Question: Answer all questions Note: Unless otherwise stated, all problems assume that the acquisition method is to be used. Please show all supporting calculations on vour

Answer all questions

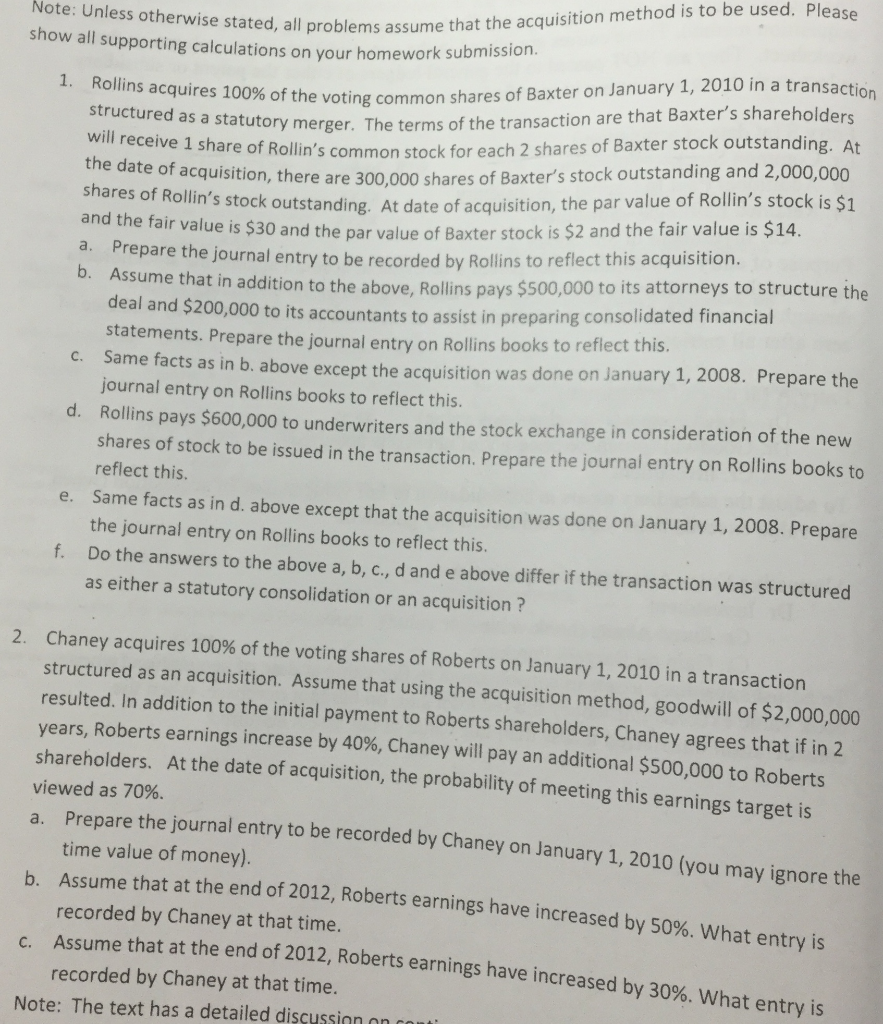

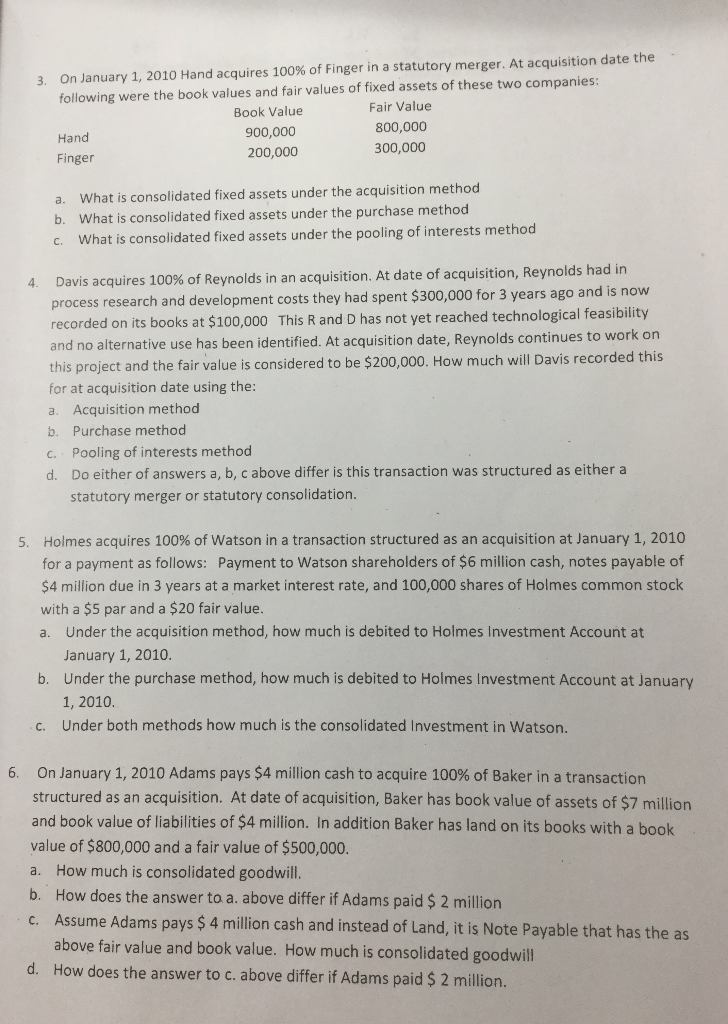

Note: Unless otherwise stated, all problems assume that the acquisition method is to be used. Please show all supporting calculations on vour homework submission. 1. Rollins acquires 100 % of the voting common shares of Baxter on January 1, 2010 in a transaction structured as a statutory merger. The terms of the transaction are that Baxter's shareholders will receive 1 share of Rollin's common stock for each 2 shares of Baxter stock outstanding. At the date of acquisition, there are 300,000 shares of Baxter's stock outstanding and 2,000,000 shares of Rollin's stock outstanding. At date of acquisition, the par value of Rollin's stock is $1 drd the fair value is $30 and the par value of Baxter stock is $2 and the fair value is $14. Prepare the journal entry to be recorded by Rollins to reflect this acquisition. b ASsume that in addition to the above, Rollins pays $500,000 to its attorneys to structure the deal and $200,000 to its accountants to assist in preparing consolidated financial statements. Prepare the journal entry on Rollins books to reflect this. Same facts as in b. above except the acquisition was done on January 1, 2008. Prepare the journal entry on Rollins books to reflect this. C. Rollins pays $600,000 to underwriters and the stock exchange in consideration of the new shares of stock to be issued in the transaction. Prepare the journal entry on Rollins books to d. reflect this. Same facts as in d. above except that the acquisition was done on January 1, 2008. Prepare . the journal entry on Rollins books to reflect this. f Do the answers to the above a, b, c., d and e above differ if the transaction was structured as either a statutory consolidation or an acquisition? 2. Chaney acquires 100% of the voting shares of Roberts on January 1, 2010 in a transaction structured as an acquisition. Assume that using the acquisition method, goodwill of $2,000,000 resulted. In addition to the initial payment to Roberts shareholders, Chaney agrees that if in 2 years, Roberts earnings increase by 40%, Chaney will pay an additional $500,000 to Roberts shareholders. At the date of acquisition, the probability of meeting this earnings target is viewed as 70%. a. Prepare the journal entry to be recorded by Chaney on January 1, 2010 (you may ignore the time value of money). b. Assume that at the end of 2012, Roberts earnings have increased by 50%. What entry is recorded by Chaney at that time. Assume that at the end of 2012, Roberts earnings have increased by 30%. What entry is C. recorded by Chaney at that time. Note: The text has a detailed discussion on conti On January 1, 2010 Hand acquires 100 % of Finger in a statutory merger. At acquisition date the 3. following were the book values and fair values of fixed assets of these two companies: Fair Value Book Value 800,000 900,000 200,000 Hand 300,000 Finger What is consolidated fixed assets under the acquisition method What is consolidated fixed assets under the purchase method What is consolidated fixed assets under the pooling of interests method a. b. c. Davis acquires 100 % of Reynolds in an acquisition. At date of acquisition, Reynolds had in process research and development costs they had spent $300,000 for 3 years ago and is now recorded on its books at $100,000 This R and D has not yet reached technological feasibility and no alternative use has been identified. At acquisition date, Reynolds continues to work on 4. this project and the fair value is considered to be $200,000. How much will Davis recorded this for at acquisition date using the: a. Acquisition method b. Purchasemethod Pooling of interests method Do either of answers a, b, c above differ is this transaction was structured as either a C. d. statutory merger or statutory consolidation. 5. Holmes acquires 100% of Watson in a transaction structured as an acquisition at January 1, 2010 for a payment as follows: Payment to Watson shareholders of $6 million cash, notes payable of $4 million due in 3 years at a market interest rate, and 100,000 shares of Holmes common stock with a $5 par and a $20 fair value. Under the acquisition method, how much is debited to Holmes Investment Account at a. January 1, 2010. Under the purchase method, how much is debited to Holmes Investment Account at January b. 1, 2010. Under both methods how much is the consolidated Investment in Watson. C. On January 1, 2010 Adams pays $4 million cash to acquire 100 % of Baker in a transaction structured as an acquisition. At date of acquisition, Baker has book value of assets of $7 million and book value of liabilities of $4 million. In addition Baker has land on its books with a book 6. value of $800,000 and a fair value of $500,000. a. How much is consolidated goodwill. How does the answer to a. above differ if Adams paid $ 2 million b. Assume Adams pays $ 4 million cash and instead of Land, it is Note Payable that has the as c. above fair value and book value. How much is consolidated goodwill d. How does the answer to c. above differ if Adams paid $ 2 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts