Question: Show your formula and steps Solve each questions (6.1) Suppose a stock had an initial price of $79 per share, paid a dividend of $1.45

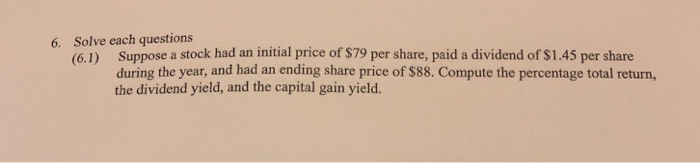

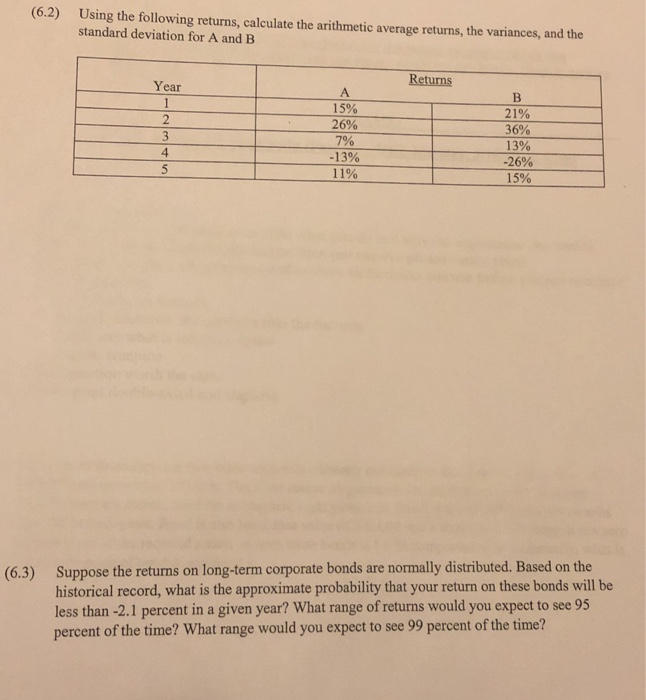

Solve each questions (6.1) Suppose a stock had an initial price of $79 per share, paid a dividend of $1.45 per share 6. during the year, and had an ending share price of $88. Compute the percentage total return, the dividend yield, and the capital gain yield. (6.2) Using the following returns, calculate the arithmetic average returns, the variances, and the standard deviation for A and B Returns Year 2 4 15% 26% 7% -13% 11% 21% 36% 13% -26% 15% 5 (6.3) Suppose the returns on long-term corporate bonds are normally distributed. Based on the historical record, what is the approximate probability that your return on these bonds will be less than -2.1 percent in a given year? What range of returns would you expect to see 95 percent of the time? What range would you expect to see 99 percent of the time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts