Question: Answer all questions on your excel sheet and save your work with your student ID number Question 1 Pass/Fail Test The Financial Modeling test is

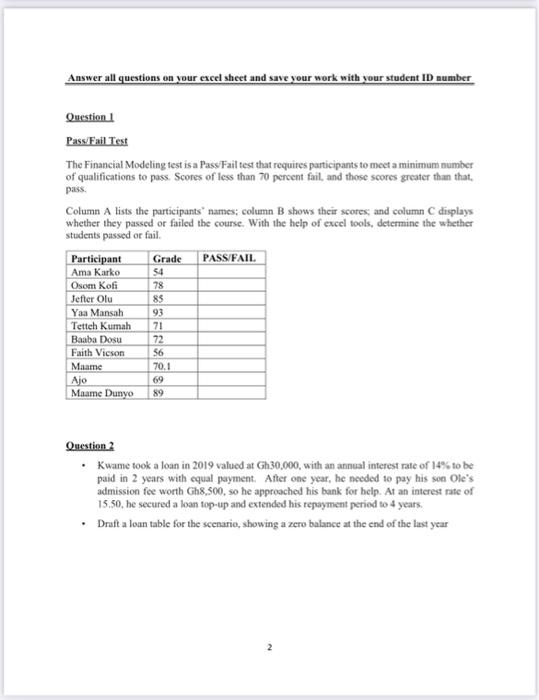

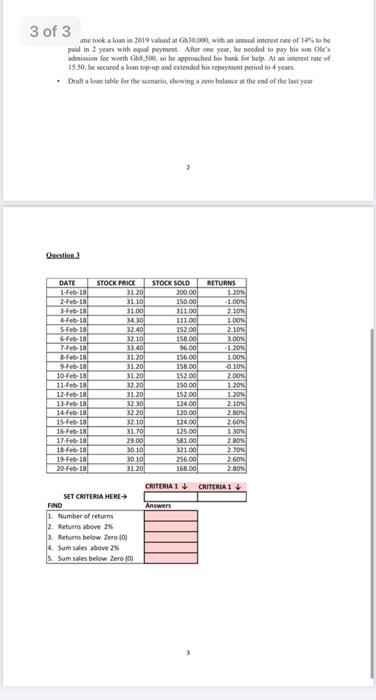

Answer all questions on your excel sheet and save your work with your student ID number Question 1 Pass/Fail Test The Financial Modeling test is a Pass Fail test that requires participants to meet a minimum number of qualifications to pass. Scores of less than 70 percent fail, and those scores greater than that. pass Column A lists the participants' names: column B shows their scores and column C displays whether they passed or failed the course. With the help of excel tools, determine the whether students passed or fail. Participant Grade PASS/FAIL Ama Karko 54 Osom Kofi 78 Jefter Olu 85 Yaa Mansah 93 Tetteh kumah 71 Baaba Dosu 72 Faith Vicson 56 Maame 70.1 Ajo Maame Dunyo 89 69 Question 2 Kwame took a loan in 2019 valued at Gh30.000, with an annual interest rate of 14% to be paid in 2 years with equal payment. After one year, he needed to pay his son Ole's admission foe worth Gh8,300, so he approached his bank for help. At an interest rate of 15.50, he secured a loan top-up and extended his repayment period to 4 years. Draft a loan table for the scenario, showing a zero balance at the end of the last year 3 of 3 ime took a loan in 2019 valued at 30,000, with an annual interest rate of 14% to be paid in 2 years with equal payment. After one year, he needed to pay his son Ole admission for woh Ghi 500, so he approached his bank for help Atminterest rate of 15.50, he secured a loan lupap and extended his repayment period to 4 years Draft akan table for the scene winga were bulance at the end of the last year Osection DATE 1-Feb 18 2. Feb 18 Heb 18 -Feb-18 Sfeb 18 STOCK PRICE 31.20 31.10 31.00 3430 3740 32.10 3340 31.200 31.20. 31 20 12 20 7-Feb-18 Web-18 9. Feb 18 10-Feb-18 11.feb 18 12-Feb 18 13. Feb 18 14 Feb 18 15-Feb18 16 F-18 17-Feb-18 18-Feb-18 19 Feb 18 20 Feb 18 STOCK SOLD 200.00 150.00 31100 11100 152.00 158.00 96.00 156.00 158.00 15200 150.00 152.00 124.00 120.00 124.00 125.00 581.00 12100 256.00 16800 RETURNS 12 -100 2.100 100 2.10 BOOK -1 0 1 OON LON 2.00 1. 20% 120% 2.10% 2.80 2.60 1 30 2 2.70 2.60 2.80% 32:30 32.30 32.10 31.70 29.00 Jo to 30.101 3170 CRITERIA 1 + CRITERIA 1 + Answers SET CRITERIA HERE FIND 1 Number of returns 2. Returns above 2% Returns below Zero (0) 4. Sum sales above 2x S. Sum sales below Zero (0) Answer all questions on your excel sheet and save your work with your student ID number Question 1 Pass/Fail Test The Financial Modeling test is a Pass Fail test that requires participants to meet a minimum number of qualifications to pass. Scores of less than 70 percent fail, and those scores greater than that. pass Column A lists the participants' names: column B shows their scores and column C displays whether they passed or failed the course. With the help of excel tools, determine the whether students passed or fail. Participant Grade PASS/FAIL Ama Karko 54 Osom Kofi 78 Jefter Olu 85 Yaa Mansah 93 Tetteh kumah 71 Baaba Dosu 72 Faith Vicson 56 Maame 70.1 Ajo Maame Dunyo 89 69 Question 2 Kwame took a loan in 2019 valued at Gh30.000, with an annual interest rate of 14% to be paid in 2 years with equal payment. After one year, he needed to pay his son Ole's admission foe worth Gh8,300, so he approached his bank for help. At an interest rate of 15.50, he secured a loan top-up and extended his repayment period to 4 years. Draft a loan table for the scenario, showing a zero balance at the end of the last year 3 of 3 ime took a loan in 2019 valued at 30,000, with an annual interest rate of 14% to be paid in 2 years with equal payment. After one year, he needed to pay his son Ole admission for woh Ghi 500, so he approached his bank for help Atminterest rate of 15.50, he secured a loan lupap and extended his repayment period to 4 years Draft akan table for the scene winga were bulance at the end of the last year Osection DATE 1-Feb 18 2. Feb 18 Heb 18 -Feb-18 Sfeb 18 STOCK PRICE 31.20 31.10 31.00 3430 3740 32.10 3340 31.200 31.20. 31 20 12 20 7-Feb-18 Web-18 9. Feb 18 10-Feb-18 11.feb 18 12-Feb 18 13. Feb 18 14 Feb 18 15-Feb18 16 F-18 17-Feb-18 18-Feb-18 19 Feb 18 20 Feb 18 STOCK SOLD 200.00 150.00 31100 11100 152.00 158.00 96.00 156.00 158.00 15200 150.00 152.00 124.00 120.00 124.00 125.00 581.00 12100 256.00 16800 RETURNS 12 -100 2.100 100 2.10 BOOK -1 0 1 OON LON 2.00 1. 20% 120% 2.10% 2.80 2.60 1 30 2 2.70 2.60 2.80% 32:30 32.30 32.10 31.70 29.00 Jo to 30.101 3170 CRITERIA 1 + CRITERIA 1 + Answers SET CRITERIA HERE FIND 1 Number of returns 2. Returns above 2% Returns below Zero (0) 4. Sum sales above 2x S. Sum sales below Zero (0)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts