Question: Answer all questions please Suppose a stock had an initial price of $80 per share, paid a dividend of $1.35 per share during the year,

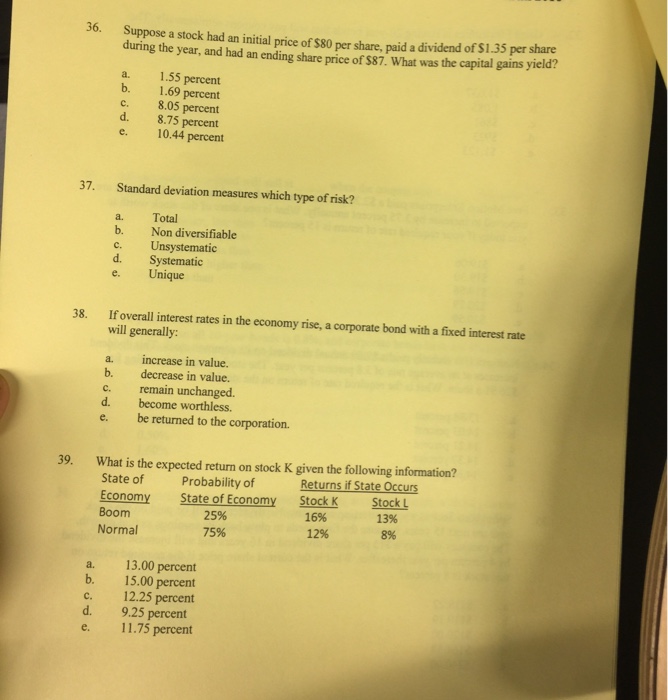

Suppose a stock had an initial price of $80 per share, paid a dividend of $1.35 per share during the year, and had an ending share price of $87. What was the capital gains yield? a. 1.55 percent b. 1.69 percent c. 8.05 percent d. 8.75 percent e. 10.44 percent Standard deviation measures which type of risk? a. Total b. Non diversifiable c. Unsystematic d. Systematic e. Unique If overall interest rates in the economy rise, a corporate bond with a fixed interest rate will generally: a. increase in value. b. decrease in value. c. remain unchanged. d. become worthless. e. be returned to the corporation. What is the expected return on stock K given the following information? a. 13.00 percent b. 15.00 percent c. 12.25 percent d. 9.25 percent e. 11.75 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts