return is 16 percent. What is the amount of the cash flow in the project's final year? [4 marks) 09. Your son is about to start kindergarten in a private school. Currently, the tuition is $12,000 per year, payable at the start of the school year (t=0). You expect annual tuition increases, on average, 6% per year over the next 13 years (t=1 to 1=13). Assurning that your son remains in this private school through high school and that your current interest rate is 6%, then what is the present value of your son's private school education? [4 marks] Q10. Assume that you are 30 years old today, and that you are planning on retirement at age 65. Your current annual salary is $45,000, and you expect your salary to remain constant for the entire work period. To save for your retirement, you plan on making annual contributions to a retirement account. Your first contribution will be made on your 31st birthday and will be 8% of this year's salary. Likewise, you expect to deposit 8% of your salary each year until you reach age 65. Assume that the rate of interest is 7%. [8 marks] a) What is the future value at retirement (age 65) of your savings? b) Assume that you are 30 years old today, and that you are planning on retiring at age 65. Your current annual salary is $45,000, and you expect your salary to increase at a rate of 5% per year as long as you work. To save for your retirement, you plan on making annual contributions to a retirement account. Your first contribution will be made on your 31st birthday and will be 8% of this year's salary. Likewise, you expect to deposit 8% of your salary each year until you reach age 65. At retirement, you will begin withdrawing equal annual payments to pay for your living expenses during retirement. The first withdraw is on your 66th birthday If you expect to die one day after your 100th birthday (Your last withdraw will be on your 100th birthday) and if the annual rate of return is 7%, then how much money will you have to spend in each of your golden years of retirement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts