Question: Answer all questions please Both Projects A and B are acceptable as independent projects. However, the selection of either one of these projects eliminates the

Answer all questions please

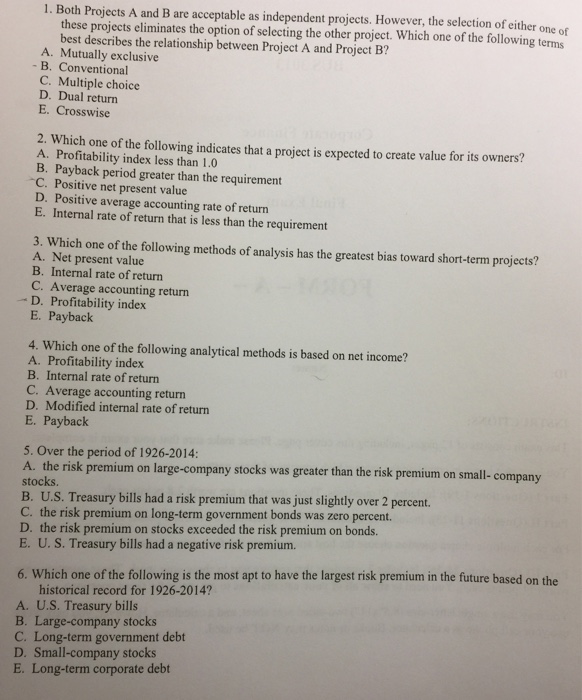

Answer all questions please Both Projects A and B are acceptable as independent projects. However, the selection of either one of these projects eliminates the option of selecting the other project. Which one of the following terms best describes the relationship between Project A and Project B? Mutually exclusive Conventional Multiple choice Dual return Cross wise Which one of the following indicates that a project is expected to create value for its owners? Profitability index less than 1.0 Payback period greater than the requirement Positive net present value Positive average accounting rate of return Internal rate of return that is less than the requirement Which one of the following methods of analysis has the greatest bias toward short-term projects? Net present value Internal rate of return Average accounting return Profitability index Payback Which one of the following analytical methods is based on net income? Profitability index Internal rate of return Average accounting return Modified internal rate of return Payback Over the period of 1926-2014: the risk premium on large-company stocks was greater than the risk premium on small-company stocks Us. Treasury bills had a risk premium that was just slightly over 2 percent. the risk premium on long-term government bonds was zero percent. the risk premium on stocks exceeded the risk premium on bonds U. S. Treasury bills had a negative risk premium Which one of the following is the most apt to have the largest risk premium in the future based on the historical record for 1926-2014? U.S. Treasury bills Large-company stocks Long-term government debt Small-company stocks Long-term corporate debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts