Question: Answer all questions, clearly identifying each. Briefly explain your answers. 1. The extended Du Pont equation may be defined as: ROE = profit margin x

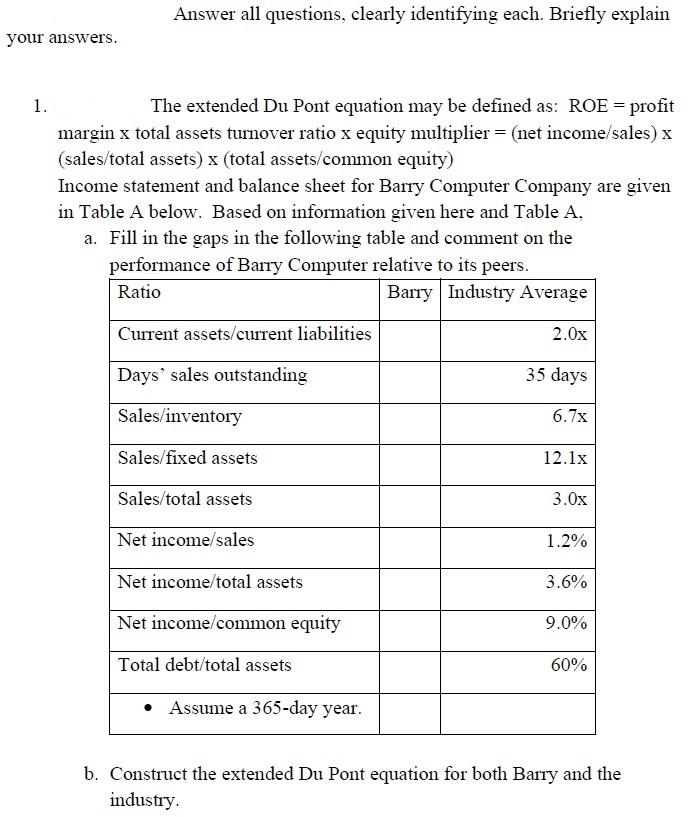

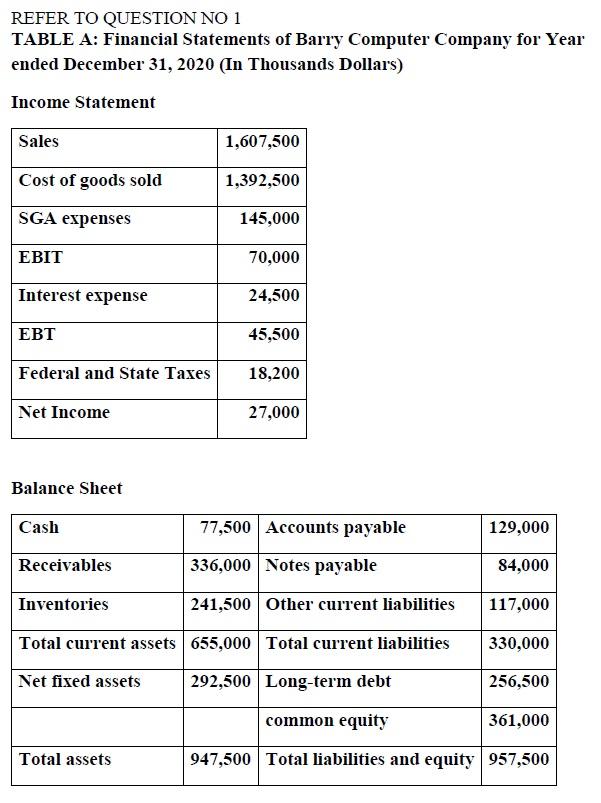

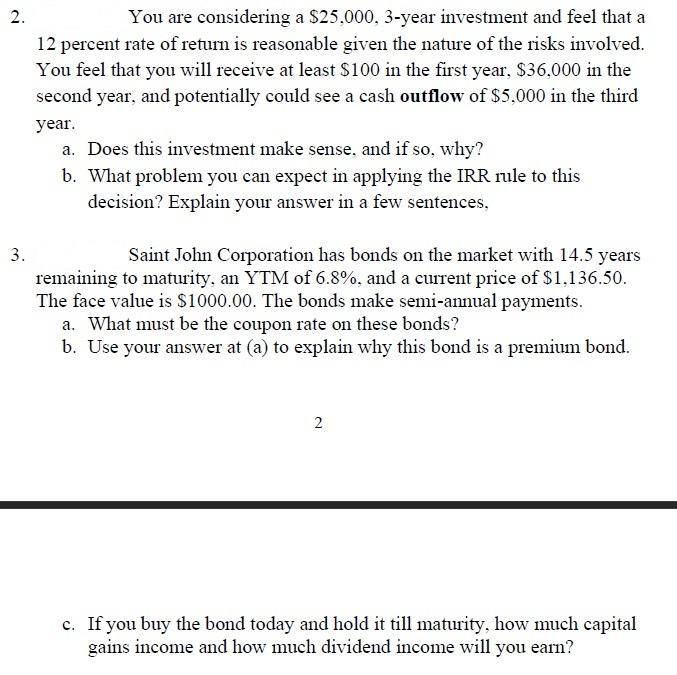

Answer all questions, clearly identifying each. Briefly explain your answers. 1. The extended Du Pont equation may be defined as: ROE = profit margin x total assets turnover ratio x equity multiplier = (net income sales) x (sales/total assets) x (total assets/common equity) Income statement and balance sheet for Barry Computer Company are given in Table A below. Based on information given here and Table A, a. Fill in the gaps in the following table and comment on the performance of Barry Computer relative to its peers. Ratio Barry Industry Average Current assets/current liabilities 2.0x Days' sales outstanding 35 days Sales/inventory 6.7x Sales/fixed assets 12.1x 3.Ox Sales/total assets Net income/sales Net income/total assets 1.2% 3.6% Net income/common equity 9.0% Total debt/total assets 60% Assume a 365-day year. b. Construct the extended Du Pont equation for both Barry and the industry. REFER TO QUESTION NO 1 TABLE A: Financial Statements of Barry Computer Company for Year ended December 31, 2020 (In Thousands Dollars) Income Statement Sales 1,607,500 Cost of goods sold 1,392,500 SGA expenses 145,000 EBIT 70,000 Interest expense 24,500 EBT 45,500 Federal and State Taxes 18,200 Net Income 27,000 Balance Sheet Cash 77,500 Accounts payable 129,000 Receivables 336,000 Notes payable 84,000 Inventories 241,500 Other current liabilities 117,000 Total current assets 655,000 Total current liabil ties 330,000 Net fixed assets 292,500 Long-term debt 256,500 common equity 361,000 Total assets 947,500 Total liabilities and equity 957,500 2. You are considering a $25.000, 3-year investment and feel that a 12 percent rate of return is reasonable given the nature of the risks involved. You feel that you will receive at least $100 in the first year, $36,000 in the second year, and potentially could see a cash outflow of $5,000 in the third year. a. Does this investment make sense, and if so, why? b. What problem you can expect in applying the IRR rule to this decision? Explain your answer in a few sentences, 3. Saint John Corporation has bonds on the market with 14.5 years remaining to maturity, an YTM of 6.8%, and a current price of $1.136.50. The face value is $1000.00. The bonds make semi-annual payments. a. What must be the coupon rate on these bonds? b. Use your answer at (a) to explain why this bond is a premium bond. 2 c. If you buy the bond today and hold it till maturity, how much capital gains income and how much dividend income will you earn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts