Question: Answer all questions Part I: Define the following terms ( 3540 words) points) Q1. Conforming vs. Non-conforming loans Q2. Equity of Redemption Part II: Q1.

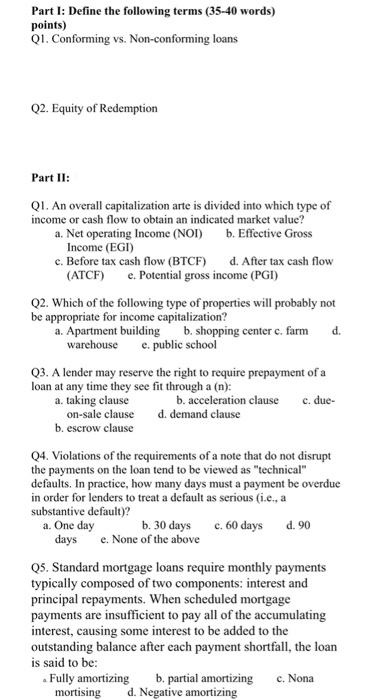

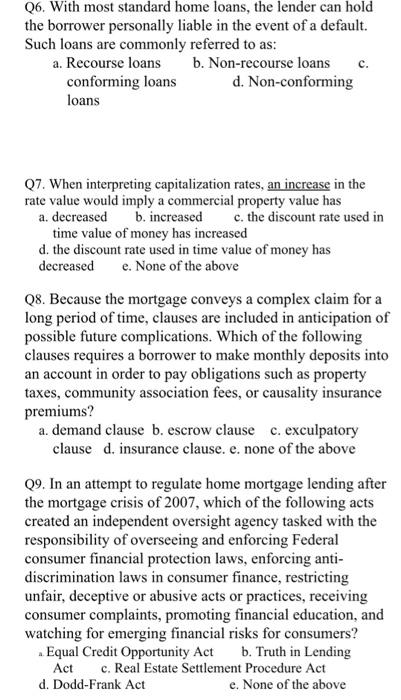

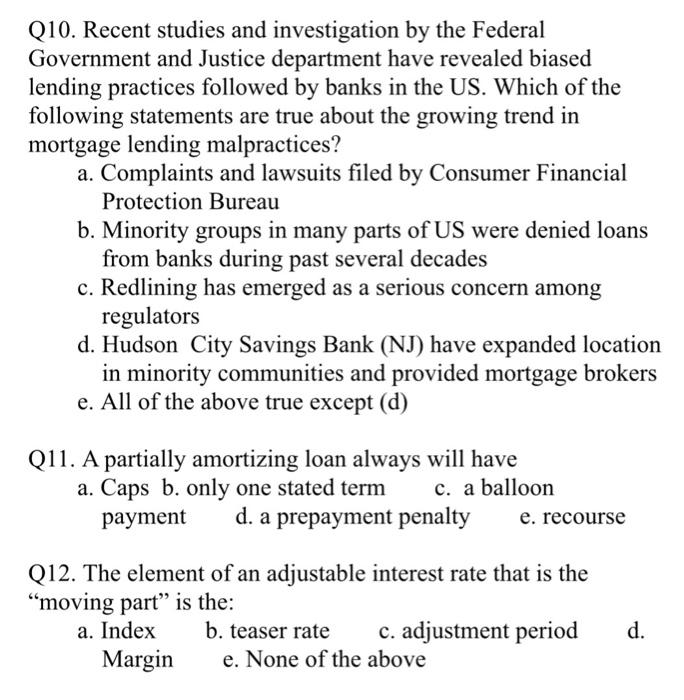

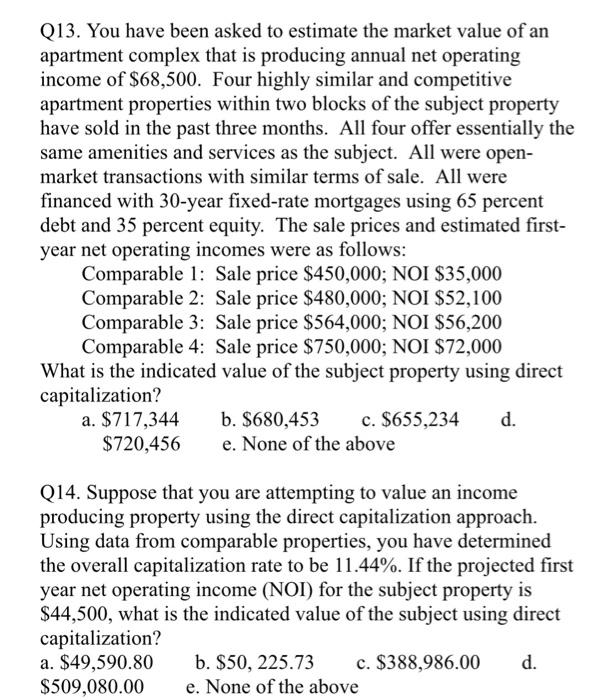

Part I: Define the following terms ( 3540 words) points) Q1. Conforming vs. Non-conforming loans Q2. Equity of Redemption Part II: Q1. An overall capitalization arte is divided into which type of income or cash flow to obtain an indicated market value? a. Net operating Income (NOI) b. Effective Gross Income (EGI) c. Before tax cash flow (BTCF) d. After tax cash flow (ATCF) e. Potential gross income (PGI) Q2. Which of the following type of properties will probably not be appropriate for income capitalization? a. Apartment building b. shopping center c. farm d. warchouse e. public school Q3. A lender may reserve the right to require prepayment of a loan at any time they see fit through a (n): a. taking clause b. acceleration clause c. dueon-sale clause d. demand clause b. escrow clause Q4. Violations of the requirements of a note that do not disrupt the payments on the loan tend to be viewed as "technical" defaults. In practice, how many days must a payment be overdue in order for lenders to treat a default as serious (i.e., a substantive default)? a. One day b. 30 days c. 60 days d. 90 days e. None of the above Q5. Standard mortgage loans require monthly payments typically composed of two components: interest and principal repayments. When scheduled mortgage payments are insufficient to pay all of the accumulating interest, causing some interest to be added to the outstanding balance after each payment shortfall, the loan is said to be: - Fully amortizing b. partial amortizing c. Nona mortising d. Negative amortizing Q6. With most standard home loans, the lender can hold the borrower personally liable in the event of a default. Such loans are commonly referred to as: a. Recourse loans b. Non-recourse loans c. conforming loans d. Non-conforming loans Q7. When interpreting capitalization rates, an increase in the rate value would imply a commercial property value has time value of money has increased d. the discount rate used in time value of money has decreased e. None of the above Q8. Because the mortgage conveys a complex claim for a long period of time, clauses are included in anticipation of possible future complications. Which of the following clauses requires a borrower to make monthly deposits into an account in order to pay obligations such as property taxes, community association fees, or causality insurance premiums? a. demand clause b. escrow clause c. exculpatory clause d. insurance clause. e. none of the above Q9. In an attempt to regulate home mortgage lending after the mortgage crisis of 2007 , which of the following acts created an independent oversight agency tasked with the responsibility of overseeing and enforcing Federal consumer financial protection laws, enforcing antidiscrimination laws in consumer finance, restricting unfair, deceptive or abusive acts or practices, receiving consumer complaints, promoting financial education, and watching for emerging financial risks for consumers? a.EqualCreditOpportunityActb.TruthinLending Act c. Real Estate Settlement Procedure Act d. Dodd-Frank Act e. None of the above Q10. Recent studies and investigation by the Federal Government and Justice department have revealed biased lending practices followed by banks in the US. Which of the following statements are true about the growing trend in mortgage lending malpractices? a. Complaints and lawsuits filed by Consumer Financial Protection Bureau b. Minority groups in many parts of US were denied loans from banks during past several decades c. Redlining has emerged as a serious concern among regulators d. Hudson City Savings Bank (NJ) have expanded location in minority communities and provided mortgage brokers e. All of the above true except (d) Q11. A partially amortizing loan always will have a. Caps b. only one stated term c. a balloon payment d. a prepayment penalty e. recourse Q12. The element of an adjustable interest rate that is the "moving part" is the: a. Index b. teaser rate c. adjustment period d. Margin e. None of the above What is the indicated value of the subject property using direct capitalization? a. $717,344 b.$680,453c.$655,234 d. $720,456 e. None of the above Q14. Suppose that you are attempting to value an income producing property using the direct capitalization approach. Using data from comparable properties, you have determined the overall capitalization rate to be 11.44%. If the projected first year net operating income (NOI) for the subject property is $44,500, what is the indicated value of the subject using direct capitalization? a. $49,590.80 d. $509,080.00 e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts