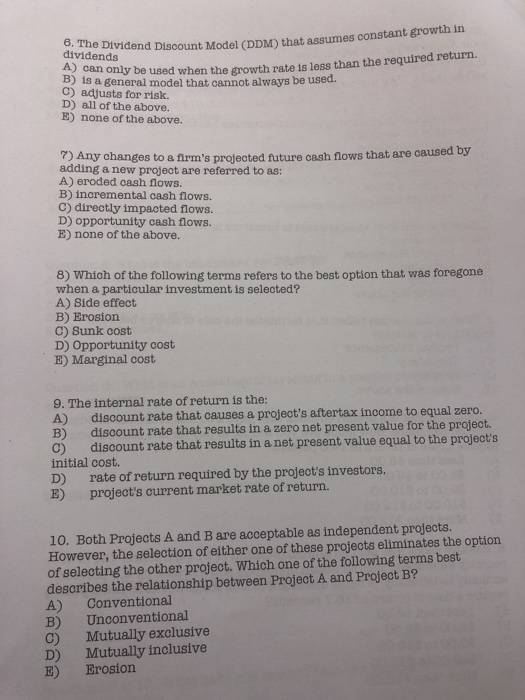

Question: finance Answer 6-10 show all work clearly and circle answer Dividend Disoount Model (DDM) that assumes constant growth in 1 ageng used when the growth

Dividend Disoount Model (DDM) that assumes constant growth in 1 ageng used when the growth rate is less than the required return. B) is a general model that cannot always be used. dividends C) adjusts for risk D) all of the above. E) none of the above. 2) Any ohanges to a firm's projected future cash fnows that are caused by adding a new project are referred to as: A) eroded cash flows. B) incremental cash fnows. C) directly impacted flows. D) opportunity cash flows. B) none of the above. 8) Which of the following terms refers to the best option that was foregone when a particular investment is selected? A) Side effect B) Erosion C) Sunk cost D) Opportunity cost E) Marginal cost 9. The internal rate of return is the: A) discount rate that causes a project's aftertax income to equal zero. B) discount rate that results in a zero net present value for the project. C) discount rate that results in a net present value equal to the project's initial cost. D) rate of return required by the projeot's investors. E) project's current market rate of return. 10. Both Projects A and B are acceptable as independent projects. However, the selection of either one of these projects eliminates the option of selecting the other project. Which one of the following terms best desoribes the relationship between Project A and Project B? A) Conventional B) Unconventional C) Mutually exclusive D) Mutually inclusive E) Erosion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts