Question: Answer ALL questions in this section. Show all your calculations where appropriate. -Please answer as soon as possible, thank you!! Section II (80 marks) Answer

Answer ALL questions in this section.

Show all your calculations where appropriate.

-Please answer as soon as possible, thank you!!

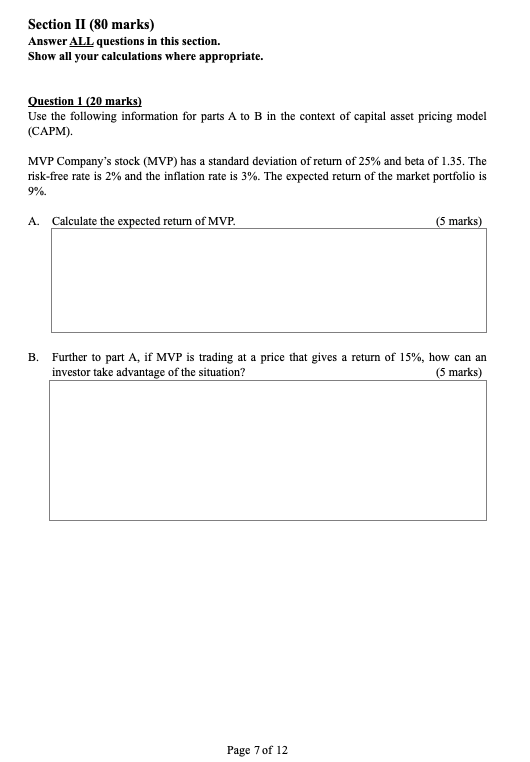

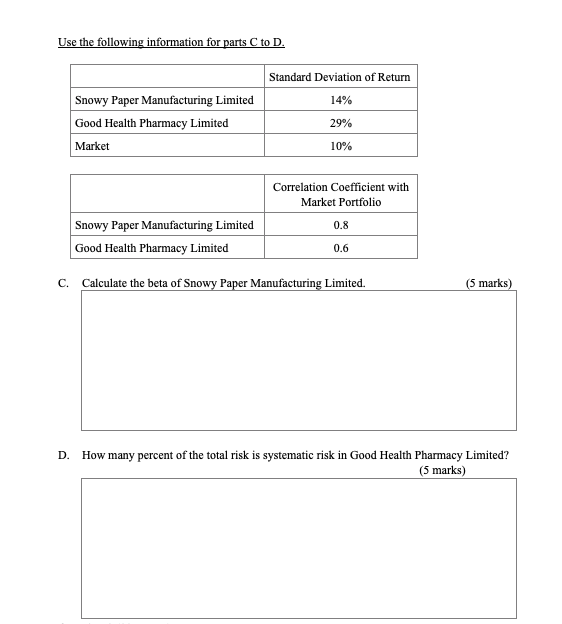

Section II (80 marks) Answer ALL questions in this section. Show all your calculations where appropriate. Question 1 (20 marks) Use the following information for parts A to B in the context of capital asset pricing model (CAPM). MVP Company's stock (MVP) has a standard deviation of return of 25% and beta of 1.35. The risk-free rate is 2% and the inflation rate is 3%. The expected return of the market portfolio is 9%. A. Calculate the expected return of MVP. (5 marks) B. Further to part A, if MVP is trading at a price that gives a return of 15%, how can an investor take advantage of the situation? (5 marks) Page 7 of 12 Use the following information for parts C to D. Standard Deviation of Return 14% Snowy Paper Manufacturing Limited Good Health Pharmacy Limited Market 29% 10% Correlation coefficient with Market Portfolio 0.8 Snowy Paper Manufacturing Limited Good Health Pharmacy Limited 0.6 C. Calculate the beta of Snowy Paper Manufacturing Limited. (5 marks) D. How many percent of the total risk is systematic risk in Good Health Pharmacy Limited

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts